As a student in Nigeria, the weight of financial struggles can often feel overwhelming. Whether it’s paying for tuition, covering accommodation costs, or simply managing daily expenses, finding funds can be a daunting task. Imagine needing money urgently and not knowing where to turn. That’s where Cash X comes in—a lifeline for students in need of quick and reliable financial support.

If you’re wondering how you, as a student, can access a Cash X loan, this guide will provide you with all the information you need. Let’s dive in and help you make informed decisions that can ease your financial burden.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do Students Need Loans?

For many students, financial stress stems from a variety of reasons, including:

- Tuition Fees: Education is expensive, and sometimes scholarships or family support may not be enough.

- Accommodation Costs: Securing a place to live close to school often comes with hefty fees.

- Study Materials: Books, laptops, and other essential learning tools can add up quickly.

- Emergencies: Unexpected expenses, like medical bills or urgent travel, can disrupt your studies.

Knowing why you need a loan helps you borrow the right amount and use it effectively.

How to Access Cash X Loans as a Student

1. Check Your Eligibility

Cash X has specific criteria for student loans:

- You must be enrolled in a recognized institution in Nigeria.

- You need a valid student ID.

- Proof of income (e.g., part-time job or financial sponsor) may be required.

- Guarantor information is often necessary.

2. Register Online

Visit Cash X and create an account. Fill in your personal details and ensure you provide accurate information to avoid delays.

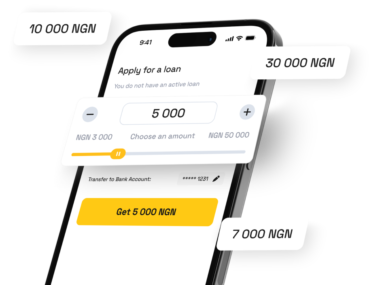

3. Apply for the Loan

After registering, follow these steps:

- Select the “Student Loan” option.

- Enter the amount you need and the purpose of the loan.

- Upload required documents, including your student ID and guarantor details.

4. Wait for Approval

Cash X typically processes loan applications within 24-48 hours. If approved, the funds will be disbursed directly to your account.

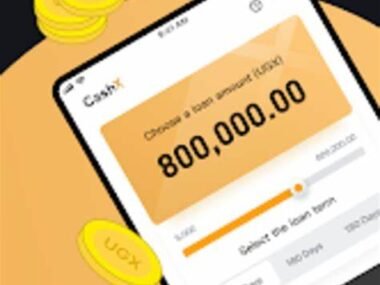

Loan Options and Details

Here is an overview of what Cash X offers to students:

| Loan Provider | Loan Amount | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|---|

| Cash X | ₦10,000 – ₦50,000 | 5% per month | Full-time students with valid school ID | Monthly payments |

| Cash X | ₦60,000 – ₦100,000 | 4% per month | Students with a guarantor and income proof | Bi-monthly payments |

How to Plan for Loan Repayment

Taking a loan is just the first step. Repayment is where the real challenge lies. Here’s how to plan effectively:

- Budget Your Expenses Create a budget that prioritizes essentials. Cut back on non-essential spending to ensure you can allocate funds for loan repayment.

- Start Saving Immediately Once you receive the loan, set aside a portion of your income or allowance each month to cover repayments.

- Seek Extra Income Consider part-time jobs or freelancing to boost your income. Even small amounts can go a long way in meeting your repayment schedule.

Benefits of Cash X Loans for Students

- Quick Approval: Funds are disbursed within 48 hours.

- Flexible Terms: Tailored repayment plans to suit students.

- Support for Emergencies: Loans can cover unexpected expenses.

Edujects Advice:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to the point it affects you negatively just because you have access to it freely. Don’t take beyond your income capacity. Endeavor to use the money for its purpose. Learn from the business side of the Igbos: they would never borrow money for unrelated things—only for the purpose it is meant for.

Anyone can face emergencies. Emergencies come and go, but loans remain until repaid. Use this provision to fill the gap of your emergency. Once the emergency is resolved, quickly source for repayment. This builds credibility with lenders, ensuring they can help others in need.

Let’s build a trust- and integrity-driven Nigeria, where other companies feel safe to invest. The best way to encourage Cash X to increase loans for emergencies is to repay on time. Don’t wait until they start chasing you with phone calls. As you take the loan today, start planning for repayment today. Share this with anyone who needs emergency help.”