Imagine this: You’re staring at an urgent financial need, your plans hanging by a thread, but the thought of securing a guarantor for a loan feels like an impossible hurdle. Does this sound like you? You’re not alone. Many Nigerians face similar struggles when trying to access financial assistance.

The good news is, obtaining a loan without a guarantor in Nigeria is possible. Whether you’re dealing with an emergency, looking to invest in your business, or simply need money to settle pressing obligations, there are options available. This article will walk you through the steps to apply for a loan without a guarantor, provide insights on repayment planning, and highlight why you might need a loan in the first place. Let’s dive in.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need a Loan?

Life throws unexpected challenges our way—a medical emergency, school fees, rent payments, or even the desire to grow your business. These situations often require immediate financial intervention, and savings alone may not suffice. Loans offer a lifeline by providing the funds you need, allowing you to focus on solving the problem at hand without depleting your resources entirely.

But why specifically opt for a loan without a guarantor? Here’s why:

- Privacy: You might not want others involved in your financial matters.

- Convenience: It’s faster to secure a loan without needing to find someone to vouch for you.

- Accessibility: Some lenders cater to individuals who don’t meet the traditional guarantor requirements.

How Can You Apply for a Loan Without a Guarantor?

Here are the steps to follow:

1. Research Lenders Offering No-Guarantor Loans

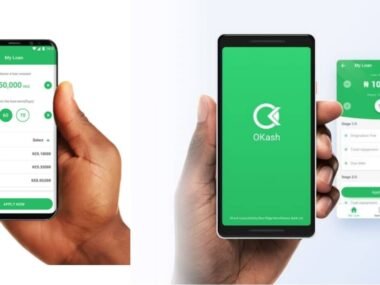

Several financial institutions and loan platforms in Nigeria now provide loans without the need for a guarantor. Examples include platforms like Okash, Carbon, and Branch. These platforms focus on assessing your creditworthiness through your income, transaction history, and other factors.

2. Prepare the Necessary Documents

While you may not need a guarantor, you’ll still need to provide certain documents, such as:

- A valid means of identification (e.g., National ID, International Passport, or Voter’s Card).

- Bank statement (usually for the last 3 to 6 months).

- Proof of income or employment.

- BVN (Bank Verification Number).

3. Apply Through a Digital Platform

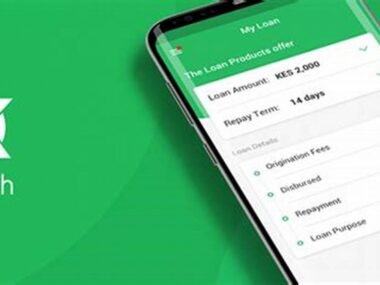

Most no-guarantor loans are offered online. Download the mobile app of the chosen lender, create an account, and fill in your details. Submit the required documents, and within hours (sometimes minutes), you’ll receive feedback on your application.

4. Review the Loan Terms

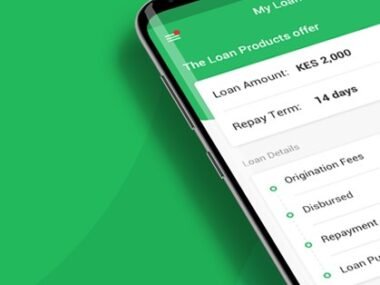

Before accepting the loan, read the terms and conditions carefully. Pay close attention to the interest rate, repayment period, and penalties for late repayment. Make sure you’re comfortable with the terms before proceeding.

5. Get the Funds and Stick to Your Plan

Once approved, the funds are disbursed to your account. Use the money for its intended purpose and start planning your repayment immediately.

Loan Options Available in Nigeria Without a Guarantor

Here’s a look at some options you can consider:

| Loan Provider | Loan Amount | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|---|

| Okash | Up to ₦50,000 | 9% – 15% monthly | Nigerian citizen, 21+, BVN, stable income | Flexible repayment (30-90 days) |

| Carbon | Up to ₦500,000 | 5% – 20% monthly | Valid ID, BVN, proof of income | 1 to 6 months |

| Branch | Up to ₦200,000 | 15% – 20% monthly | BVN, bank statement, smartphone | 4 to 12 weeks |

| FairMoney | Up to ₦500,000 | 10% – 25% monthly | Nigerian citizen, 18+, BVN, active account | 2 to 6 months |

Planning for Repayment

One of the biggest challenges people face with loans is repayment. Here are tips to ensure you stay on track:

- Set a Budget: As soon as you receive the loan, allocate a portion of your income specifically for repayments.

- Automate Payments: Many loan apps allow you to set up automatic deductions from your account to avoid missing payments.

- Cut Unnecessary Expenses: During the repayment period, focus on essentials and cut down on non-essential spending.

- Consider Early Repayment: If possible, repay your loan early to reduce the total interest paid.

Why Should You Choose Okash for Your Loan?

Okash is one of the most reliable platforms for no-guarantor loans in Nigeria. Here’s why:

- Fast Approval: Loans are approved within minutes.

- No Collateral Needed: You don’t need to pledge assets.

- User-Friendly App: The process is seamless, from application to disbursement.

For more information, visit the Okash official website.

Advice from the Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. Don’t take beyond the capacity of your income expectations. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo community. Igbos would never borrow money to do other things; they ensure it’s used for the specific purpose it’s meant for. Anyone can have emergencies. An emergency requires an emergency purpose, and this emergency will come and go. Now that you have provision through this loan to fill the gap of the emergency, immediately as the emergency is fixed, quickly source for the repayment plan. This will give the bank more credibility to help others solve their emergencies when they arise. Let’s build trust and integrity in Nigeria, where other companies can invest. The best way we can encourage Okash to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they are running after you with phone calls. As you take the loan today, start planning for repayment today. You can share this with anyone who needs to know and who is in need of emergency help.”