In times of financial need, choosing the right loan option can be daunting. Whether you are planning for a business venture, managing an emergency, or simply bridging a financial gap, the decision to borrow money should not be taken lightly. The question is, should you rely on traditional bank loans with their structured systems or opt for the convenience of mobile loan apps in Nigeria?

Both options have their advantages and disadvantages, and the best choice depends on your specific financial needs and situation. In this article, we’ll break down what you need to know to make an informed decision.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Understanding Traditional Bank Loans

Traditional bank loans have been a reliable option for decades. They provide borrowers with structured repayment terms, competitive interest rates, and a range of loan types, such as personal loans, business loans, and mortgage loans.

Pros of Bank Loans

- Lower Interest Rates: Most banks offer competitive rates, especially for individuals with good credit history.

- Large Loan Amounts: Banks can provide significant sums for long-term projects.

- Credibility: Bank loans are reputable and secure, offering legal protection.

Cons of Bank Loans

- Lengthy Process: The application process can take weeks due to document verification and credit checks.

- Strict Requirements: Banks often require collateral, proof of income, and guarantors.

- Inflexibility: Early repayments may attract penalties, and terms are often rigid.

Mobile Loan Apps: A Modern Solution

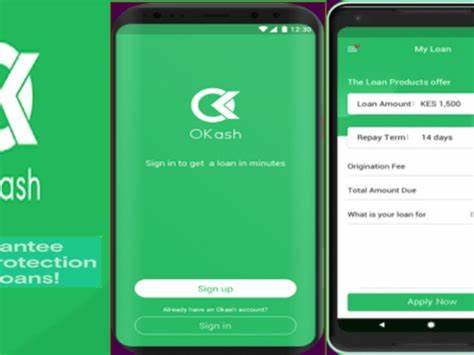

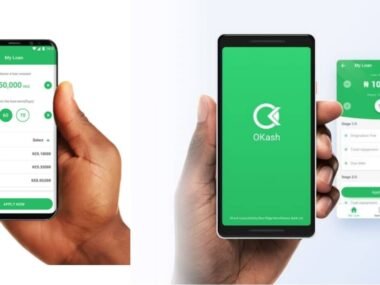

Mobile loan apps have revolutionized lending in Nigeria by offering quick and easy access to funds. Popular platforms like Okash, Carbon, and Palmcredit allow users to borrow money with just a few taps on their smartphones.

Pros of Mobile Loan Apps

- Convenience: No need for physical visits; applications are done online.

- Quick Disbursement: Funds are usually deposited within minutes or hours.

- Minimal Requirements: Most apps do not require collateral or guarantors.

Cons of Mobile Loan Apps

- Higher Interest Rates: Convenience comes at a cost, with interest rates often exceeding 15% monthly.

- Smaller Loan Amounts: Loans are typically capped at lower amounts, especially for first-time users.

- Short Repayment Periods: Borrowers are often required to repay within 30 days or less.

Key Factors to Consider

When deciding between traditional bank loans and mobile loan apps, consider the following:

1. Loan Purpose

- For large investments, such as starting a business or buying property, traditional bank loans are ideal.

- For short-term emergencies, mobile loan apps are more suitable.

2. Interest Rates

Compare the interest rates of banks and mobile apps to determine which option aligns with your repayment capacity.

3. Loan Amounts

If you need a substantial amount, banks are more likely to meet your needs. For smaller amounts, mobile apps can suffice.

4. Speed of Disbursement

- Urgent needs like medical emergencies are better handled with mobile loan apps due to their speed.

- Non-urgent needs can afford the longer timelines associated with bank loans.

5. Repayment Terms

Banks usually provide flexible repayment schedules spread over months or years, while mobile apps require prompt repayments, often within 30 days.

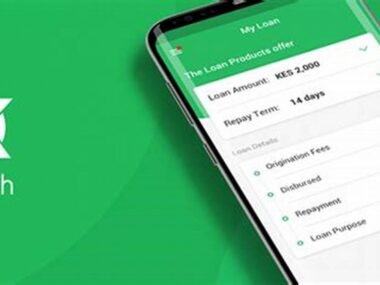

Loan Details: Okash

| Loan Feature | Details |

|---|---|

| Maximum Loan Amount | ₦50,000 – ₦500,000 |

| Interest Rate | 15% – 35% (depending on loan amount) |

| Eligibility | Valid ID, active phone number, BVN |

| Repayment Methods | Bank transfer, in-app payment |

How to Plan for Repayment

- Budget Wisely: Create a repayment plan before borrowing.

- Allocate Funds: Set aside money for monthly repayments to avoid default.

- Cut Unnecessary Costs: Limit expenses to ensure timely payments.

Why You Need Money

Understanding why you need a loan is crucial. Borrow only for essential purposes, such as:

- Funding a business

- Covering medical expenses

- Paying school fees

- Handling unforeseen emergencies

Advice from the Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. And don’t take beyond the capacity of income expectations. Endeavor to use the money for its purpose.

Learn from the business side of the Igbos. Igbos would never borrow money to do other things rather than the purpose the money is meant for. Anyone can have an emergency. An emergency requires an emergency purpose, and this emergency would come and go. Now that you have provision through this loan to fill in the gap of the emergency, immediately as the emergency is fixed, quickly source for the repayment plan.

This would give the bank more credibility to help others solve their emergencies when they arise. Let us build a trust- and integrity-driven Nigeria where other companies can invest. The best way we can encourage Okash to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they start running after you with phone calls. As you take the loan today, start planning for the repayment today. Share this with anyone who needs to know and who is in need of emergency help.