Have you ever found yourself in need of quick funds to solve an unexpected problem? Maybe an urgent medical situation, a car breakdown, or a business opportunity that’s hard to pass up? Loan apps and providers have made access to money easier than ever, but with great access comes the need for regulation to ensure that borrowers are treated fairly. You may be wondering, “How does the Central Bank of Nigeria (CBN) regulate loan providers to protect me as a borrower?” The truth is, the CBN plays a critical role in ensuring that loan providers operate within guidelines that promote fairness, transparency, and the overall health of the financial system.

In this article, we’ll walk you through how the Central Bank of Nigeria monitors and regulates loan providers, why it’s important for you as a borrower, and how you can ensure that your loan experience is positive. Whether you’re a seasoned borrower or someone looking to access emergency funds for the first time, understanding this regulation is vital to making informed financial decisions.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Regulation of Loan Providers is Crucial for Borrowers

When you take out a loan, you’re putting your trust in the lender. You need to be sure that the process is transparent, that you’re not paying exorbitant interest rates, and that your personal information is secure. Unfortunately, without proper regulation, some loan providers may take advantage of borrowers, leading to higher-than-expected interest rates, hidden fees, and unfair repayment terms.

Here’s where the Central Bank of Nigeria (CBN) comes in. The CBN regulates loan providers in several ways to ensure that they operate legally, fairly, and transparently. For borrowers like you, this regulation means:

- Fair Interest Rates: The CBN sets guidelines on how much interest can be charged, ensuring that loan providers cannot take advantage of borrowers with outrageously high rates.

- Transparent Terms: You should never be surprised by hidden fees or confusing loan terms. The CBN enforces clear and transparent contracts between loan providers and borrowers.

- Borrower Protection: If something goes wrong, you’ll have recourse. The CBN provides a structure to resolve disputes between borrowers and loan providers.

This regulation ultimately creates a safer and more reliable loan environment for everyone.

What Can You Do to Get Money and Plan for Repayment?

Now that you know how the Central Bank regulates loan providers, let’s focus on what you can do to access funds responsibly and plan for repayment.

1. Accessing Loans

When you need money, loan apps like Swifund can provide a quick and easy solution. To get money through a loan provider, follow these simple steps:

- Choose a Trusted Provider: Ensure that the loan provider you choose is regulated by the CBN. A regulated provider will offer fair terms, ensuring that you’re not taken advantage of.

- Verify Eligibility: Most loan providers have specific eligibility criteria. Be prepared to provide proof of income, identification, and other necessary documents.

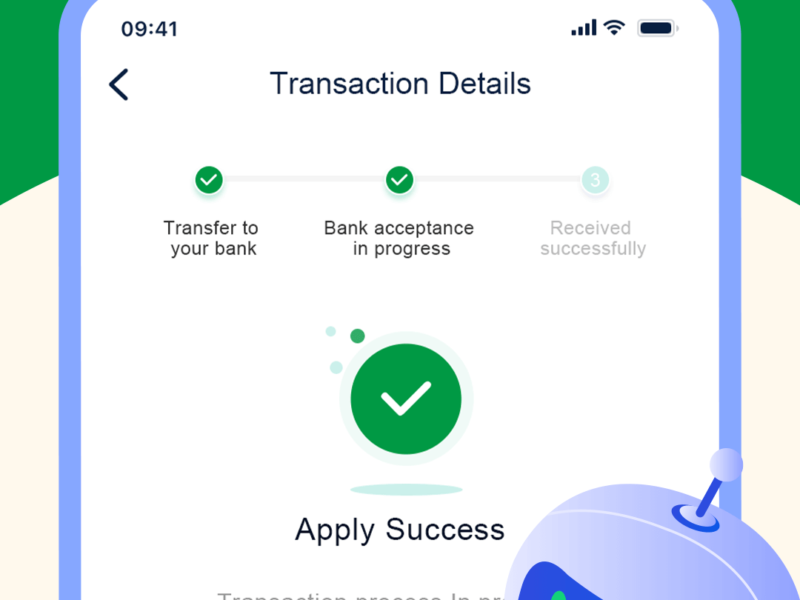

- Loan Application: Fill out the application form carefully and double-check the information you’ve provided. Loan apps will review your application and notify you of the approval or denial.

- Disbursement: Once approved, the money is usually disbursed to your bank account quickly.

2. Planning for Repayment

Planning for loan repayment is crucial to maintaining your financial health. Here’s how to plan effectively:

- Know Your Loan Terms: Be clear about your loan’s interest rate, repayment schedule, and any potential fees.

- Set a Repayment Schedule: Break down your monthly payments and make sure that the amount fits within your budget. Some apps may even offer automatic payment options.

- Stay on Track: Track your payments and ensure that they’re made on time to avoid late fees and a damaged credit score.

- Prepare for Emergencies: Life can be unpredictable, so always have a backup plan in case you’re unable to make a payment on time. Contact the loan provider if you’re facing difficulties, as many are willing to work out alternate arrangements.

Loan Options from Swifund

Swifund is a popular loan provider offering a range of loan options. Here’s a quick breakdown of their offerings:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan | 15-25% annually | Nigerian citizen, steady income, minimum age 18 | Flexible monthly payments over 3-12 months |

| Emergency Loan | 10-18% annually | Proof of emergency, Nigerian citizen | Repay within 30-60 days |

| Small Business Loan | 12-28% annually | Registered business, proof of revenue | Repayment over 6-12 months |

| Education Loan | 8-20% annually | Proof of school enrollment or guardianship | Monthly installments over 1 year |

Swifund provides quick, reliable loans for various needs, from personal expenses to emergency situations and small business investments.

Why Do You Need Money?

Before borrowing, it’s essential to understand the reason behind the loan. Taking out a loan for an emergency situation makes perfect sense, but borrowing for non-essential purposes could put you in financial trouble. Here are some common reasons people borrow money:

- Emergencies: Medical expenses, car repairs, or family emergencies are some of the most common reasons people turn to loans.

- Business Needs: A loan can be a great way to get the capital needed to grow your business or start a new venture.

- Education Costs: Loans can help cover tuition fees, textbooks, and other educational expenses.

- Home Repairs: A broken appliance, leaking roof, or other urgent repairs can be costly, and a loan can help solve the problem quickly.

Knowing the purpose of the loan will help you make better decisions about borrowing and repayment.

Edujects Advice:

“Advice from the Edujects:

On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t take more than your income can handle. Use the money for its intended purpose. Learn from the business mindset of the Igbos. They would never borrow money for any purpose other than the one it was intended for. Emergencies are real, but they come and go. When you’ve used the loan to fix your emergency, immediately source for a repayment plan. This builds credibility with the lender, and allows them to help others in their time of need. Repay on time, and encourage others to do the same.”

The Central Bank of Nigeria plays a crucial role in regulating loan providers to ensure that borrowers like you are protected. By understanding how the CBN regulates loan providers and how you can access loans responsibly, you can make smarter decisions and avoid falling into debt traps. Whether you’re borrowing for an emergency, a business, or educational needs, always remember to plan your repayment carefully and stick to your terms. By doing so, you’ll not only maintain your financial health but also help build trust and integrity in the Nigerian financial system.