As a small business owner in Nigeria, you’ve likely faced the challenge of needing quick access to funds for business expansion, operations, or dealing with unforeseen circumstances. Whether you’re trying to grow your startup or manage an urgent cash flow problem, having access to financing can mean the difference between success and failure. The good news is that there are specific loans designed to help small business owners in Nigeria achieve their goals. But with so many options out there, how do you know which one to choose, and how can you ensure you repay it without putting your business at risk?

In this article, we will dive deep into the different types of loans available to small business owners in Nigeria, what you can do to secure funding, and most importantly, how you can plan for repayment to ensure your financial health remains intact. Whether you’re just starting out or looking to scale your business, this comprehensive guide will give you the knowledge you need to borrow wisely and responsibly.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do Small Business Owners Need Loans?

Running a small business often comes with its financial ups and downs. You might need capital to:

- Start or Expand Your Business: You could be looking for funds to purchase inventory, equipment, or raw materials to kickstart your business or expand your existing operations.

- Handle Cash Flow Issues: Many small businesses struggle with cash flow, particularly if clients delay payments. A loan can help you bridge the gap and keep your business running smoothly.

- Seize Business Opportunities: Sometimes, an unexpected opportunity arises, such as a special order or a chance to buy goods at a discount. With a loan, you can seize these opportunities and grow your business.

- Pay Overheads and Expenses: From rent to employee salaries, there are always operational expenses that need to be covered. A loan can help you meet these costs while maintaining your day-to-day operations.

Specific Loans for Small Business Owners in Nigeria

In Nigeria, there are several types of loans tailored specifically for small business owners. These loans can come from banks, microfinance institutions, or fintech platforms, and each has its own set of terms, eligibility requirements, and repayment options. Here are the most popular loan types for Nigerian small business owners:

1. Bank Loans

Traditional banks offer business loans that come with longer repayment terms, but they often require collateral and a solid business plan. They are usually suited for established businesses looking to expand.

Typical Terms:

- Loan Amount: ₦500,000 – ₦20,000,000

- Interest Rate: 15% – 25% p.a.

- Repayment Period: 12 months to 5 years

- Eligibility: Registered business, collateral (property or equipment), proof of income and financial stability

2. Microfinance Bank Loans

Microfinance banks offer smaller loans with lower interest rates than traditional banks, making them ideal for businesses that are just starting or those with limited access to collateral. They offer faster approval processes and less stringent requirements.

Typical Terms:

- Loan Amount: ₦50,000 – ₦5,000,000

- Interest Rate: 10% – 20% p.a.

- Repayment Period: 6 months to 2 years

- Eligibility: Must be a registered business with a minimum of six months of operation

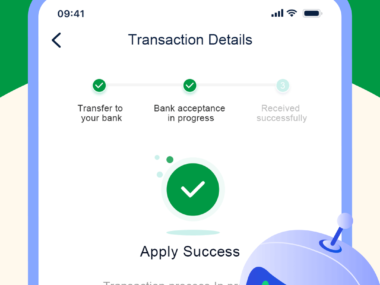

3. Fintech Loans (Swifund)

Fintech companies like Swiffund offer quick, online loans that cater to small business owners in Nigeria. These loans are typically unsecured, meaning no collateral is required, and can be approved within 24 hours. Swiffund offers flexible repayment schedules and easy application processes.

Typical Terms:

- Loan Amount: ₦20,000 – ₦5,000,000

- Interest Rate: 10% – 18% p.a.

- Repayment Period: 3 months to 12 months

- Eligibility: Must be a registered business, with a minimum of three months of operation, and must meet Swiffund’s credit scoring requirements

4. Government Loans and Grants

The Nigerian government, through various agencies, provides financial assistance to small business owners in the form of loans and grants. These programs are designed to support entrepreneurs in various sectors, including agriculture, technology, and manufacturing. The Central Bank of Nigeria (CBN) has a number of initiatives to provide funding to small businesses with low-interest rates and favorable repayment terms.

Typical Terms:

- Loan Amount: Varies by program

- Interest Rate: 5% – 10% p.a.

- Repayment Period: 1 year to 5 years

- Eligibility: Must meet specific program criteria, such as the Nigerian Youth Investment Fund (NYIF) or the Anchor Borrowers’ Program (ABP)

How Can You Get a Loan for Your Small Business?

- Have a Solid Business Plan: Most lenders will require a detailed business plan to understand your business model, goals, and how you plan to use the loan.

- Understand Your Loan Options: Be sure to explore all available loan options—banks, microfinance institutions, fintech companies, and government programs—to find the best deal for your business.

- Check Your Credit Score: Your credit score can impact your ability to secure a loan, especially for larger amounts. Be sure to check your credit score and work on improving it if necessary.

- Prepare Required Documents: Lenders will often ask for proof of identity, business registration, bank statements, and financial statements. Ensure all documents are up-to-date and accurate.

- Repayment Plan: Always make sure you have a clear plan in place for how you’ll repay the loan. Consider your business’s cash flow and set aside a portion of your revenue for repayments.

Loan Options from Swifund

| Loan Type | Interest Rate | Eligibility | Repayment |

|---|---|---|---|

| Quick Business Loan | 12% – 15% p.a. | Registered business with 3 months operation | Repay in 3 – 12 months |

| Emergency Loan | 15% p.a. | Must have a Swiffund account and valid ID | Repay in 7 – 30 days |

| Expansion Loan | 10% – 18% p.a. | Business expansion plans and proof of income | Repay in 6 – 12 months |

| Inventory Loan | 14% p.a. | Business involved in sales or retail | Repay in 3 – 6 months |

Advice from Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t borrow beyond your income expectations. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo. Igbo people never borrow money for unnecessary things; the money is meant for a purpose. Everyone can have an emergency, and an emergency requires an emergency purpose. This emergency will come and go. Now that you have provision through this loan, fill the gap of the emergency. As soon as the emergency is fixed, quickly source for the repayment plan. This will build trust and integrity, driving Nigeria’s financial sector forward, where more companies can invest. The best we can encourage Swiffund to increase the number of loans given for emergencies is to pay back on time. Don’t wait until they come chasing you with phone calls. As you take the loan today, start planning for the repayment today. Share this advice with anyone who needs emergency help.”