Navigating the world of loans can feel overwhelming, especially when you’re in urgent need of financial help. You might ask yourself, “Am I eligible for a loan?” or “Which loan provider can meet my needs?” These are valid questions, and the answers could make all the difference in securing the financial support you need without causing future stress.

In this guide, we’ll walk you through the essential steps to determine your loan eligibility, how to choose the best provider, and practical tips to manage your finances effectively.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Understanding Loan Eligibility

Loan eligibility varies from provider to provider, but most lenders look at a few key factors:

- Credit Score:

Your credit score reflects your financial trustworthiness. While some lenders focus heavily on this, others cater to individuals with no credit history. - Income Stability:

Lenders want assurance that you can repay the loan. A steady income stream or proof of employment is often required. - Debt-to-Income Ratio:

This measures how much of your income is already committed to existing debts. A low ratio makes you more eligible. - Loan Purpose:

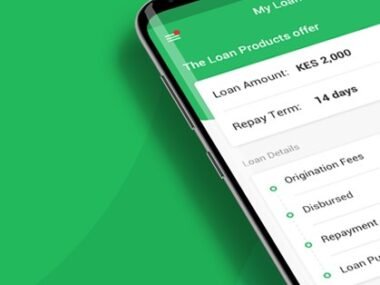

Many lenders want to know how you intend to use the money, whether for emergencies, education, business, or personal expenses.

Steps to Know If You’re Eligible for a Loan

- Check Your Financial Health:

Assess your income, savings, and existing financial obligations. Ensure you have room in your budget to accommodate loan repayment. - Understand Lender Requirements:

Research different loan providers and their eligibility criteria. For instance, some providers might cater specifically to first-time borrowers or small business owners. - Prequalify Online:

Many lenders allow you to prequalify online without affecting your credit score. This gives you an idea of whether you meet their criteria. - Review Documentation:

Gather documents like proof of identity, income, and any collateral if required.

Choosing the Best Loan Provider

Finding the right provider isn’t just about who offers the most money—it’s about terms, trustworthiness, and service quality. Let’s take Okash as an example.

| Loan Provider | Loan Amount | Interest Rate | Eligibility | Repayment Options |

|---|---|---|---|---|

| Okash | ₦5,000 – ₦500,000 | 0.1% – 1% daily | Nigerian residents, aged 20–55, with a valid ID and phone line | Flexible installments via debit card or bank transfer |

How to Plan for Loan Repayment

- Create a Budget:

Before taking the loan, map out how much of your income can go toward repayments without affecting other necessities. - Set Up Auto-Payments:

Automating your repayments ensures you don’t miss deadlines, avoiding penalties and maintaining a good credit score. - Avoid Late Payments:

Late fees can accumulate quickly, making the loan more expensive over time. Always prioritize timely payments.

Why Do You Need a Loan?

Loans are a tool, not a lifeline. Understanding your reason for borrowing is key to managing the money responsibly. Common reasons include:

- Emergencies: Medical bills, car repairs, or unexpected home expenses.

- Business Opportunities: Expanding a small business or buying inventory.

- Personal Goals: Education, weddings, or consolidating high-interest debts.

Whatever the purpose, ensure the loan aligns with your financial goals and doesn’t create long-term strain.