Running a business in Nigeria can be both rewarding and challenging. Often, financial limitations stand as the biggest hurdle for business owners trying to expand or sustain their ventures. If you’ve ever found yourself asking, “How do I qualify for a business loan in Nigeria?”, you’re not alone. Many entrepreneurs face this same challenge, and the good news is that solutions like Cash X loans are available to provide the financial push you need.

Let’s walk through everything you need to know about qualifying for a business loan in Nigeria, from eligibility requirements to repayment strategies, so you can take that next step with confidence.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why You Might Need a Business Loan

Understanding why you need a loan can help you plan better and make the right financial decisions. Common reasons for business loans include:

- Business Expansion: To open a new branch, hire more staff, or invest in marketing.

- Operational Costs: Covering rent, utilities, or salaries during tough months.

- Equipment Purchase: Buying machinery, tools, or vehicles to improve productivity.

- Emergencies: Addressing unexpected expenses that threaten your operations.

How to Qualify for a Business Loan in Nigeria

1. Prepare Your Business Plan

A solid business plan is essential. It should outline:

- Your business goals.

- How the loan will be used.

- Projected revenue and profit margins.

- Repayment strategies.

2. Check Your Eligibility

Cash X has specific requirements for business loans, including:

- Business Registration: Your business must be registered with the Corporate Affairs Commission (CAC).

- Proof of Income: Provide evidence of consistent cash flow to demonstrate your ability to repay the loan.

- Credit History: A good credit score increases your chances of approval.

- Guarantors: Some loans may require credible guarantors.

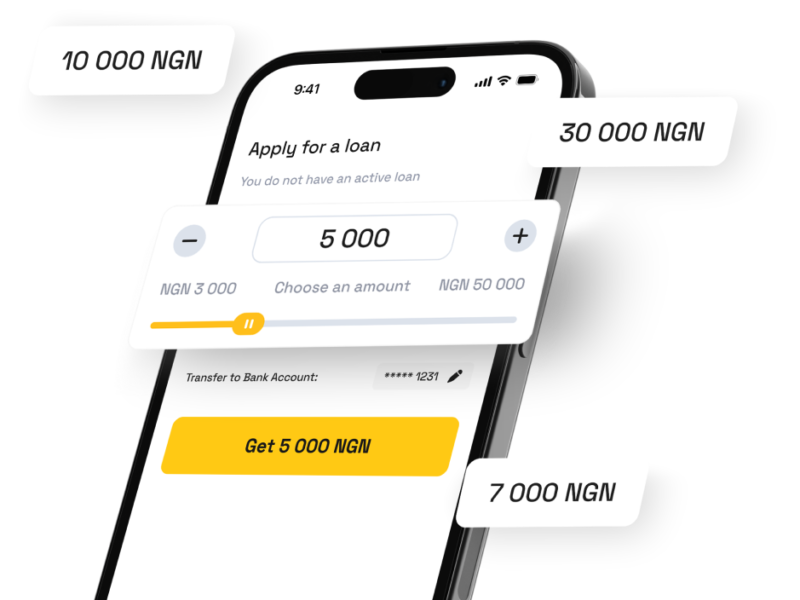

3. Apply Online

Visit Cash X and follow these steps:

- Create an account and log in.

- Select the “Business Loan” option.

- Complete the application form, providing all required details.

- Upload supporting documents, such as CAC registration, bank statements, and ID cards.

4. Provide Collateral (If Required)

Some loans may require collateral, such as property or valuable assets, to secure the funds.

5. Await Approval

Loan applications are typically processed within 24-48 hours. If approved, funds are disbursed directly to your account.

Loan Options and Details

Here’s what Cash X offers for business owners:

| Loan Provider | Loan Amount | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|---|

| Cash X | ₦50,000 – ₦200,000 | 5% per month | Registered businesses with proof of income | Monthly payments |

| Cash X | ₦300,000 – ₦1,000,000 | 4% per month | Established businesses with collateral | Quarterly payments |

How to Plan for Loan Repayment

Taking a business loan is a significant commitment. Here’s how to ensure smooth repayment:

- Track Your Expenses Monitor your business expenses closely to avoid unnecessary costs. This will free up funds for repayment.

- Increase Revenue Streams Explore ways to boost your sales or add new revenue streams to your business.

- Create a Dedicated Repayment Account Set up an account specifically for loan repayments and deposit funds into it regularly.

- Stick to Your Budget Limit non-essential spending and focus on loan repayment as a top priority.

Benefits of Cash X Loans for Businesses

- Quick Processing: Funds are disbursed within 48 hours.

- Flexible Terms: Tailored repayment options to suit your business model.

- Accessible to SMEs: Designed for small and medium-sized enterprises.

Edujects Advice:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to the point it affects you negatively just because you have access to it freely. Don’t take beyond your income capacity. Endeavor to use the money for its purpose. Learn from the business side of the Igbos: they would never borrow money for unrelated things—only for the purpose it is meant for.

Anyone can face emergencies. Emergencies come and go, but loans remain until repaid. Use this provision to fill the gap of your emergency. Once the emergency is resolved, quickly source for repayment. This builds credibility with lenders, ensuring they can help others in need.

Let’s build a trust- and integrity-driven Nigeria, where other companies feel safe to invest. The best way to encourage Cash X to increase loans for emergencies is to repay on time. Don’t wait until they start chasing you with phone calls. As you take the loan today, start planning for repayment today. Share this with anyone who needs emergency help.”