Life doesn’t stop at retirement. For many elderly Nigerians, the challenges that come with aging, including rising healthcare costs, maintenance of a comfortable lifestyle, or even assisting younger family members, often create a financial burden. The dream of financial freedom, independence, and security doesn’t disappear just because one reaches old age. But what happens when the funds fall short? Can elderly Nigerians access loans to meet their needs? The good news is—yes, there are options for elderly Nigerians who need quick financial help.

If you’re in the older age bracket, you might feel like opportunities for financial assistance are limited or complicated, but that’s not true. The reality is that several financial institutions have designed loan products specifically for elderly Nigerians who need financial support, whether for medical expenses, home improvements, or helping their families. This article will walk you through the available loan options, how to assess your eligibility, and how to plan for repayment.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do Elderly Nigerians Need Loans?

There are various reasons elderly Nigerians might find themselves needing to take out a loan. Here are some common scenarios:

- Medical Emergencies: Healthcare costs can be particularly burdensome as people age. Unforeseen medical expenses, including surgeries, medications, or long-term care, can quickly become overwhelming.

- Home Repairs or Maintenance: Older homes might require renovations, or there could be unexpected home repairs that need to be handled immediately. This can be especially critical for seniors who want to stay in a safe and comfortable environment.

- Helping Family Members: Elderly Nigerians, especially grandparents, often provide financial support to their children or grandchildren. Sometimes, this support may come at a time when their own finances are stretched thin.

- General Wellbeing: As people age, they might want to maintain a certain lifestyle or travel for leisure, something that becomes financially challenging without additional resources.

While these situations are a part of everyday life, getting the financial help you need when you’re older can be tricky. Let’s dive into how elderly Nigerians can secure loans and manage repayments effectively.

Are There Loans Available for Elderly Nigerians?

Yes, there are loans available for elderly Nigerians, though the terms and conditions may differ based on factors like age, income, and financial history. The good news is that there are now more financial institutions catering to seniors, with products designed to meet their unique needs. Here’s a breakdown of the loan options available:

- Personal Loans for Seniors

- Eligibility: Many banks and financial institutions are now offering personal loans for seniors who have a reliable income source, such as a pension or business income.

- Interest Rates: Interest rates may vary depending on the lender and the loan amount, but generally, they will be higher for older borrowers due to perceived risk.

- Repayment Plans: Flexible repayment plans are essential for seniors. Look for options that allow for monthly repayments, with the flexibility to extend the repayment period if needed.

- Medical Loans

- Eligibility: Some lenders provide loans specifically for medical emergencies or healthcare-related expenses. If you have a medical condition that requires ongoing care or an emergency situation, a medical loan might be an option.

- Interest Rates: Medical loans may have lower interest rates compared to general loans, but terms can vary based on the lender.

- Repayment Plans: These loans typically offer flexible or deferred repayment plans, allowing seniors to focus on their recovery rather than stress about paying off the loan immediately.

- Pension-Backed Loans

- Eligibility: For pensioners, some banks offer loans that are backed by their pension. This can be an excellent option for seniors who have regular income but need additional funds.

- Interest Rates: These loans tend to have lower interest rates since they are secured against the pension, but the loan amount will typically be limited to a percentage of the pension.

- Repayment Plans: Repayment is usually deducted directly from the monthly pension, making it easier for seniors to manage their loan repayments without missing payments.

- Home Improvement Loans

- Eligibility: If you own your home, you may be eligible for a home improvement loan to repair or renovate your house. These loans are often secured against your property.

- Interest Rates: Interest rates can vary depending on the lender and the value of your property.

- Repayment Plans: These loans often come with long repayment periods, making monthly payments manageable.

How to Apply for a Loan as an Elderly Nigerian

To access a loan, elderly Nigerians should consider the following steps:

- Research Lenders: Not all financial institutions offer loans to seniors, so it’s important to find those that cater to your age group. Look for banks, microfinance institutions, or fintech platforms with flexible lending terms for elderly borrowers.

- Understand the Terms: Carefully read and understand the loan terms, including interest rates, repayment schedules, and any fees or penalties for late payments.

- Check Your Eligibility: Some loans may require proof of income, like a pension statement, or collateral. Make sure you have the necessary documentation ready.

- Plan Your Repayments: Before committing to a loan, make sure you have a clear plan for repaying the loan. Factor your income and any existing expenses to ensure that you can meet the monthly payments without causing financial strain.

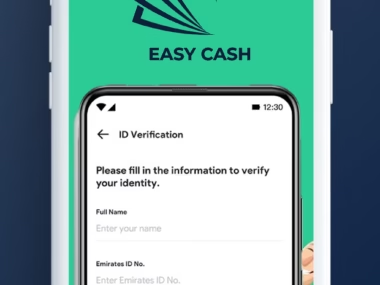

Loan Options from Easy Cash

One of the lenders offering loans for elderly Nigerians is Easy Cash, a well-known microfinance institution providing financial assistance to Nigerians, including seniors. Here’s a breakdown of their loan offerings:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan | 12% per month | Nigerian citizen, age 60 or above, proof of income | Flexible monthly repayments |

| Medical Loan | 10% per month | Must be facing a medical emergency, proof of need | Repayment in 3 to 12 months |

| Home Improvement Loan | 15% per month | Must own a home, with proof of ownership | Payable over 6 to 18 months |

| Pension-Backed Loan | 9% per month | Must have a valid pension account and steady income | Direct deduction from pension account |

To learn more about Easy Cash loans, visit Easy Cash.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. Don’t take more than your capacity can handle. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo culture—the Igbo would never borrow money for things other than its intended purpose. An emergency requires an emergency purpose, and once the emergency is fixed, immediately source for the repayment plan. This will help build credibility for the bank to assist others in their time of need. Always repay your loans on time—don’t wait until they start chasing you. When you take the loan, plan for repayment from the start. Share this with anyone in need of emergency financial help.”

Conclusion

Elderly Nigerians can access loans, though the terms may be different compared to younger borrowers. By understanding your options, planning ahead for repayment, and choosing the right lender, you can secure the funds you need without compromising your financial future. Whether it’s for medical expenses, home repairs, or assisting loved ones, a loan can be a valuable resource when used wisely.