Are you self-employed or working informally and wondering if you can qualify for a loan in Nigeria? You’re not alone. Many Nigerians face this challenge, especially when financial needs arise, but formal employment isn’t part of the equation. In this article, we’ll explore how self-employed and informal workers can apply for loans, how to manage repayments, and why these loans might be the solution you’ve been searching for.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Understanding the Challenges of Self-Employment in Nigeria

Being self-employed or working informally often means financial uncertainty. Unlike formally employed individuals, you might not have consistent pay slips, making traditional banks skeptical about approving loans. However, the good news is that many financial institutions and loan apps have developed products tailored for individuals like you.

Steps to Secure a Loan as a Self-Employed or Informal Worker

1. Identify Your Needs

Before applying for a loan, ask yourself: Why do I need this money? Whether it’s for a business expansion, medical emergency, or school fees, understanding the purpose of the loan helps in planning effectively.

2. Choose the Right Loan Provider

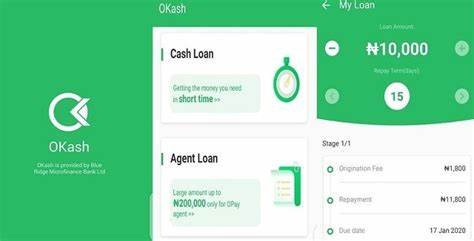

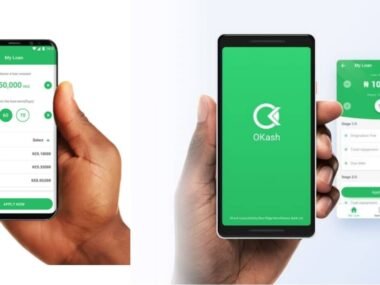

Several loan platforms in Nigeria, such as Okash, offer flexible loan options for self-employed individuals. These lenders often don’t require extensive documentation, making them ideal for informal workers.

3. Prepare the Necessary Documentation

While informal workers may not have traditional payslips, you can boost your credibility by providing:

- Bank statements showing cash flow.

- Proof of business operations (e.g., receipts or invoices).

- A valid means of identification (e.g., National ID, Voter’s Card).

4. Demonstrate Your Ability to Repay

Lenders prioritize trust. You can do this by:

- Sharing a detailed repayment plan.

- Showing steady income sources.

Managing Your Loan Repayment

Once you secure the loan, repayment is your responsibility. Consider these tips to stay on track:

- Create a Budget: Allocate funds towards repayment immediately after receiving your loan.

- Generate Extra Income: Engage in side gigs or expand your business to meet repayment demands.

- Avoid Over-Borrowing: Only take what you can repay comfortably.

Why Do You Need Money?

There are various reasons to consider a loan:

- Business Growth: Expand operations, buy inventory, or invest in tools and equipment.

- Emergency Expenses: Handle medical bills, urgent repairs, or unforeseen family needs.

- Education: Pay school fees or enroll in courses to enhance your skills.

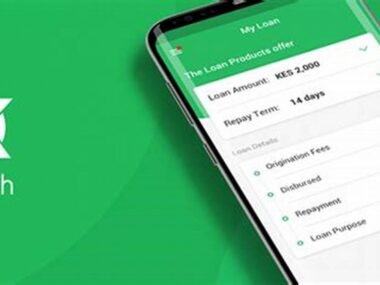

Loan Details for Okash

Here’s a breakdown of Okash loan offerings:

| Loan Provider | Loan Amount (₦) | Interest Rate (%) | Eligibility | Repayment Terms |

|---|---|---|---|---|

| Okash | 5,000 – 50,000 | 9 – 24 | Nigerian ID, active phone number, and proof of income (business or informal sources). | Weekly or monthly payments via mobile wallet or bank transfer. |

Advice from the Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t take beyond the capacity of your income expectations. Endeavor to use the money for its purpose.

Learn from the business side of the Igbo people— they would never borrow money for anything outside its intended purpose. Emergencies require emergency solutions, and emergencies will come and go.

Now that you have this loan to fill the gap, immediately start planning for repayment once the emergency is resolved. This builds trust and integrity, encouraging lenders like Okash to continue offering loans.

The best way to ensure lenders remain supportive is to pay back on time. Don’t wait for them to chase you with phone calls. As you take the loan today, start planning for repayment today.

Share this advice with others who need emergency assistance.