Imagine this: You’ve just received your acceptance letter to the university of your dreams, but there’s a big hurdle standing between you and your future—the cost of tuition. You’ve worked hard, and you’re excited about the opportunities ahead, but the reality of paying for school is overwhelming. You know you need help, but the question is, can students in Nigeria access educational loans to fund their studies?

You’re not alone. In a country where the financial burden of education often falls heavily on students and their families, many Nigerian students are wondering how they can get the funds they need to succeed. In this article, we’ll explore how Nigerian students can access educational loans, how to plan for repayment, and why it’s crucial to use borrowed money wisely. We’ll also introduce loan providers like Easy Cash, who can help students bridge the gap between ambition and reality.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do Students Need Loans?

Education is one of the most important investments a person can make in their future, yet for many students in Nigeria, the cost of tuition, books, accommodation, and other academic expenses is simply unaffordable. The need for financial assistance to pursue higher education has never been more urgent. Without a loan or other financial support, many students might be forced to delay or abandon their academic dreams altogether.

For those who manage to secure a loan, it becomes an avenue to achieve the following:

- Tuition Fees: A large portion of a student’s financial burden is the cost of tuition, which can be expensive for those attending private universities or seeking advanced degrees.

- Accommodation and Living Expenses: Renting an apartment or paying for a hostel is another significant cost for students, especially those studying far from home.

- Study Materials: Books, laptops, and other study materials add to the expenses that students need to cover.

- Transport and Miscellaneous: For students living far from school, travel expenses also add to the financial load.

How Can Students Access Loans?

Though educational loans are not yet as common in Nigeria as they are in other countries, several options are emerging to help students access the funds they need for school. Here’s a closer look at how Nigerian students can get educational loans:

- Government-Sponsored Loans: In Nigeria, there are some government programs aimed at providing loans for students. These programs, though limited, may offer subsidized interest rates and flexible repayment plans. However, they are often competitive, and the application process can be lengthy.

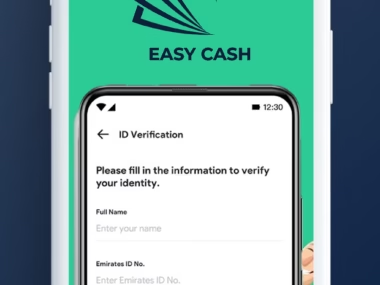

- Private Loan Providers: Some private companies like Easy Cash are helping to bridge the gap for students in need of quick and accessible loans. These loans can be used for educational purposes, but they come with higher interest rates compared to government-sponsored loans. Easy Cash provides loans that can help students pay for their school fees, books, and accommodation.

- Crowdfunding: In addition to loans, some students are turning to online crowdfunding platforms to gather financial support from friends, family, and even strangers. While this option doesn’t involve repayment, it requires a lot of time and effort to raise the necessary funds.

How to Plan for Loan Repayment

Once you’ve secured a loan, it’s essential to plan for repayment. Here are steps you can take to ensure you stay on track:

- Understand the Loan Terms: Before taking out a loan, make sure you fully understand the terms and conditions, including the interest rate, repayment period, and any penalties for late payments.

- Set a Realistic Repayment Amount: As a student, your income may be limited, especially if you rely on part-time work or financial support from family. Try to keep your repayment plan manageable—avoid taking out more than what you can realistically pay back.

- Stick to the Repayment Plan: Once the loan is disbursed, set reminders to ensure you make repayments on time. Failing to repay on time can result in additional fees, and it may impact your credit rating, making it more difficult to borrow in the future.

- Use the Loan Responsibly: The key to success is ensuring that the loan is used for its intended purpose—education. Using the funds irresponsibly can lead to unnecessary debt and financial strain.

Types of Loans Easy Cash Offers and Their Terms

For students in need of quick funds for education, Easy Cash is an excellent option. Below is a breakdown of the loans Easy Cash provides, their interest rates, eligibility requirements, and repayment plans:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Quick Loans | 15% per month | Must be a Nigerian citizen, with proof of income | Weekly, bi-weekly, or monthly |

| Education Loans | 18% per month | Must be a student with proof of enrollment and a stable income | Flexible repayment options |

| Emergency Loans | 20% per month | Must have a verifiable emergency and a stable income | Flexible, with a maximum of 30 days |

Easy Cash offers a variety of loans designed to meet different needs, and their flexible repayment options ensure that students can manage the repayment process without added stress.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t borrow more than what your income can comfortably cover. Endeavor to use the money for its intended purpose. Learn from the business-minded Igbo people—they never borrow money for purposes other than the one it was meant for. Anyone can have an emergency, but an emergency needs a defined purpose. Once the emergency is resolved, plan immediately for repayment. This builds trust and credibility. By repaying your loan on time, you ensure that more people can get help when they need it. Don’t wait until the lender starts calling you—start planning for repayment as soon as you take the loan. Share this information with anyone who needs help and is in an emergency.”

Conclusion

Securing an educational loan in Nigeria can be a game-changer for students, enabling them to continue their studies without the overwhelming financial burden. Whether you choose government-sponsored loans, private loans like those from Easy Cash, or crowdfunding, it’s essential to approach borrowing with responsibility. Make sure you understand the loan terms, plan your repayment strategy, and use the funds wisely to invest in your future.