Emergencies don’t wait, and sometimes life hits you with financial needs you didn’t anticipate. Maybe you need funds to pay school fees, cover unexpected medical bills, or even boost your small business. But the thought of providing collateral can be overwhelming, especially when you don’t have any assets to pledge. You might wonder, “Are there loans I can get in Nigeria without collateral?”

The answer is yes! Several financial institutions and online platforms in Nigeria offer collateral-free loans. These loans are designed to help individuals access quick funds without the need to secure them with property or other assets. Let’s explore how you can access such loans, plan for repayment, and make the most of this opportunity.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

What Are Collateral-Free Loans?

Collateral-free loans are financial products that allow you to borrow money without needing to pledge any assets, such as land, vehicles, or property, as security. Instead, lenders rely on factors like your income, credit history, and repayment capability to determine your eligibility.

Why Do People Need Collateral-Free Loans?

Collateral-free loans are particularly helpful for:

- Emergencies: Medical bills, car repairs, or urgent school fees.

- Small Businesses: Entrepreneurs looking for quick capital to expand their ventures.

- Personal Expenses: Unexpected costs that can’t wait until the next paycheck.

How to Get a Collateral-Free Loan in Nigeria

Getting a collateral-free loan is straightforward if you know the right steps to follow:

1. Choose a Trusted Lender

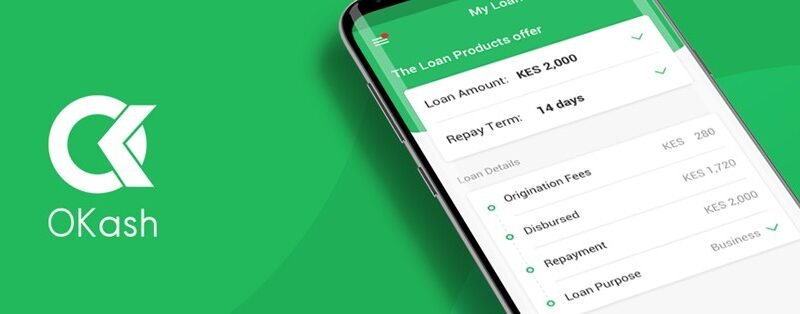

Look for reputable platforms like Okash, Carbon, or FairMoney. Research their interest rates, repayment terms, and user reviews to find a lender that suits your needs.

2. Check Eligibility Requirements

Most lenders have specific requirements, including:

- Age (usually 18+).

- Valid ID (e.g., NIN, voter’s card).

- Steady income or proof of employment.

- A functioning bank account.

3. Apply Online

Many lenders, including Okash, offer user-friendly apps or websites for applications. Simply provide your details, upload the required documents, and submit.

4. Approval and Disbursement

Once approved, funds are typically disbursed within hours or days.

5. Use the Money Wisely

Ensure you use the loan for its intended purpose. Mismanaging funds can lead to financial strain when it’s time to repay.

Planning for Repayment

Borrowing without planning for repayment can lead to trouble. Here’s how to stay ahead:

1. Understand the Terms

Before accepting the loan, understand the repayment period, interest rate, and penalties for late payment.

2. Budget Carefully

Create a repayment plan that fits your monthly budget. Factor in the loan amount and interest to avoid surprises.

3. Pay Early, If Possible

Some lenders allow early repayment without penalties. This can save you money on interest.

4. Set Up Automatic Payments

Enable auto-debit to ensure timely payments and avoid defaulting.

Loan Details for Okash

Here’s a summary of what Okash offers:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Quick Personal Loan | 15% per annum | Age 18+, valid ID, steady income | 14 to 90 days |

| SME Loan | 20-25% per annum | Business owner, valid documentation | 30 days to 12 months |

| Emergency Loan | 12-18% per annum | Proof of emergency, stable income | 7 to 30 days |

Edujects Advice

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. And don’t take beyond the capacity of income expectations. Endeavor to use the money for its purpose.

Learn from the business side of the Igbos. Igbos would never borrow money to do other things rather than what it is meant for. Anyone can have an emergency, and an emergency requires an emergency purpose. This emergency would come and go.

Now that you have provision through this loan to fill in the gap of the emergency, immediately as the emergency is fixed, quickly source for the repayment plan. This would give the bank more credibility to help others solve their emergencies when they arise.

Let’s build a trust-driven Nigeria, where other companies can invest. The best way we can encourage Okash to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they are now running after you with phone calls. As you take the loan today, start planning for the repayment today.

Share this advice with anyone who needs to know and who is in need of emergency help.”