We all find ourselves in difficult situations sometimes. Maybe it’s an unexpected emergency, a business opportunity you can’t afford to miss, or a personal need you can’t delay. When you’re in a bind and in urgent need of funds, a loan can seem like the lifeline you’ve been waiting for. But, how do you know when it’s the right time to borrow money?

Taking out a loan is a significant decision. It comes with both opportunities and risks. Whether you’re looking for money to expand your business, cover a medical bill, or solve any other urgent financial problem, understanding when to take a loan is key to managing your finances effectively.

Imagine this: you have a small business, and the opportunity to secure a big deal arises. But the catch? You don’t have the capital to follow through. You know that borrowing money could be the solution, but is it the right time to take a loan? Will you be able to repay it? How do you balance your financial responsibilities with the need for this loan?

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

In this article, we’ll explore when the best time to take a loan is, how to determine if borrowing money is the right choice for you, and the steps you can take to ensure that your loan benefits you in the long run. If you’re in need of money right now and have questions, keep reading.

When Is the Best Time to Take a Loan?

Borrowing money isn’t always a bad thing, but timing is everything. The best time to take out a loan depends on several factors, including your financial situation, the purpose of the loan, and your ability to repay. Let’s look at some scenarios where taking out a loan can be a good idea.

1. When You Have an Urgent Need

Life is unpredictable, and emergencies happen. Whether it’s a medical expense, a sudden car breakdown, or a critical home repair, these are moments where taking a loan can be necessary. Emergency loans can provide immediate relief, allowing you to handle the situation without stressing about where the money will come from.

Example:

Suppose you need to pay for an unexpected surgery, and your savings are not enough to cover the cost. A loan can help bridge that gap and get you the medical treatment you need.

2. When You Need to Expand or Invest in Your Business

For business owners, taking a loan at the right time can be an opportunity for growth. If you have a plan in place to generate revenue from the loan, borrowing money to expand your business can yield a significant return. This is especially true if you have identified an immediate opportunity for business growth but lack the necessary funds to take action.

Example:

You might need a loan to buy inventory or upgrade your equipment to meet increased demand for your products. With the loan in hand, you can make the investments necessary to grow your business and ensure that your repayment plan is aligned with the increased income your business will generate.

3. When You Can Manage the Repayments

One of the most crucial aspects of taking out a loan is your ability to repay it on time. Even if you have an urgent need or business opportunity, you should only take a loan if you are sure you can manage the monthly repayments. Defaulting on your loan can result in financial distress, higher interest rates, and a damaged credit score.

How to Plan for Repayment:

- Evaluate your income: Ensure that you can comfortably meet the repayment schedule.

- Create a budget: Allocate a portion of your income towards repaying the loan before taking on other expenses.

- Stick to the repayment plan: Avoid taking on additional loans or spending excessively.

4. When You’ve Weighed All Other Options

Sometimes, the best time to take a loan is when you’ve considered all other options. For example, can you get by without borrowing money by saving for a few months? Can you reduce expenses or increase your income temporarily? If a loan is your only viable option, ensure that it’s the best choice.

How Can You Get Money Fast for Your Urgent Needs?

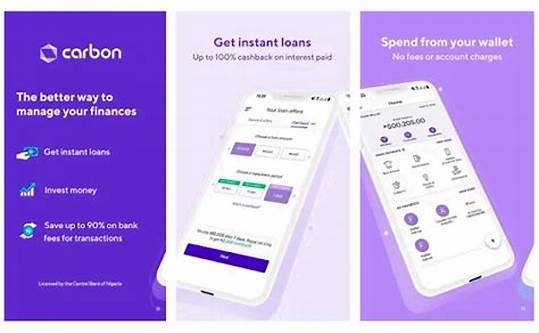

If you find that the right time to take a loan is now, there are several options available to quickly access funds, especially in Nigeria. One such option is Carbon Loan, which provides fast and accessible loans for individuals in urgent need of funds.

Here’s a look at some of the loan options Carbon offers:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan | 15% per month | Nigerian citizen, stable income source, minimum age 21 | Flexible repayment options up to 12 months |

| Emergency Loan | 12% per month | Proof of urgent need, valid identification | Repayment in 3 to 6 months |

| Business Loan | 18% per month | Business owners with proven income and a registered business | Flexible repayment over 6 to 12 months |

For more details, visit the Carbon website.

How to Plan on Repayment

Before you sign any loan agreement, it’s vital to have a clear and achievable plan for repayment. Here are some steps you can take:

- Calculate the total loan cost: This includes both the principal and interest.

- Estimate monthly payments: Based on the loan amount, interest rate, and repayment period.

- Ensure your income can cover it: Only borrow what you can afford to repay.

If you plan ahead and ensure that your loan is used for its intended purpose, it can be a useful financial tool to help you in times of need.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t borrow beyond your income expectations. Endeavor to use the money for its intended purpose. Learn from the Igbo business model. They would never borrow money for anything other than the intended purpose. An emergency requires an emergency purpose, and once it’s fixed, immediately start planning for repayment. This ensures credibility with the bank and will help others in need. The best way to encourage Carbon Loan to extend more emergency loans is by paying back on time. As you take the loan, start planning for repayment today. Share this advice with anyone who needs help.”

Conclusion

Taking a loan can be a lifeline, but only if it’s done at the right time and with a solid plan for repayment. Whether you’re facing an emergency, planning for business growth, or need extra funds to cover personal expenses, understanding when to take a loan is crucial to your financial well-being. Always consider your ability to repay, weigh all other options, and ensure that borrowing money will benefit you in the long term.