Starting or growing a business requires money, and for many Nigerians, accessing funds can feel like an uphill battle. The dream of running a successful business, growing your brand, and contributing to the economy is one that many entrepreneurs share. But what do you do when you lack the funds to turn your ideas into reality? The good news is that there’s an option that many overlook—using a personal loan to finance your business.

It might sound like an unconventional approach, but it’s becoming a more popular choice for Nigerians who need quick access to capital without jumping through too many hoops. Personal loans can provide that financial cushion, allowing you to get your business off the ground or keep it running smoothly. This article will explain how personal loans can be used for business, how to plan for repayment, and provide you with some resources to get started.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need a Personal Loan for Your Business?

The question many people ask is why a personal loan, instead of a business loan, might be the right choice for your business needs. The reality is that business loans often come with stringent requirements, including a lengthy application process, collateral, and sometimes a credit score that many small businesses just can’t meet.

But personal loans—these unsecured loans—are typically easier to obtain and can be used for virtually anything, including business expenses. Here are some reasons you might want to consider using a personal loan for your business:

- Starting a New Business: Whether you’re opening a shop, starting an online store, or launching a service-based business, you need working capital to cover initial expenses like inventory, equipment, and marketing.

- Expanding Your Business: If you already have a business but need to scale—perhaps you need new equipment, more staff, or additional inventory—a personal loan might be an easier option to get the funds.

- Emergency Cash Flow: Business owners often face cash flow problems, especially in the early stages. A personal loan can help bridge the gap between expenses and income.

- Covering Operating Costs: When your business is struggling to keep up with operational expenses like rent, utilities, or salaries, a personal loan can help you cover these immediate needs.

How Can You Use a Personal Loan for Your Business?

A personal loan is flexible and can be used in many ways to finance your business, such as:

- Purchasing Equipment: Whether it’s a computer for your office, machinery for your factory, or even furniture for your shop, a personal loan can help you buy what you need to operate.

- Covering Operating Expenses: This could include rent for your business premises, utilities, inventory purchases, or marketing efforts.

- Hiring Staff: If you need additional help to grow your business, a personal loan can help pay salaries until your business is profitable enough to cover these costs.

- Repairs and Maintenance: If your business depends on equipment or physical premises, a personal loan can be used for necessary repairs or maintenance.

How Can You Plan for Repayment?

One of the most crucial parts of taking a personal loan is planning for repayment. If you don’t plan for how you’re going to repay the loan, it can lead to a financial mess that impacts both your business and your personal finances. Here are some tips for managing repayment:

- Assess Your Income: Look at how much revenue your business generates on a monthly or weekly basis. You need to make sure that you can afford the loan repayment alongside your operating expenses.

- Choose the Right Loan Amount: Don’t borrow more than you need. Taking a larger loan might feel tempting, but it also means higher repayment amounts. Be realistic about how much money you need and only borrow that amount.

- Set a Clear Repayment Schedule: Agree to a repayment plan that aligns with your business cash flow. Some loans offer flexibility in repayments, allowing you to pay based on what your business earns each month.

- Consider Loan Terms: Choose a loan term that’s comfortable for your business. Don’t go for a long-term loan if you know your business can handle short-term payments. The quicker you pay it off, the less interest you’ll pay in the long run.

Can You Use Easy Cash Loans for Your Business?

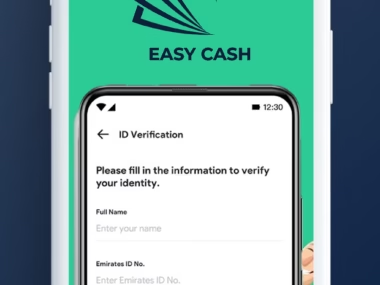

One of the options available for personal loans in Nigeria is Easy Cash, a microfinance institution offering fast loans to Nigerians in need. They offer personal loans that can be used for various purposes, including financing your business. Here’s a quick look at what they offer:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan | 12% per month | Nigerian citizen, stable income source | Flexible monthly repayments |

| Emergency Loan | 10% per month | Proof of urgent need, personal emergency | Repayment in 3 to 6 months |

| Business Loan | 15% per month | Nigerian citizen, must be business owner with income | Flexible repayments up to 12 months |

You can apply for these loans by visiting Easy Cash and follow the simple application steps.

What Are the Risks?

While personal loans can be a great way to finance your business, there are risks to consider:

- Debt Repayment Pressure: If your business doesn’t generate enough revenue to cover the loan, you might face financial strain. It’s important to have a clear repayment plan.

- High Interest Rates: Personal loans typically have higher interest rates compared to secured business loans, which means you’ll end up paying more over time.

- Impact on Personal Finances: Since personal loans are unsecured, the lender may not have collateral, but your personal credit and finances could be impacted if you default on the loan.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t take more than your capacity can handle. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo culture—the Igbo would never borrow money for things other than its intended purpose. An emergency requires an emergency purpose, and once the emergency is fixed, immediately source for the repayment plan. This will help build credibility for the bank to assist others in their time of need. Always repay your loans on time—don’t wait until they start chasing you. When you take the loan, plan for repayment from the start. Share this with anyone in need of emergency financial help.”

Conclusion

Personal loans can be a practical and flexible option to finance your business, whether you’re starting from scratch or expanding an existing operation. The key is to assess your business needs, choose the right loan amount, and plan for repayment to ensure that your business remains financially stable. With the right approach, a personal loan can help you grow and succeed in your entrepreneurial journey.