Life is unpredictable. One moment, you’re planning for the future, and the next, you’re faced with a medical emergency or an unexpected school fee deadline that you simply can’t cover. When this happens, stress and worry can cloud your thinking, and you might start asking, “Is there any way I can get a loan to pay for these emergency expenses?”

The good news is yes, there are options available to help you navigate these tough situations. Emergency loans can help you pay for medical bills, school fees, and other urgent expenses when you don’t have enough money. But before diving into borrowing, it’s essential to understand how to get these loans, the terms, and how to plan for repayment.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

What is an Emergency Loan?

An emergency loan is designed to help you cover urgent expenses, like medical bills, school fees, car repairs, or other unforeseen costs. These loans are often quick to process, allowing you to access funds in a short amount of time.

Emergency loans come in many forms, including personal loans, payday loans, or loans specifically tailored for medical or educational expenses. While borrowing money can seem like the quick solution, it’s important to weigh your options carefully and ensure you understand the terms of the loan.

Can I Use an Emergency Loan for Medical Bills or School Fees?

Yes, emergency loans can be used for both medical bills and school fees. In fact, these are some of the most common reasons people seek emergency loans. If you’re facing a medical emergency or need to pay school fees unexpectedly, a loan can help ease the financial burden.

However, it’s important to check with the lender to see if they have specific restrictions on how the loan can be used. Most lenders won’t mind if you use the loan for medical or educational purposes, but always ensure you’re transparent about your needs to avoid any confusion later on.

How Can I Get an Emergency Loan for Medical Bills or School Fees?

Here’s how you can go about securing an emergency loan for medical bills or school fees:

- Check Your Credit Score

Your credit score is an important factor that lenders use to determine your loan eligibility. A higher score can increase your chances of getting approved for a loan with favorable terms. If your score is low, you may still be able to get a loan, but the terms may not be as favorable. - Research Lenders

Different lenders offer different loan products. Research various options, from traditional banks to online lenders. Some lenders, like Swiffund, specialize in short-term loans for emergencies and may offer more flexible terms. - Determine the Loan Amount

Think carefully about how much money you need. Borrowing more than you need will result in higher interest payments. Make sure to borrow an amount that covers your medical or school fee needs without taking on excessive debt. - Prepare Your Documentation

Depending on the lender, you may need to provide documentation such as proof of income, medical bills, or school fee invoices. Be prepared to provide any required information quickly to speed up the loan approval process. - Apply for the Loan

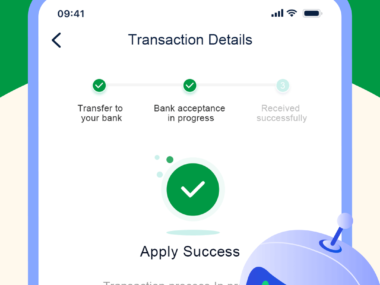

Once you’ve found a lender, fill out the application and submit your documentation. Many online lenders, like Swiffund, have streamlined applications that allow you to apply from the comfort of your home. - Wait for Approval and Disbursement

Once your loan is approved, the funds will typically be disbursed quickly. Some lenders can transfer the money to your bank account within hours, making it easier to pay for medical bills or school fees right away.

How Do I Plan for Repayment?

Getting a loan is one thing; planning for repayment is another. Here’s how you can ensure that you’re not overwhelmed by debt:

- Understand the Repayment Terms

Before accepting any loan, carefully read the repayment terms. Some loans may require weekly, bi-weekly, or monthly payments. Understand when the payments are due and how much you’ll need to pay each time. - Create a Repayment Plan

It’s essential to have a clear repayment strategy. Use a loan calculator or budget planner to figure out how much you need to pay each month. Make sure to set aside money for your loan repayment before spending on other non-essential items. - Look for Opportunities to Pay Early

Some loans allow you to make early repayments without penalties. If your loan allows this, consider paying off your loan faster to reduce interest costs. If your financial situation improves, paying off the loan sooner will help you avoid accumulating debt. - Set Up Alerts and Automatic Payments

Many lenders offer automatic payment setups, which can help you avoid missing a payment. Setting up payment reminders or automatic deductions will ensure that you never forget a payment.

Loan Options from Swiffund

Swiffund offers emergency loans to help cover medical bills, school fees, and other urgent expenses. Here’s a breakdown of what they offer:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan | 10-25% per annum | Age 18+, valid ID, steady income | Repayment over 30 days to 12 months |

| Medical Loan | 12-20% per annum | Proof of medical emergency, stable income | Repayment over 30 days to 6 months |

| Education Loan | 15-30% per annum | Proof of school fees, stable income | Repayment over 3-12 months |

Advice from the Edujects: “On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. And don’t take beyond the capacity of income expectations. Endeavor to use the money for its purpose. Learn from the business side of the Igbos — they would never take borrowed money to do other things rather than what the money is meant for. Anyone can have an emergency, and an emergency requires an emergency purpose. This emergency would come and go. Now that you have provision through this loan to fill in the gap of the emergency, immediately as the emergency is fixed, quickly source for the repayment plan. This would give the bank more credibility to help others solve their emergencies when they arrive. Let’s build a trust-driven Nigeria, where other companies can invest. The best we can encourage Swiffund to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they are now running after you with phone calls. As you take the loan today, start planning for the repayment today. Share this advice with anyone who may need emergency help.”