Imagine this: You’re in a tight spot—perhaps your car broke down, your business needs a quick infusion of cash, or an unexpected medical emergency pops up. You know that loans are the answer, and you’re tempted to take advantage of the convenience mobile apps offer. With just a few clicks, you could have access to funds within minutes, right? But here’s where the question arises: Are there hidden charges when applying for loans via mobile apps?

The ease of mobile loan apps is undeniable, but many people overlook the fine print. While these apps often advertise quick loans with minimal paperwork, it’s essential to understand the true cost of borrowing. This article will guide you through everything you need to know about hidden charges in mobile loan apps, how to navigate them, and how to plan for repayment to ensure you don’t fall into a debt trap.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do People Use Mobile Loan Apps?

In today’s fast-paced world, mobile loan apps have become a lifesaver for many individuals seeking fast financial help. The idea of applying for a loan from the comfort of your home, with no long queues or complex documentation, is highly appealing. These apps cater to those who need immediate access to funds for various reasons, such as:

- Emergency medical bills

- Business cash flow issues

- Unexpected personal expenses

- Family emergencies

- Debt consolidation

The process is quick, and in some cases, the funds are disbursed almost instantly. But before you click that “Apply” button, let’s take a closer look at the potential hidden charges that could affect your loan’s total cost.

Hidden Charges in Mobile Loan Apps: What You Need to Know

Many mobile loan apps advertise “interest-free” loans or claim that they offer “easy, transparent lending.” However, there are often hidden charges embedded in the terms and conditions that could lead to a higher repayment amount than initially expected. Here are the most common hidden charges:

- Processing Fees: Most loan apps charge a processing fee for approving your loan application. This fee is often a percentage of the loan amount and can range from 1% to 5%. These fees are not always clearly stated upfront, but they can significantly increase the overall cost of the loan.

- Late Payment Fees: If you miss a payment or fail to repay your loan on time, many mobile apps impose hefty late fees. These charges can quickly accumulate, making it difficult to catch up on payments.

- Loan Extension Fees: In cases where you cannot repay the loan within the agreed period, some mobile apps offer an extension. However, extending the loan comes with a fee, which may not always be clearly stated at the time of borrowing.

- High Interest Rates: While some apps advertise low-interest rates initially, they might hike the rate after the first few repayments, leading to higher-than-expected interest costs.

- Service Charges: Some apps charge a service fee, which can be a flat rate or a percentage of the loan amount. These fees are often deducted from the loan amount before it is disbursed, leaving you with less than you expected.

- Penalties for Early Repayment: In some cases, repaying the loan early may not save you money. Some mobile apps impose prepayment penalties that discourage early repayment, even though it could help you avoid extra interest costs.

How to Avoid Hidden Charges in Mobile Loan Apps

To make sure you aren’t caught off guard by unexpected charges, follow these tips before applying for a loan through a mobile app:

- Read the Terms and Conditions Carefully: Always read the fine print before applying for a loan. Look for any hidden charges, fees, or penalties mentioned. If something doesn’t seem clear, reach out to the lender for clarification.

- Compare Loan Offers: Don’t settle for the first loan app you come across. Compare offers from different mobile loan apps to find the one with the most transparent fee structure.

- Ask About All Fees Upfront: Before you proceed with the loan application, ask the lender to provide a complete breakdown of all the fees associated with the loan, including processing fees, late payment fees, and early repayment penalties.

- Calculate the Total Loan Repayment: Use a loan calculator (many apps offer them) to calculate the total amount you’ll need to repay, including any fees and interest. This will help you understand the true cost of borrowing.

How to Plan for Loan Repayment

Once you’ve secured a loan through a mobile app, planning for repayment is critical to avoid falling into financial trouble. Here’s how you can ensure you meet your loan obligations without strain:

- Create a Payment Schedule: As soon as you receive the loan, create a repayment schedule. Mark your payment due dates and set reminders to ensure you never miss a payment.

- Include Loan Repayment in Your Monthly Budget: Treat the loan repayment as part of your monthly expenses. Allocate a portion of your income to repay the loan, and prioritize it to avoid late fees.

- Consider Your Cash Flow: If your income fluctuates, make sure you have enough to cover the loan repayment. Adjust your budget or save in advance for months when your income might be lower.

- Avoid Borrowing Again: Resist the temptation to borrow again until the previous loan is fully repaid. Multiple loans can lead to a debt spiral that’s difficult to escape.

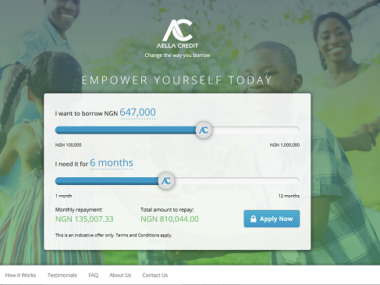

Aella Loans: A Breakdown of Their Loan Options

Aella Loans is one of the leading mobile loan apps in Nigeria, offering loans to individuals in need of quick financial assistance. Below is a detailed table of the loan options they provide, along with their interest rates, eligibility requirements, and repayment methods.

| Loan Type | Interest Rate | Eligibility Criteria | Repayment Method |

|---|---|---|---|

| Personal Loan | 5% – 20% per month | Nigerian citizens, 18 years and above, with a steady income | Weekly or monthly installments via bank transfer or mobile wallet |

| Business Loan | 10% – 25% per month | Must have a registered business or proof of self-employment | Weekly or monthly installments based on business cash flow |

| Emergency Loan | 10% – 15% per month | Must provide proof of emergency (medical, family, etc.) | Flexible repayment, up to 3 months |

| Salary Loan | 5% – 15% per month | Employed individuals with a regular income stream | Weekly or monthly deductions from salary via bank |

For more details, you can visit Aella Loans’ website.

Advice from Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t take beyond the capacity of your income expectations. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo community. They would never borrow money for anything other than what it was meant for. An emergency requires an emergency purpose, and this emergency will come and go. Now that you have provision through this loan, use it to fill the gap of the emergency. As soon as the emergency is fixed, quickly source for the repayment plan. This would give the bank more credibility to help others solve their emergencies when they arise. Let’s build a trust-driven Nigeria, where companies like Aella Loans can invest more in helping people in need. The best way to encourage Aella Loans to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they are chasing you with phone calls. As you take the loan today, start planning for the repayment today.”

Mobile loan apps are a convenient solution to financial emergencies, but they come with their own set of risks, particularly hidden charges. By being aware of these charges and taking proactive steps to plan your loan repayment, you can avoid the pitfalls many borrowers face. Aella Loans and other mobile loan apps offer great options, but only if you fully understand the terms and make informed decisions.