We’ve all been there – it’s the middle of the month, the bank balance is running dangerously low, and you’re staring at that N5,000, wondering how on earth you’re going to make it last until payday. Your stomach churns as you look at the stack of bills on your table, thinking about all the things you need to cover: groceries, transportation, the kids’ school fees, your utility bills. The pressure is real, and the anxiety about not being able to make it until payday can be overwhelming.

But what if I told you there was a way to stretch that N5,000, even if it feels like a tiny amount, and make it last longer? No, it doesn’t require a miracle. But the next best thing? A loan from Carbon.

Picture this: instead of stressing and trying to figure out how you can cut back on essentials (which often leads to sacrificing your well-being or putting yourself in even more uncomfortable situations), you can use a Carbon loan to bridge that gap and secure your finances in the short term. Carbon’s loan service can give you a much-needed financial cushion to weather the storm, while you stay focused on the things that really matter.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Let’s break it down: how exactly can you stretch that N5,000, and what role can a loan from Carbon play in giving you the financial breathing room you need?

Why Do You Need Money Right Now?

Emergencies happen, and they’re always inconvenient. Perhaps your phone broke down, and you need it for work. Maybe an unexpected medical expense came up. Or, maybe, you’re simply in a situation where you need to make it through until payday without falling behind on your essential bills.

Whatever the reason, financial stress is a burden that affects your peace of mind. You might have already tried to cut back on expenses – you skipped meals, reduced transportation costs, and maybe even put off some bills. But, sometimes, those sacrifices aren’t enough. You need quick access to money.

This is where borrowing money comes in as a viable solution. But not all loans are created equal, and you need a loan that’s reliable, easy to access, and flexible in terms of repayment. This is where Carbon shines.

How Can You Get Money Fast?

In today’s fast-paced world, getting money quickly is no longer an impossible task. While traditional loans from banks may take days or even weeks to process, Carbon makes it simple, fast, and easy to access the funds you need, when you need them the most.

Here’s how you can get started with Carbon:

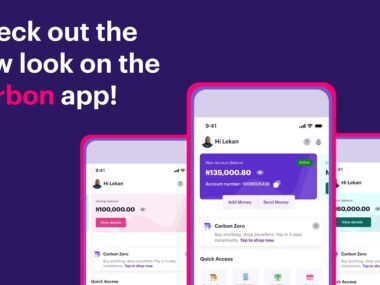

- Download the Carbon App: Carbon is available for both Android and iOS. Head over to Google Play or the App Store to download the app.

- Register for an Account: Signing up is quick and straightforward. Provide your name, email address, phone number, and other necessary details. It won’t take more than a few minutes.

- Apply for a Loan: Once your account is set up, you can apply for a loan. Carbon’s loan application process is simple, requiring basic details about your finances.

- Quick Approval & Instant Disbursement: One of the best things about Carbon is how fast the approval process is. In most cases, you can get your loan approved within minutes, and the funds will be transferred directly to your bank account.

- Repay with Ease: Carbon makes it easy to pay back your loan with flexible repayment options, including direct bank transfer or payment through the app.

How Can You Plan for Repayment?

Taking a loan might be the perfect short-term solution to your financial crunch, but it’s crucial that you plan ahead to ensure smooth repayment. One of the reasons loans can be so stressful is when borrowers fail to create a repayment plan, and then find themselves overwhelmed by the debt when it’s time to pay back.

With Carbon, repayment is flexible and manageable, allowing you to comfortably repay the loan without putting yourself under unnecessary pressure. Here are a few tips for managing your repayment:

- Set a Realistic Budget: Before you take out the loan, it’s essential to determine how much you can afford to repay. Review your monthly expenses and income to identify how much of your income can be allocated to the loan repayment. Carbon provides flexible loan amounts and repayment terms that cater to different income levels.

- Stick to Your Repayment Schedule: Carbon provides clear repayment schedules based on your loan agreement. Whether you choose a one-time repayment or installments, make sure you stick to the plan. Setting reminders in your phone or the Carbon app ensures that you don’t miss a payment.

- Prioritize Repayment: It’s tempting to think that you can postpone repayment or use the loan for other purposes, but it’s critical to repay on time. This will not only ensure you avoid late fees but also help maintain your credit score, so you can access future loans if needed.

- Consider Short-Term Loans for Quick Repayment: One of the advantages of Carbon loans is that they often come with shorter repayment terms, which means you can clear the debt faster. Always remember, the quicker you pay back the loan, the less financial burden it creates.

Carbon Loan Details: Transparent and Clear

When you decide to take out a loan from Carbon, you want to ensure that the terms are clear and that you understand what you’re signing up for. Here’s an overview of the types of loans Carbon offers, their interest rates, eligibility criteria, and repayment methods.

| Loan Type | Interest Rate | Eligibility | Repayment Options |

|---|---|---|---|

| Personal Loan | 5% – 10% | 18+, Nigerian Citizen | Bank transfer, Carbon app |

| Emergency Loan | 10% – 15% | 18+, Nigerian Citizen | Bank transfer, Carbon app |

| Business Loan | 7% – 12% | 18+, Business owner | Bank transfer, Carbon app |

Advice from the Eduject:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t over-use it just because you have access to it freely. Don’t borrow beyond your repayment capacity based on your income expectations. Make sure to use the money for its intended purpose. Learn from the business-savvy Igbo people, who would never take a loan for something other than the purpose it’s meant for. Everyone faces emergencies, but they should be tackled with focused solutions. Once the emergency is resolved, ensure you immediately source a repayment plan. This creates credibility and builds trust between you and your lender.

We need to foster a Nigeria where trust and integrity are key, and repayment on time is critical. A well-repaid loan will encourage Carbon and other lending platforms to help even more people when they face financial struggles. Don’t wait until they come knocking at your door. Start planning for repayment today, the moment you access the loan. And remember, share this advice with anyone in need of emergency help.”

Conclusion: A Loan That Works for You

Stretching that N5,000 to cover all your needs until payday might seem impossible, but with Carbon, it’s within reach. Whether you’re facing an emergency or just need a little extra cushion until the next paycheck, a loan from Carbon can give you the financial freedom you need to keep your head above water.

By understanding your loan terms, planning for repayment, and borrowing responsibly, you can get through your financial tight spot while keeping your finances in check for the future.

Apply for a Carbon loan today, and make it through to payday with peace of mind!