When life throws unexpected expenses your way—whether it’s for medical bills, school fees, or an urgent business opportunity—you might wonder, “How can I get access to quick funds?” The thought of taking out a loan may cross your mind, but then another question arises: “Do I need collateral to qualify for most loans in Nigeria?” If you’re asking yourself this, you’re not alone. Many Nigerians are finding themselves in similar situations and are searching for solutions.

The need for financial assistance is growing, and thankfully, there are multiple avenues to secure loans in Nigeria. But before diving into the world of loans, it’s crucial to understand what you’re getting into, how to plan for repayment, and why you need the money in the first place. This article will walk you through everything you need to know about qualifying for loans in Nigeria, whether you need collateral, and how to handle repayment.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Understanding Loans and Collateral

Before we jump into specifics, let’s break it down: what exactly is collateral, and why is it important in the context of loans?

Collateral is an asset (such as a car, property, or savings) that you offer to a lender as security for a loan. If you fail to repay the loan, the lender has the right to seize the collateral to cover the debt. Collateral is commonly required for traditional loans in Nigeria, particularly when the loan amount is large or the borrower’s creditworthiness is in question.

However, the good news is that not all loans in Nigeria require collateral. Many lenders now offer unsecured loans, which do not require you to put up any assets. These loans typically have higher interest rates due to the increased risk to the lender, but they provide a more accessible option for those who don’t have valuable assets to offer.

Do I Need Collateral to Qualify for Most Loans in Nigeria?

The answer depends on the type of loan and the lender. Here’s a breakdown:

- Personal Loans: Personal loans from banks or microfinance institutions may require collateral, especially if the loan amount is high. However, some lenders offer unsecured personal loans, where you don’t need to provide collateral. Your credit score, income, and repayment history play a bigger role here.

- Microloans and Payday Loans: These are typically smaller loans designed to cover short-term needs. Many microloan lenders in Nigeria do not require collateral. They often use alternative forms of credit assessment, such as your phone usage, social media activity, and transaction history with mobile money providers.

- Business Loans: Business loans, particularly for small businesses or startups, may require collateral. The amount of collateral required depends on the size of the loan and the risk involved. However, some innovative lenders offer unsecured business loans with minimal documentation, based on your business’s cash flow and projected earnings.

How Can You Plan for Loan Repayment?

When taking out any loan, one of the most important things to consider is your ability to repay it. Here’s how you can plan for repayment:

- Know Your Monthly Budget: Look at your income and expenses to determine how much you can comfortably afford to repay each month. It’s important to avoid overextending yourself, as defaulting on a loan can harm your credit rating and financial future.

- Set a Realistic Repayment Plan: When taking out a loan, work with the lender to establish a repayment schedule that fits your financial situation. Many Nigerian lenders offer flexible repayment plans, such as weekly, bi-weekly, or monthly payments.

- Start Repayment Immediately: The earlier you start repaying, the better. Begin setting aside money as soon as you receive the loan, so you’re not caught off guard when repayment begins.

- Use the Loan for Its Intended Purpose: It’s tempting to use loan money for things outside its intended purpose, but doing so could make it harder to repay. Stick to using the funds as planned, and ensure you have a clear path to generating income or savings to cover the loan.

Why Do You Need the Loan?

Before you decide to take a loan, it’s essential to clearly understand why you need the money. Whether it’s for a medical emergency, paying for education, or expanding your business, always ensure the purpose is justified and reasonable. Taking a loan for unnecessary purchases can put unnecessary financial strain on you and may jeopardize your ability to repay it.

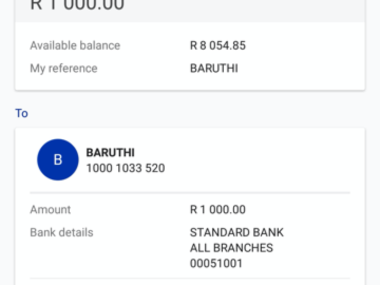

Loan Options from Umbanigeria

Let’s take a look at some loan options available in Nigeria from Umbanigeria, a popular lender:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan | 10-15% annually | Nigerian citizen, minimum age of 21, stable income | Monthly installments over 6-12 months |

| Business Loan | 15-20% annually | Registered business, proof of revenue | Flexible based on business cash flow |

| Emergency Loan | 12-18% annually | Proof of emergency, Nigerian citizen | Quick repayment, typically within 3-6 months |

| Education Loan | 8-12% annually | Student or guardian, school enrollment proof | Monthly installments for up to 1 year |

Umbanigeria provides loans with relatively competitive interest rates, and eligibility is based on a variety of factors, including income and purpose of the loan. It’s important to review the repayment plan carefully and ensure that you can meet the terms.

“Advice from the Edujects: On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t take more than your income can handle. Use the money for its intended purpose. Learn from the business mindset of the Igbos. They would never take a loan for any other purpose than the one it’s meant for. Emergencies come and go, but managing your repayment responsibly builds trust and credibility. Repay on time, and Umba Nigeria will have more confidence in helping others during their emergencies. Start planning your repayment as soon as you take the loan, and avoid waiting for phone calls from the bank asking for repayment. Let’s build a trustworthy, integrity-driven Nigeria where companies can invest in us.”

Taking out a loan in Nigeria can be a lifesaver during financial emergencies, but it’s important to understand the requirements, including whether or not collateral is needed. Whether you qualify for an unsecured loan or are required to provide collateral depends on the type of loan and the lender’s policies. Always ensure you have a clear repayment plan in place and use the loan for its intended purpose.

Make sure to do thorough research before taking out a loan and consider your ability to repay. Loan providers like Umbanigeria offer flexible options, so explore your choices carefully.