Life has a way of presenting opportunities and challenges when we least expect them. Whether it’s a chance to grow your business, tackle a personal project, or cover an emergency, financial constraints should never be the reason you hold back. Imagine finally pursuing that dream venture or taking care of that urgent need without stressing over exorbitant interest rates. At Umba Nigeria, we’ve got your back. With our low-interest loans, you can make those possibilities a reality while staying financially responsible.

If you’re looking for fast, reliable loans or simply need guidance on managing borrowed funds, this comprehensive guide is here to empower you with actionable insights.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why You May Need a Loan

- Emergencies: Life is unpredictable. Medical bills, car repairs, or urgent family responsibilities can arise at any moment, demanding immediate financial attention.

- Business Expansion: Whether you’re launching a new startup or scaling an existing business, capital is often the lifeline to success.

- Education: From tuition fees to study materials, education can open doors to better opportunities, but it often comes with high costs.

- Dream Adventures: Sometimes, it’s okay to invest in experiences, like traveling or attending special events, which can bring lasting memories and personal growth.

- Debt Consolidation: Simplify your financial life by merging multiple debts into one manageable loan with a lower interest rate.

How to Plan Repayments and Avoid Overwhelming Debt

Taking out a loan is a responsibility that requires strategic planning. Here’s how you can manage it effectively:

- Evaluate Your Needs: Borrow only what you truly need. Overborrowing can lead to financial strain.

- Understand the Loan Terms: Pay close attention to the interest rate, repayment schedule, and any penalties for late payments.

- Budget Wisely: Set aside a fixed portion of your income each month to cover the loan repayments.

- Consider Early Repayment: If your financial situation improves, paying off your loan early can save you money on interest.

- Build an Emergency Fund: This will help you stay on track with repayments even if unexpected expenses arise.

Why Choose Umba Nigeria?

At Umba Nigeria, we believe that access to affordable credit can transform lives. That’s why we’re committed to offering loans with:

- Low Interest Rates: Starting as low as 3% per month, so you don’t have to worry about excessive financial burdens.

- Flexible Terms: We work with you to create repayment plans that suit your financial situation.

- Quick Approvals: Our streamlined process ensures you get the funds you need when you need them.

- Transparency: No hidden fees or surprises—just straightforward, reliable service.

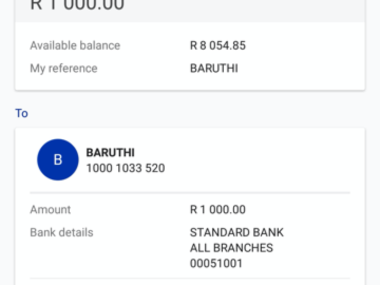

Here’s a breakdown of the loan options we offer:

| Loan Type | Interest Rate | Eligibility | Repayment Options |

|---|---|---|---|

| Personal Loan | From 5% per month | Employed or self-employed | Flexible installments or lump sum |

| Emergency Loan | From 7% per month | Valid ID, proof of need | Monthly repayments |

| Business Loan | From 3% per month | Business registration required | Revenue-based or fixed-term repayments |

| Educational Loan | From 6% per month | Admission letter or invoice | Pay in installments or defer payments |

How to Apply for a Loan with Umba Nigeria

Getting a loan with Umba Nigeria is easy and straightforward. Just follow these steps:

- Visit our website: Umba Nigeria.

- Sign up or log in: Create an account or log into your existing profile.

- Submit your application: Fill out the required details, including the loan amount, purpose, and any supporting documents.

- Get approval: Our team will review your application quickly to ensure you get your funds without unnecessary delays.

- Receive your funds: Once approved, the money is transferred directly to your account, ready for you to use.

Tips for Responsible Borrowing

Taking a loan can be a positive step if managed wisely. Here are some tips to help you stay on top of your finances:

- Borrow with a Purpose: Ensure the loan aligns with your financial goals or addresses a pressing need.

- Track Your Expenses: Monitor your spending to avoid falling behind on repayments.

- Communicate Early: If you encounter challenges, reach out to your lender for possible solutions like repayment restructuring.

- Build Your Creditworthiness: Timely repayments improve your credit score, making it easier to access loans in the future.

Eduject’s Advice

On no account should you take beyond what you can repay. This is an opportunity, but don’t misuse it just because you have access to it freely. Do not borrow beyond your income expectations, and always use the money for its intended purpose.

Learn from the business practices of the Igbos. They never take loans for unnecessary reasons. Emergencies require urgent solutions, and when the emergency is resolved, immediately plan for repayment. Paying back on time not only builds trust but also ensures that financial institutions like Umba Nigeria can continue to provide support to others.

Let’s build a Nigeria driven by integrity and trust, where companies are encouraged to invest. Take your loan today and start planning for repayment immediately. Don’t wait for endless phone calls. Share this advice with anyone who might need it.