There comes a time in many people’s lives when they need financial help, but not everyone has a bank account or the credit history that banks typically require. If you find yourself in this situation, you might be wondering, “Can I still get a loan without a bank account?” The good news is that the answer is yes – there are options available for people who need loans but don’t have a traditional bank account. Whether you need money for an emergency, starting a business, or other personal expenses, it’s essential to understand the available loan options, how to apply for them, and how you can effectively plan to repay them. Let’s walk you through the possibilities and guide you toward making the right financial decision.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need the Loan?

Before seeking out a loan, it’s crucial to define why you need the money. Are you facing a financial emergency, such as medical bills, repairs, or an unexpected situation? Or are you looking to invest in something that will yield long-term benefits, like a business venture or educational expenses? Knowing the purpose of the loan will not only help you decide which loan option works best, but it also ensures that you use the money wisely.

Taking a loan is a responsibility, and it’s essential that you use the funds for what they are intended. Borrowing more than you need or using the loan for non-essential expenses could lead to financial strain in the future.

Loan Options Without a Bank Account

If you don’t have a bank account, you might feel limited in your options for obtaining a loan, but several financial services cater to those without traditional bank accounts. Here are a few options to consider:

- Microfinance Institutions: Microfinance institutions (MFIs) are non-bank financial entities that offer small loans, often with fewer requirements than commercial banks. Many of them cater to people who do not have a bank account. The loans may be smaller but can be highly beneficial for emergency situations or small business growth.

- Peer-to-Peer Lending: Peer-to-peer lending platforms allow individuals to lend money directly to others. These platforms operate outside traditional banking systems and may offer loans without requiring a bank account. Peer-to-peer lending can be a good option if you have an urgent need and are willing to go through the platform’s verification process.

- Payday Loans: While generally more expensive and often criticized for their high-interest rates, payday loans are a quick option for people without a bank account. These loans are usually small amounts and are meant to be repaid when you receive your next paycheck.

- Loan Apps: In today’s digital world, there are mobile apps that offer loans with little or no documentation. These apps cater to individuals who don’t have a bank account and can often disburse loans directly to your mobile wallet.

How to Apply for a Loan Without a Bank Account

Applying for a loan without a bank account is similar to applying for a traditional loan, but with some variations. Here’s a simple guide:

- Research Loan Providers: Start by looking for loan providers that cater to people without a bank account. Some online platforms and microfinance institutions might be a good place to start.

- Eligibility Requirements: Each loan provider will have different eligibility criteria. Make sure you meet the basic requirements, such as age, income, and residence status.

- Provide Identification: Loan providers will often ask for a form of identification, such as your national ID or driver’s license. If you don’t have a bank account, some may also ask for proof of your income or other documentation that confirms your ability to repay the loan.

- Submit an Application: Once you find a suitable provider and meet the eligibility requirements, you can submit your loan application either online or in person, depending on the loan provider.

- Loan Disbursement: If your loan application is approved, the funds may be disbursed via mobile money, through a voucher system, or via other non-bank methods.

How to Plan for Repayment

Planning for loan repayment is crucial to ensure that you can meet your financial obligations and avoid the stress of defaulting. Here’s how to set yourself up for successful repayment:

- Understand the Repayment Terms: Be clear about the loan amount, interest rate, and the repayment schedule. Understanding these terms will help you determine if the loan is affordable and what kind of monthly payment you can handle.

- Create a Budget: Plan your monthly budget to ensure that you can allocate enough funds toward loan repayment. Prioritize your loan payments to avoid missing deadlines.

- Track Your Spending: Monitor your expenses and make adjustments if needed. Ensure that you only spend on essential items while you’re repaying the loan.

- Set Up Automatic Payments: If your loan provider allows it, set up automatic payments from your mobile money account or another reliable source. This will help ensure that you never miss a repayment.

- Seek Help if Necessary: If you find that you’re struggling to repay the loan, reach out to the loan provider. Many institutions are open to negotiating the repayment schedule if you face a genuine financial hardship.

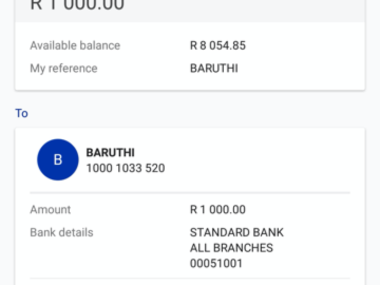

Example Loan Options from Umbanigeria

Umbanigeria is one of the loan providers in Nigeria offering a variety of loan products. Here’s a look at their options:

| Loan Type | Interest Rate | Eligibility | Repayment Terms |

|---|---|---|---|

| Personal Loan | 3% – 5% | Nigerian citizens, 18+, proof of income | Weekly, bi-weekly, or monthly payments |

| Emergency Loan | 5% – 8% | Nigerian citizens, 18+, urgent financial need | Within 30 days |

| Business Loan | 7% – 10% | Entrepreneurs, 18+, business registration | Monthly payments, flexible terms |

You can apply for a loan with Umbanigeria through their official website or mobile platform. They offer quick approval and convenient payment options.

Advice from Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t take more than your income can handle. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo people. They would never take borrowed money for non-essential things. An emergency is an emergency, and it will pass. Once the emergency is fixed, immediately begin planning for the repayment. This will help build credibility and trust with the loan provider, allowing them to assist others in future emergencies. Make sure to repay on time, as this helps increase the number of loans available for others. Start planning for repayment the moment you take the loan. Don’t wait until the lender is chasing you down for payments. Repay on time and make a positive impact. Share this advice with others who may need emergency help.”