Imagine you’ve secured a loan to cover an urgent expense, whether it’s medical bills, home repairs, or something important. But once the loan agreement is finalized, you start to feel the weight of the interest rate and repayment terms. The repayment feels like an additional burden you didn’t anticipate, leaving you wondering: “Can I negotiate these terms? Is there a way to lower my interest rate or extend my repayment period?”

If you’ve been in this situation, you’re not alone. The good news is, it’s possible to negotiate lower interest rates or better repayment terms. Many borrowers think their loan terms are set in stone, but lenders are often willing to work with you—especially if you demonstrate a good understanding of your finances and approach the negotiation respectfully and strategically.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need Money?

Before we dive into the negotiation process, let’s address why you need the loan in the first place. You might be borrowing to cover an emergency, a medical expense, a car repair, or even to expand your business. Whatever the reason, loans can provide the financial breathing room you need to take care of pressing issues. However, with this freedom comes responsibility—especially when it comes to repaying the money. The last thing you want is for a loan to create more stress than it resolves.

What Are the Key Factors to Consider When Negotiating Loan Terms?

When you’re thinking about negotiating lower interest rates or better repayment terms, here’s what you need to keep in mind:

- Your Credit Score: Your credit score is one of the most significant factors in determining your loan’s interest rate. The higher your credit score, the better your chances of negotiating favorable terms. If your score is low, it might be harder to get a reduction, but it’s still possible depending on the lender.

- The Lender’s Flexibility: Not all lenders offer room for negotiation. Traditional banks might have rigid policies, but alternative lenders, such as online lenders and microfinance institutions, may be more flexible. It’s important to understand the nature of your lender before making a request.

- Your Payment History: If you’ve been consistent in making timely payments, you’re in a stronger position to negotiate. Lenders are more likely to offer better terms to borrowers with a good track record of repaying loans on time.

- Loan Terms: Depending on the type of loan you’ve taken, certain terms might be more flexible than others. For example, interest rates might be negotiable, but repayment schedules might not be. It’s essential to know what’s up for negotiation.

Steps to Negotiating Lower Interest Rates or Better Repayment Terms

- Understand Your Current Loan Terms: Before negotiating, ensure you have a clear understanding of your current loan terms. Know the interest rate, repayment schedule, and any fees associated with the loan. This will give you a strong foundation for negotiations.

- Research Other Loan Providers: If your lender is unwilling to offer better terms, research other loan providers to see what terms they offer. This knowledge can help you approach your lender with a more informed perspective and demonstrate that you have other options.

- Reach Out to Your Lender: Start by contacting your lender. Be polite but assertive in requesting a review of your loan terms. Explain why you’re seeking better terms—whether it’s due to financial hardship, an improved credit score, or a better understanding of the loan market.

- Present Your Case: If you’ve been making consistent payments, highlight that fact. If your credit score has improved since you took out the loan, bring that up as well. Your lender may be more willing to offer better terms if they see you as a low-risk borrower.

- Consider Extending the Loan Term: If negotiating a lower interest rate isn’t possible, you can ask to extend the loan term. While this might not reduce your interest rate, it can lower your monthly payments and make repayment more manageable.

- Offer a Lump-Sum Payment: If you have a bit of extra cash, offering a lump sum payment to pay off the loan early could potentially reduce the interest rate or even lead to a discount on the total amount due. This is something that many lenders are open to, as it allows them to recover their funds sooner.

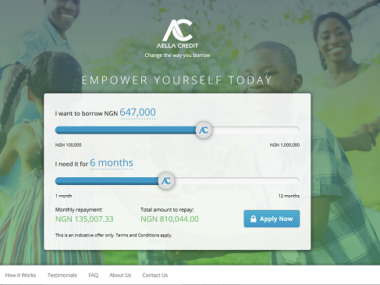

Loan Options from Aella Loans

If you’re looking for flexible loan options that suit your needs, Aella Loans offers a variety of products. Here’s a quick look at what they offer:

| Loan Type | Interest Rate | Eligibility | Repayment Terms |

|---|---|---|---|

| Personal Loan | 2% – 5% | Nigerian citizens, 18+, proof of income | Weekly, bi-weekly, or monthly payments |

| Emergency Loan | 4% – 6% | Nigerian citizens, 18+, urgent financial need | Within 30 days |

| Business Loan | 5% – 7% | Entrepreneurs, 18+, business registration | Monthly payments, flexible terms |

Aella Loans provides easy access to financial support, and their application process is simple and quick. Check out Aella Loans for more details.

Planning for Repayment: A Smart Approach

Once you’ve secured a loan with more manageable terms, it’s crucial to plan for repayment. Here’s how you can make sure you’re staying on track:

- Create a Budget: Determine how much you can realistically afford to pay back each month. Include this in your budget to ensure you’re not stretching yourself too thin.

- Automate Payments: Set up automatic payments so you don’t risk missing a due date. This will help you avoid late fees and protect your credit score.

- Use Extra Funds Wisely: If you receive an unexpected bonus or extra income, consider putting it toward your loan repayment. This can help you pay off the loan faster and reduce the overall interest you pay.

- Communicate with Your Lender: If you encounter any financial difficulty, don’t hesitate to contact your lender. They may be willing to extend your repayment term or temporarily lower your payment amount.

Advice from Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t borrow beyond your income expectations. Use the money for its purpose. Learn from the business side of the Igbo people—they never borrow money for unnecessary things. An emergency requires an emergency purpose, and once the emergency is fixed, immediately plan for repayment. This helps build credibility and trust, allowing other businesses to invest in the future. Start planning for repayment as soon as you take the loan. You can share this advice with others who are in need of emergency help.”