As a farmer in Nigeria, you know how difficult it can be to get the resources you need to grow your business. Whether it’s for seeds, equipment, or expanding your land, financial constraints are often a barrier that stands between you and success. The good news is that there are agricultural loans available to help you overcome these challenges, and these loans could be the game-changer you need to take your farm to the next level.

But before you rush to apply, it’s important to understand the options available, how to access these loans, and how to plan for repayment to ensure you don’t fall into further financial trouble. In this article, we’ll break down the types of agricultural loans available for Nigerian farmers, how they can access them, and how they can manage repayment to ensure long-term financial stability.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

The Importance of Agricultural Loans for Nigerian Farmers

Agriculture is the backbone of Nigeria’s economy, and the government has recognized the importance of supporting farmers with financial resources. Agricultural loans are essential for farmers who want to expand their businesses, improve yields, and manage unforeseen challenges like crop failure or market fluctuations. These loans can help farmers improve productivity, upgrade infrastructure, and invest in modern farming techniques.

Types of Agricultural Loans for Farmers in Nigeria

There are several types of loans available for Nigerian farmers. Below are the most common options:

1. Government Agricultural Loans

The Nigerian government offers a variety of loan schemes specifically designed to help farmers. These include:

- Central Bank of Nigeria (CBN) Agriculture Credit Guarantee Scheme Fund (ACGSF): This fund provides loans with low-interest rates and is designed to help farmers who may not qualify for regular bank loans.

- Anchor Borrowers’ Programme (ABP): Managed by the CBN, this initiative helps smallholder farmers gain access to financing, input, and technical support to increase production.

2. Commercial Bank Agricultural Loans

Commercial banks in Nigeria also offer agricultural loans with various repayment plans. These loans are typically offered at higher interest rates compared to government loans but come with flexible terms.

3. Microfinance and Development Finance Institutions (DFIs) Loans

Microfinance banks and DFIs play an important role in providing loans to smallholder farmers, especially those in rural areas. These loans are designed to be more accessible to farmers who may not meet the requirements for larger commercial loans.

4. Agricultural Development Programs

Private organizations, NGOs, and international institutions like the World Bank provide loans and grants to support agricultural development. These loans often come with a focus on specific projects like irrigation, mechanization, or capacity building.

How to Access Agricultural Loans for Farmers

Accessing an agricultural loan in Nigeria requires the farmer to meet certain eligibility criteria, which generally include:

- Valid Business Plan: Most financial institutions require farmers to present a detailed business plan outlining how they intend to use the loan to boost their farm’s productivity.

- Proof of Land Ownership or Lease Agreement: This is essential for most agricultural loans as it ensures that the loan is backed by collateral.

- Proof of Income or Cash Flow: Lenders want to see that farmers can repay the loan. This might include a record of past sales, crop yields, or other financial documentation.

- Farmer’s Identity Verification: To prevent fraud, lenders require government-issued identification to verify the farmer’s identity.

How to Plan for Loan Repayment

Once you’ve successfully secured a loan, planning for repayment is crucial. Here’s how you can manage repayment:

1. Create a Detailed Repayment Plan

Before taking out a loan, calculate your expected cash flow, taking into account factors such as crop yield and market prices. Ensure that the loan repayment aligns with your harvest cycle and income inflow. Consider the following:

- Repayment Period: Some loans offer longer repayment terms, which can ease the pressure.

- Installment Plans: If your loan requires monthly or quarterly payments, create a strict budget to allocate a portion of your income for repayment.

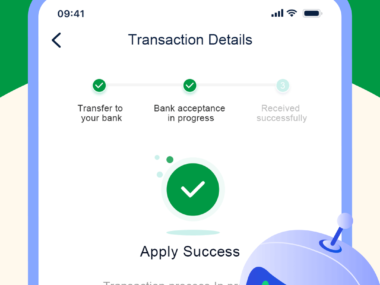

2. Start Repaying Early

It’s best to begin repayments as soon as possible. Even small repayments will show your commitment and help build your relationship with the lender. It also helps to avoid interest accumulation on outstanding payments.

3. Diversify Your Income Streams

Explore other ways to supplement your income, such as integrating livestock into your farming activities or exploring agribusiness ventures. Diversifying your income will create a safety net to ensure loan repayment is never at risk.

4. Emergency Fund for Unforeseen Events

Unpredictable events, such as crop diseases, weather conditions, or fluctuating market prices, can disrupt your income. Having an emergency fund can help you stay afloat during tough times.

Why Do Farmers Need Agricultural Loans?

Farmers need loans to:

- Increase Productivity: Loans can help farmers purchase seeds, fertilizers, and modern equipment that will significantly improve their productivity.

- Expand Operations: If a farmer has limited land or resources, a loan can be used to expand the business by acquiring additional land, livestock, or machinery.

- Cover Unexpected Costs: Whether it’s a sudden pest infestation or unexpected medical expenses, loans can provide the funds needed to weather financial challenges.

- Invest in Technology and Training: Loans can be used to invest in new technologies like irrigation systems or farming machinery, and to attend training sessions that can enhance farming skills and productivity.

Available Agricultural Loans from Swifund

If you’re considering a loan from a trusted institution, Swiffund offers several loan options for Nigerian farmers. Below is an overview of what they offer:

| Loan Type | Interest Rate | Eligibility | Repayment Method |

|---|---|---|---|

| Farmers’ Growth Loan | 10% p.a. | Nigerian citizen, at least 18 years, with land | Monthly, flexible repayment |

| Smallholder Loans | 12% p.a. | Registered farmer, existing farming business | Quarterly, direct debit |

| Agricultural Equipment Loan | 8% p.a. | Farmers with existing equipment to upgrade | Monthly, installment payments |

| Crop Production Loan | 15% p.a. | Must have at least one harvest cycle | Single repayment at harvest |

For more information, visit Swifund.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t borrow beyond your income expectations. Use the money for its intended purpose. Learn from the business side of the Igbo people. They would never borrow money for anything other than its intended purpose. Emergencies come and go. Once the emergency is solved, quickly source for the repayment plan. This builds trust and credibility with lenders. Pay back on time so that others can benefit when their emergencies arise. Repay today, plan today.”