Picture this: You’re facing a financial emergency, and the idea of getting a loan to get you through it seems like the perfect solution. But then, doubt creeps in. You’re either unemployed, self-employed, or not in a traditional job with a steady paycheck. Can you still get that loan? And if so, what steps should you take to ensure you’re not caught in a financial trap?

This article will break it down for you in clear, simple terms. If you’re struggling with whether you qualify for a loan in your situation, we’ve got you covered. We’ll guide you through the options available for both unemployed and self-employed individuals, explain how to plan for repayment, and give you actionable steps to make sure you don’t overextend yourself. Let’s walk this journey together and empower you to take control of your financial situation.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Can Unemployed or Self-Employed Individuals Get Loans?

Yes, it is possible to get a loan even if you’re unemployed or self-employed. It may seem tricky at first, but there are several options available if you approach it strategically.

1. Options for Unemployed Individuals

If you are unemployed, your best option would be to look for loans that don’t require a regular paycheck. This could include:

- Secured Loans: These loans require collateral like your car, house, or another valuable asset. While it may be risky, it could be your best bet to secure the funds you need.

- Unsecured Loans with a Guarantor: Some lenders offer loans to unemployed individuals, provided you have a guarantor—a person who will agree to pay the loan if you default.

- Peer-to-Peer Lending: This is a new and innovative option where individuals lend money to others through online platforms. The application process is often easier and doesn’t always require proof of employment.

2. Options for Self-Employed Individuals

Self-employed individuals have a bit more flexibility when applying for loans since they usually have a history of income, even if it’s irregular. Lenders will focus on:

- Business Loans: If your self-employment is business-related, you could apply for a business loan. This often requires showing proof of your business income, expenses, and profitability.

- Personal Loans: If your self-employment doesn’t involve a formal business structure, you could apply for personal loans. Lenders will assess your overall financial health, including bank statements, tax returns, and savings.

- Microfinance Loans: If you run a small business, microfinance institutions could offer loans tailored to your needs. They often have fewer requirements and are designed to help individuals with limited income sources.

Why Do You Need Money?

Before rushing into taking a loan, it’s essential to have a clear understanding of why you need the money. Is it for an emergency like medical expenses, paying off an existing debt, or investing in your business? Knowing the reason behind the loan will help you choose the right loan option and ensure that you’re not over-borrowing.

The key is to only borrow what you can afford to pay back. Taking out too much money without a clear plan for repayment can lead to more financial stress in the long run.

How to Plan for Loan Repayment

Repaying your loan on time is crucial for maintaining your financial health and credit score. Here are a few tips on how to plan for repayment:

- Budget Wisely: Set aside a portion of your income (or what you anticipate earning) to cover the loan repayment. Make sure this amount is sustainable and doesn’t leave you with insufficient funds for other necessities.

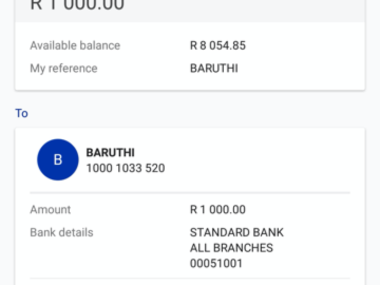

- Automate Payments: If possible, set up automatic payments to avoid missing a due date. Many banks and lenders allow this feature, and it can help you stay on track.

- Prioritize Payments: If you’re juggling multiple loans, prioritize the one with the highest interest rate or the one that is most urgent.

- Emergency Fund: Try to create an emergency fund to cover unexpected expenses. This can reduce your reliance on loans for future crises.

Loan Options from Umbanigeria

For those in Nigeria, Umbanigeria offers several loan options. Below is a table outlining the loan types, interest rates, eligibility criteria, and repayment options available from Umbanigeria:

| Loan Type | Interest Rate | Eligibility Criteria | Repayment Method |

|---|---|---|---|

| Personal Loan | 10% per annum | Must be a Nigerian citizen, minimum 18 years old | Monthly installments via bank transfer |

| Business Loan | 15% per annum | Must have a registered business or proven self-employment status | Monthly installments, based on business income |

| Emergency Loan | 12% per annum | Must provide proof of an emergency (medical, family, etc.) | Flexible, with up to 6 months repayment |

| Microloan | 18% per annum | For small business owners with minimal credit history | Weekly or bi-weekly payments |

Advice from Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t take beyond the capacity of your income expectations. Endeavor to use the money for its purpose. Learn from the business side of the Igbo community. They would never borrow money to do anything other than what the money was meant for. An emergency requires an emergency purpose, and this emergency would come and go. Now that you have provision through this loan, to fill in the gap of the emergency, as soon as the emergency is fixed, quickly source for the repayment plan. This would give the bank more credibility to help others solve their emergencies when they arise. Let’s build a trust-driven Nigeria, where other companies can invest. The best way to encourage Umbanigeria to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they are chasing you with phone calls. As you take the loan today, start planning for the repayment today.”

Getting a loan while unemployed or self-employed is possible, but it requires careful planning and the right approach. Whether you are looking to cover an emergency, expand your business, or simply manage daily expenses, there are options available that can work for you. The key is to understand your financial situation, choose the right type of loan, and plan your repayments carefully. By following the steps outlined in this article, you can make an informed decision about borrowing and ensure that you can manage the debt responsibly.