In life, there are moments when things don’t go as planned, and you might find yourself in urgent need of money. Whether it’s for an emergency, a health crisis, or just to keep things afloat, borrowing money can be the quickest solution. But once you’ve secured the loan, the real question arises: How much of your income should go toward repaying the loan?

If you’re in Nigeria and looking to borrow money or seeking fast financial help, you are not alone. Many face the same challenge—how to balance borrowing with their day-to-day expenses. It’s essential to figure out how much of your monthly income you can afford to allocate toward loan repayments without jeopardizing your financial stability. This balance is critical because while loans can offer relief, poor repayment planning can lead to further stress, debt, and even financial collapse. So, let’s explore how to responsibly manage loan repayments without it affecting your long-term goals.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need Money?

The need for money can arise from a variety of situations:

- Medical emergencies

- Family crises

- Education fees

- Business opportunities

- Daily living expenses

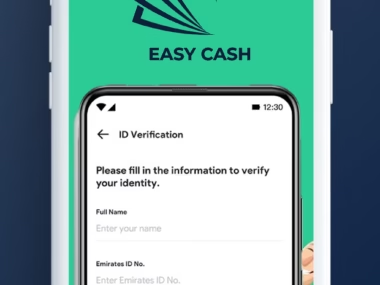

Whatever the reason, the emotional strain of not having enough money to meet these urgent needs can be overwhelming. But in today’s world, loans provide a lifeline. Companies like Easy Cash make it possible to access funds quickly, relieving that pressure and offering an immediate solution. However, understanding how to manage repayment is just as crucial as receiving the loan.

How to Plan Your Loan Repayment

Loan repayment planning starts before you even borrow the money. One of the first steps is understanding how much you can afford to repay each month based on your income and expenses. Ideally, you should never allocate more than 30% of your monthly income to loan repayment. Doing so helps ensure that you still have enough money for your daily needs and any unforeseen emergencies.

Here’s a simple breakdown of how to approach your loan repayment:

- Assess Your Income and Expenses: Look at your monthly income from all sources and list your regular expenses (e.g., rent, utilities, food, transportation). Calculate what’s left after these expenses are covered.

- Determine Your Loan Repayment Amount: Once you know how much money is left after expenses, decide how much of that can be allocated to your loan. As a general rule, keep it under 30% of your monthly income.

- Set Up a Payment Plan: Many loan providers, such as Easy Cash, offer flexible repayment schedules. Depending on the terms, you can pay weekly, bi-weekly, or monthly. Stick to this plan to avoid falling behind on payments.

- Cut Back on Non-Essential Spending: If you’re struggling to balance your loan repayments with your daily expenses, consider cutting back on luxuries or non-essential purchases until the loan is paid off.

- Track Your Progress: Keep track of your loan balance and progress on repayment. Staying organized ensures you know when the loan is nearly paid off and helps prevent any surprises down the line.

Types of Loans Available and Repayment Terms

If you’re considering a loan from Easy Cash, here’s an overview of their offerings:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Quick Loans | 15% per month | Must be a Nigerian citizen, with proof of income | Weekly, bi-weekly, or monthly |

| Emergency Loans | 18% per month | Must have a verifiable emergency and a stable income | Flexible repayment options |

| Payday Loans | 20% per month | Employed or self-employed individuals | Flexible, with a maximum of 30 days |

Easy Cash allows you to access funds quickly for urgent needs, but always remember that loans must be repaid. Stay within your financial limits to avoid overburdening yourself.

Tips on Borrowing Responsibly

When you borrow money, it’s essential to borrow only what you can repay comfortably. Borrowing excessively puts undue strain on your finances, leading to defaults, and affecting your future creditworthiness. Always assess your income carefully before taking on a loan.

Why You Must Repay On Time

Repaying your loan on time isn’t just a way of fulfilling an obligation—it’s an essential step in building your financial future. Repaying your loan on time enhances your creditworthiness, making it easier to access loans in the future.

Edujects Advice:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to the point it affects you just because you have access to it freely. Don’t take more than what your income can handle. Endeavor to use the money for its intended purpose. Learn from the business mindset of the Igbo people. They would never take borrowed money to fund activities that are unrelated to the purpose of the loan. Emergency funds should be used for emergency needs only. Once the emergency is resolved, plan immediately for the repayment. This will build credibility for you and for loan providers. Repaying on time allows Easy Cash to help more people in emergencies. Share this with anyone in need of emergency funds. Remember: Start planning for repayment the moment you receive the loan.”

By understanding how much of your income should go toward loan repayment, setting up a realistic repayment plan, and borrowing responsibly, you’ll avoid the pitfalls of debt and create a pathway toward financial stability. Stay disciplined with your finances, and you’ll see the benefits in the long run.