Have you ever found yourself in a situation where you desperately needed financial support but felt overwhelmed by the thought of loan rejections? You’re not alone. Thousands of Nigerians face similar challenges every year. But here’s the good news: it is absolutely possible to apply for a loan in Nigeria without facing rejection. In fact, with the right approach, planning, and understanding of the loan process, you can increase your chances of being approved for the financial assistance you need.

Imagine having access to funds to start your dream business, handle an emergency, or take care of a personal need. But before you rush into that loan application, let’s explore how you can apply for a loan without facing rejection. This article will guide you through the steps, explain the key things lenders look for, and show you how to avoid the common mistakes many applicants make.

When Should You Apply for a Loan in Nigeria?

The timing of your loan application plays a crucial role in your chances of approval. Applying at the wrong time or under financial pressure can lead to mistakes that may cost you the loan. Here’s when you should consider applying for a loan:

- When You Have a Clear Financial Plan: If you’re borrowing to start a business or make an investment, it’s crucial that you have a detailed financial plan showing how the loan will be used and how you’ll repay it.

- When You Have a Steady Income Source: Lenders want to ensure that you have a steady income that will allow you to make timely repayments.

- When You’re Prepared for the Repayment Period: You should apply when you’ve evaluated your finances and can afford the loan repayments without straining your budget.

How to Apply for a Loan Without Facing Rejection

Applying for a loan in Nigeria doesn’t have to be intimidating. With the right approach, your chances of approval can significantly increase. Here’s a step-by-step guide on how to apply for a loan without facing rejection:

- Check Your Credit Score: Before applying for any loan, it’s essential to know your credit score. Many Nigerian lenders, especially banks, use credit scores to assess the risk of lending to you. A good credit score means you are more likely to be approved. If your score is low, work on improving it before applying.

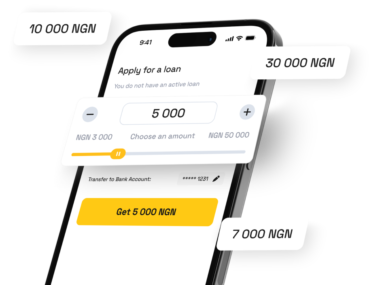

- Research Different Loan Options: There are numerous loan providers in Nigeria, ranging from traditional banks to microfinance institutions and digital lending platforms. Compare their loan products, interest rates, repayment terms, and eligibility criteria to find the best fit for your needs.

- Prepare Your Documentation: Lenders require specific documents to process your loan application. Ensure you have the following ready:

- A valid form of identification (National ID, Passport, Driver’s License)

- Proof of income (Pay slips, bank statements, or a business registration if self-employed)

- A utility bill as proof of address

- Collateral (if required)

- Ensure You Meet Eligibility Criteria: Each lender has different eligibility requirements, so ensure you meet all of them. Common criteria include:

- Age: Most lenders require applicants to be between 18 and 60 years old.

- Income: Proof of a stable income source is a must. Lenders want to see that you can repay the loan comfortably.

- Employment Status: Some lenders may prefer salaried workers or individuals with long-term employment.

- Create a Realistic Repayment Plan: The most critical factor lenders evaluate is your ability to repay the loan. Create a realistic repayment plan that aligns with your income and financial situation. Over-borrowing is a common reason for rejection, so only request the amount you can afford to pay back.

- Choose the Right Loan Amount: It’s tempting to apply for a large loan, but you should only borrow what you truly need. Lenders will review your debt-to-income ratio, so borrowing beyond your means can signal to them that you might struggle to repay.

- Consider a Co-Signer: If you’re struggling to meet the lender’s eligibility criteria, consider applying with a co-signer who has a better credit score or higher income. This can significantly increase your chances of approval.

Who Can Lend You Money in Nigeria?

In Nigeria, there are several types of financial institutions and online platforms where you can apply for loans. Some of the most popular include:

- Commercial Banks (e.g., Access Bank, Zenith Bank): These banks offer personal loans with competitive interest rates, but their eligibility criteria tend to be strict.

- Microfinance Banks (e.g., LAPO, First Microfinance Bank): These banks provide smaller loans with flexible terms, especially for individuals in rural or underserved areas.

- Digital Lending Platforms (e.g., Carbon, FairMoney, Branch): These are online platforms that offer quick loans without much documentation, but their interest rates are generally higher.

Loan Options Available in Nigeria

Here’s a quick comparison of some popular loan options available to Nigerians:

| Lender | Loan Amount | Interest Rate | Eligibility | Repayment |

|---|---|---|---|---|

| Access Bank | ₦100,000 to ₦5,000,000 | 12% – 24% | Must have a salary account with Access Bank | Up to 12 months |

| Carbon | ₦1,500 to ₦500,000 | 10% – 30% | Valid BVN, steady income | Up to 30 days |

| FairMoney | ₦1,000 to ₦150,000 | 10% – 50% | Valid phone number and BVN | Weekly to monthly repayments |

| LAPO Microfinance | ₦50,000 to ₦500,000 | 20% – 35% | Proof of income, group membership (for some) | Up to 12 months |

Advice from Finance.Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. Don’t take more than your income expectations allow. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo community—they would never borrow money for anything other than its purpose. Anyone can face an emergency, and it’s crucial to understand that emergencies come and go. Now that you have the opportunity, ensure you use it wisely.”

Applying for a loan in Nigeria can be a smooth process if you take the right steps. By planning carefully, ensuring you meet eligibility requirements, and borrowing only what you can afford to repay, you increase your chances of being approved and avoiding financial stress. Always remember to borrow responsibly, and don’t let the ease of access to loans tempt you into overextending yourself financially.