Education is a powerful tool. It can shape the future, open doors to better opportunities, and transform lives. However, the path to education—especially higher education—can be financially challenging. For many Nigerians, pursuing academic dreams often requires more than just determination; it requires access to funds. But what if there was a way to bridge the financial gap between you and your educational aspirations? Can you get a loan specifically for educational purposes in Nigeria?

This question is more urgent now than ever. With rising tuition fees, additional costs for books, accommodation, and other school expenses, many students and parents are looking for financial solutions to make their educational journey possible. If you’re feeling overwhelmed or unsure about how to pay for education, don’t worry. You’re not alone. This article will provide you with the essential information about educational loans in Nigeria and how you can access them to fund your academic goals.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need a Loan for Education?

Before we dive into the specifics of educational loans, let’s take a moment to understand why these loans are essential.

- Rising Tuition Fees: With the cost of education increasing every year, many students find it difficult to afford the tuition fees. An educational loan can help fill this gap and make it possible to continue your studies.

- Accommodation and Living Expenses: In addition to tuition, you’ll need funds for housing, books, and daily living costs. A loan can ease the financial burden of managing these expenses.

- Emergency Costs: Sometimes, unexpected expenses arise during your academic journey. Educational loans can help cover these unplanned costs, allowing you to stay focused on your studies.

The good news is that there are loans available in Nigeria that cater specifically to education. Let’s explore how you can secure one.

Types of Educational Loans Available in Nigeria

Several institutions and financial bodies in Nigeria offer loans designed to help students and parents fund education. These loans can be for tuition fees, accommodation, books, or any other educational-related expenses. Here are some of the most common types of loans available:

- Government-Sponsored Educational Loans The Nigerian government, through various programs, offers educational loans to students in need. These loans are typically available for undergraduate students at public universities and may come with lower interest rates and more flexible repayment plans.

- Private Sector Loans Many banks and financial institutions in Nigeria offer educational loans. These loans are available to both undergraduate and postgraduate students. Private loans can be used to cover a wide range of education-related expenses, including tuition fees, textbooks, and accommodation.

- Institutional Loans Some universities and institutions have in-house loan programs for students. These loans often have favorable terms, such as lower interest rates and longer repayment periods, but they are typically limited to students enrolled at those specific institutions.

- Peer-to-Peer Loans Peer-to-peer lending platforms allow students to access funds from individual investors. These platforms have grown in popularity, especially for students looking for quick and flexible loan options. The interest rates and repayment terms can vary based on the platform and the investor.

How to Qualify for Educational Loans in Nigeria

To qualify for an educational loan, there are several requirements you must meet. Although the specifics can vary depending on the lender, these are some common criteria:

- Proof of Admission: You’ll need to provide evidence of admission to a recognized educational institution. This could include a letter of acceptance or enrollment.

- Proof of Identity: Lenders will ask for valid identification, such as a National ID card, international passport, or driver’s license.

- Proof of Financial Need: You may need to demonstrate your financial need by providing proof of your family’s income or your ability to repay the loan.

- Guarantor: Some lenders may require a guarantor, such as a parent, guardian, or another responsible individual, to co-sign the loan agreement.

How to Plan for Loan Repayment

While securing an educational loan is a major step, it’s equally important to plan for how you will repay it. Here are some tips to help you manage loan repayment:

- Know the Repayment Terms: Understand the interest rate, repayment schedule, and any other fees associated with your loan. This will help you plan your finances effectively.

- Create a Budget: Develop a realistic budget that includes your living expenses, tuition, and loan repayment. Keep track of your income and expenses to ensure you can meet your repayment obligations.

- Start Repaying Early: If possible, start repaying the loan as soon as you finish school or even before graduation. This will reduce the overall interest paid and ease the burden in the long run.

- Explore Scholarships and Grants: In addition to loans, look for scholarships or grants that you may be eligible for. These funds don’t need to be repaid and can help reduce the amount you need to borrow.

Easy Cash Loans for Education

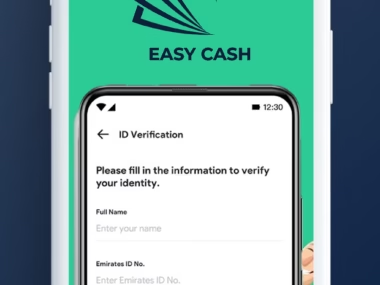

If you’re looking for a reliable and quick way to secure funds for your education, Easy Cash offers flexible loan options to help you achieve your academic dreams. Here’s a breakdown of the loan options they provide:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Student Loan | 12% per month | Nigerian student with proof of admission | Weekly, bi-weekly, or monthly |

| Emergency Education Loan | 15% per month | Must have urgent education-related expenses | Flexible repayment options |

| School Fees Loan | 10% per month | Must be enrolled in an accredited institution | Payable in 6 to 12 months |

Easy Cash offers a variety of loan options with simple application processes and flexible repayment terms. You can apply for these loans via their official website.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. Don’t take more than your income can comfortably cover. Endeavor to use the money for its intended purpose. Learn from the business mindset of the Igbo people—they never borrow money for purposes other than the one it was meant for. Anyone can have an emergency, but an emergency needs a defined purpose. Once the emergency is resolved, plan immediately for repayment. This builds trust and credibility. By repaying your loan on time, you ensure that more people can get help when they need it. Don’t wait until the lender starts calling you—start planning for repayment as soon as you take the loan. Share this information with anyone who needs help and is in an emergency.”

Conclusion

If you’re looking to fund your education in Nigeria, there are plenty of loan options available to help you achieve your academic goals. Whether you’re seeking a government-sponsored loan, a private sector loan, or even a peer-to-peer lending option, it’s essential to choose the best loan that fits your needs and financial situation. Remember, managing the repayment of your educational loan responsibly will not only help you graduate without a financial burden, but it will also ensure that more students in the future will have access to similar opportunities.