Have you ever found yourself in a situation where you need quick access to funds, but the thought of securing a loan with a guarantor seems impossible? You’re not alone. In today’s fast-paced world, there are times when emergencies arise—medical bills, unexpected expenses, or even business opportunities that require immediate financial assistance. Many Nigerians face the dilemma of how to secure a loan without needing a guarantor, and the good news is that it’s entirely possible.

In this comprehensive guide, we will show you how to apply for a loan in Nigeria without a guarantor, what steps you need to take, how to plan for repayment, and why you need to act wisely when borrowing money. If you’re reading this, it’s likely because you’re seeking a solution to your financial needs, and we’re here to ensure you understand the process thoroughly.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Let’s get started.

Why Do You Need Money?

Before diving into how to apply for a loan, it’s important to first understand why you need the money. Are you looking to start or grow your business? Do you need money for personal emergencies or an investment opportunity? It’s crucial to have a clear purpose for borrowing money. This will help you stay focused on how to use the funds wisely, ensuring that you don’t end up in debt without a clear repayment strategy.

The right mindset is essential when applying for a loan. Always ask yourself: Will this loan help me achieve a greater financial goal? When you are intentional about the purpose of the loan, it can motivate you to use the money responsibly, leading to a better chance of successfully repaying it.

How to Apply for a Loan in Nigeria Without a Guarantor

Securing a loan without a guarantor in Nigeria is easier than it seems, especially with a variety of options available today. Below is a step-by-step guide on how to apply for a loan:

1. Understand the Types of Loans Available

There are two main types of loans that do not require a guarantor: Personal Loans and Microloans. Personal loans are typically unsecured loans offered by banks or financial institutions, while microloans are smaller loans offered by fintech companies.

2. Choose a Reputable Lender

One of the first things you need to do is choose a reliable and trustworthy lender. Some reputable lenders in Nigeria include:

- Umbanigeria (Provides loans with flexible repayment terms and low interest rates).

- Branch Nigeria (Offers quick loans without collateral).

- Carbon (A digital bank offering personal loans with no guarantor).

3. Complete the Application Process

Once you’ve chosen your lender, the next step is to complete the loan application. This process typically requires the following:

- Proof of identity (e.g., National ID, Driver’s License).

- Proof of income (recent payslips, bank statements).

- A valid phone number and email address.

4. Check Loan Eligibility Criteria

Different lenders have different requirements. Generally, lenders will check your credit history, income, and your ability to repay the loan. Some may also request proof of address or an active bank account.

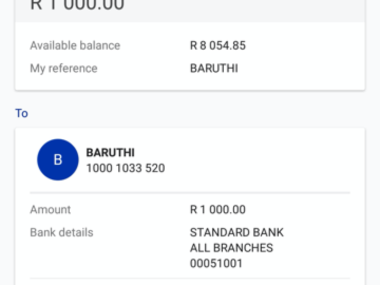

5. Loan Disbursement

Once your loan application is approved, the lender will disburse the loan amount into your bank account. The disbursement time can vary depending on the lender, but it often takes as little as 24 hours.

How to Plan for Repayment

Once you’ve secured your loan, it’s crucial to have a clear repayment plan. Here are some tips:

1. Understand the Repayment Terms

Before accepting a loan, make sure you understand the interest rate, repayment schedule, and any other terms. Ensure that the monthly repayment amount is something you can afford comfortably. Avoid loans with high-interest rates that could end up being difficult to repay.

2. Create a Budget

Make a monthly budget to plan how you will allocate funds to pay back your loan. Factor in your income and other expenses, and set aside an amount specifically for the loan repayment. Prioritize paying off your loan to avoid defaulting.

3. Stick to the Plan

Consistency is key. If your loan has a set repayment schedule, make sure you stick to it. If you can, pay a little extra each month to reduce the principal faster and save on interest.

Loan Options from Umbanigeria

| Loan Type | Interest Rate | Eligibility Criteria | Repayment Period |

|---|---|---|---|

| Personal Loan | 15% per annum | Minimum of 18 years old, steady income, good credit score | Up to 12 months |

| Emergency Loan | 18% per annum | Must have an urgent need, stable income | 1 to 3 months |

| Business Loan | 12% per annum | Registered business, at least 1 year of operation | Up to 24 months |

Note: These rates and terms are subject to change. Always check with the lender for current information.

Advice from Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t over-use it to affect you just because you have access to it freely. Don’t take beyond the capacity of your income expectations. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo community. The Igbo would never borrow money for anything other than the specific purpose the money was meant for. Anyone can have an emergency, and an emergency requires an emergency purpose. When the emergency is fixed, immediately start planning for repayment. This approach will build trust and credibility, ensuring that you can receive future support when needed. Don’t wait until you’re being chased by the bank for repayment. Start planning for repayment today.”

In conclusion, applying for a loan in Nigeria without a guarantor is completely possible. With the right knowledge and proper planning, you can secure the funds you need while ensuring that you have a clear path for repayment. Remember, borrowing money is not a quick fix to a long-term problem; it’s a solution for specific needs. Be cautious, be responsible, and always ensure that the loan serves a clear purpose.