Life as a student or young professional in Nigeria can be financially overwhelming. Tuition fees, books, living expenses, and unexpected costs often leave many wondering how they can make ends meet. If you’re in this position, you’re not alone. The good news is that there are options available to help ease the financial burden. Loans tailored for students and young professionals offer a lifeline for those seeking to invest in their future. This article explores the available loan options, how to access them, repayment plans, and why borrowing responsibly is key.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need Money?

The need for financial support often stems from various challenges:

- Education Costs: Tuition, accommodation, and exam fees can be daunting.

- Startup Support: Young professionals often need seed capital to launch their careers or businesses.

- Emergencies: Unforeseen expenses like medical bills or urgent family needs can arise unexpectedly.

- Upskilling and Certification: To stay competitive, many young professionals require additional training or certifications.

Whatever your reason, it’s important to remember that loans should be a tool to help you achieve your goals, not a financial trap.

Loan Options Available in Nigeria

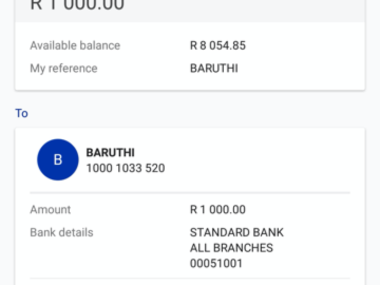

Below is a table summarizing loan options from Umbanigeria, a notable provider of student and young professional loans:

| Loan Name | Maximum Amount | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|---|

| Umbanigeria EduLoan | ₦200,000 | 10% per annum | Students with admission letters or professionals with proof of employment | Monthly installment for up to 12 months |

| Startup Builder Loan | ₦500,000 | 15% per annum | Young professionals under 35 with a business plan | Quarterly installment for up to 24 months |

| Emergency Loan | ₦100,000 | 8% per annum | Anyone with proof of a verifiable emergency (e.g., medical, natural disaster) | Lump sum within 6 months |

| Certification Loan | ₦200,000 | 12% per annum | Young professionals seeking funding for recognized certifications | Monthly installment for up to 18 months |

How to Access These Loans

- Research and Compare: Visit company websites like Umbanigeria (…) and check their terms.

- Prepare Required Documents: This includes identification, proof of admission or employment, and a business plan (where applicable).

- Apply Online or In-Person: Most companies offer easy online application processes.

- Provide a Guarantor: Some loans may require a guarantor to co-sign the agreement.

- Await Approval: If approved, funds are disbursed directly to your account or institution, depending on the loan type.

How to Plan for Repayment

- Budget Wisely: Allocate a portion of your income or allowance towards repayment.

- Set Up Automatic Payments: Many loan providers allow you to automate repayments to avoid missing deadlines.

- Cut Unnecessary Expenses: Focus on your essentials until the loan is fully repaid.

- Generate Extra Income: Consider freelancing, part-time work, or selling unused items to boost your income.

Additional Tips for Responsible Borrowing

Taking a loan is a serious commitment. Here are some vital tips:

- Borrow only what you need.

- Avoid loans for luxury or non-essential items.

- Always read the terms and conditions carefully.

Advice from the Edujects: “On no account should you take beyond what you can repay. This is an opportunity, but don’t misuse it just because you have access to it freely. Don’t take more than your income capacity allows. Ensure you use the money for its intended purpose. Learn from the business mindset of the Igbos; they borrow money strictly for its intended purpose. Emergencies come and go, but with proper planning, you can repay loans on time. Build credibility by repaying promptly, enabling banks to support others in need. Let’s foster a trust-driven Nigeria where companies feel confident investing. As you take the loan today, start planning your repayment today. Share this advice with anyone in need of emergency financial support.”