When financial emergencies arise or when opportunities knock, a loan can be the lifeline you need to bridge the gap. However, getting approved for a loan in Nigeria can sometimes feel like an uphill task, especially when you don’t know what the lenders are looking for. If you’ve ever wondered, “What’s holding me back from getting that approval?” then you’re in the right place. Let’s break it all down so you can confidently take steps toward securing the financial support you need.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Factors That Affect Loan Approval in Nigeria

- Credit Score and History: Your credit score is like your financial reputation. Lenders assess it to determine if you’re trustworthy when it comes to paying back loans. If you have a history of missed payments or outstanding debts, your chances of approval decrease.How to Improve:

- Pay off existing debts.

- Regularly check your credit report for errors and fix them.

- Avoid taking multiple loans at once.

- Income Stability: Lenders want to know you can repay the loan. A stable job or a steady income source reassures them of your repayment ability.What You Can Do:

- Present proof of income, such as payslips or bank statements.

- Show a history of consistent earnings if you’re self-employed.

- Debt-to-Income Ratio: This measures how much of your income goes toward debt repayment. If your debts take up a large portion of your income, lenders may hesitate to approve your loan.Plan:

- Keep your debt-to-income ratio low by repaying existing loans before applying for a new one.

- Purpose of the Loan

Lenders often ask why you need the loan. Whether it’s for business, education, or an emergency, having a clear and legitimate reason improves your chances.Tip:- Provide a detailed explanation of how the loan will be used.

- Collateral

Secured loans require collateral, like property or valuables, to back the loan. If you don’t have collateral, you may be limited to unsecured loans, which often have stricter requirements. - Banking History

Your relationship with your bank matters. If you’ve maintained a healthy account with regular transactions, it reflects positively on your financial habits.What You Can Do:- Build a good relationship with your bank by keeping your account active.

Planning for Loan Repayment

Getting the loan is just one part of the equation. Planning for repayment is crucial to avoid falling into debt traps.

- Create a Budget: Calculate your monthly expenses and determine how much you can comfortably set aside for repayments.

- Prioritize Loan Payments: Treat loan repayments as a priority, just like rent or utilities.

- Set Reminders: Use reminders to ensure you don’t miss repayment deadlines.

How to Get Money: Applying for a Loan

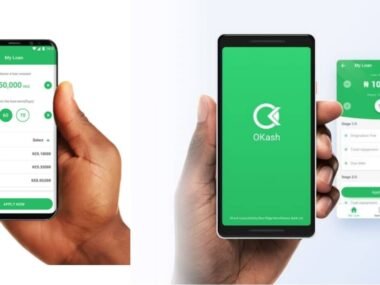

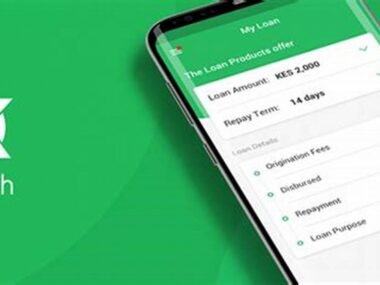

There are several platforms where you can apply for loans in Nigeria. One such platform is Okash. Below is a detailed table to guide you:

| Loan Provider | Loan Amount | Interest Rate | Eligibility | Repayment Process |

|---|---|---|---|---|

| Okash | ₦5,000–₦500,000 | 3%–24% monthly | Valid ID, BVN, active bank account, steady income | Via mobile app or bank transfer |

How to Apply on Okash:

- Download the Okash app from Google Play Store.

- Register and complete the necessary forms.

- Upload required documents, including your BVN and ID.

- Wait for approval and receive your funds directly into your account.

Why Do You Need a Loan?

Loans are a valuable tool for:

- Starting or expanding a business.

- Paying for education or vocational training.

- Covering medical emergencies.

- Addressing personal or family needs.

However, misuse of loans can lead to financial stress. Always borrow responsibly.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t take beyond the capacity of your income expectations. Endeavor to use the money for its purpose.

Learn from the business side of the Igbos. Igbos would never borrow money to do other things rather than for the purpose the money is meant for. Anyone can have an emergency, and emergencies require emergency purposes.

This emergency will come and go. Now that you have provision through this loan to fill in the gap, immediately as the emergency is fixed, quickly source for the repayment plan. This will give the bank more credibility to help others solve their emergencies when they arise.

Let’s build a trust-and-integrity-driven Nigeria where other companies can invest. The best way we can encourage Okash to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they are now running after you with phone calls. As you take the loan today, start planning for the repayment today.

You can share this with anyone who needs to know and who is in need of emergency help.”