In the midst of life’s unexpected challenges, we all find ourselves needing financial support. Whether it’s for an urgent medical situation, starting a small business, or paying school fees, loans often become a crucial lifeline. However, many Nigerians still find themselves in the dark about how loans and interest rates work. If you’re considering taking out a loan in Nigeria, it’s essential to understand how interest rates function and what to consider before borrowing.

Understanding the ins and outs of loan interest rates can make a significant difference in your financial journey. By grasping the fundamental concepts, you’ll be able to make more informed decisions about borrowing, and importantly, avoid falling into debt traps that can affect your financial future. So, let’s take a deeper look at how interest rates work, what you need to consider before applying for a loan, and how you can manage repayment effectively.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Understanding Interest Rates for Loans in Nigeria

When you borrow money from a bank or a financial institution in Nigeria, you are not only expected to pay back the amount you borrowed but also an additional amount known as the interest. Interest is essentially the cost of borrowing money. It is the fee that the lender charges you for using their money.

In Nigeria, interest rates are typically expressed as a percentage, known as the “Annual Percentage Rate” (APR). This percentage indicates how much the lender will charge you for borrowing their money, calculated annually.

Types of Interest Rates

- Fixed Interest Rate: With this type, the interest rate remains the same throughout the loan period, providing you with a predictable repayment schedule. Fixed rates are generally easier to manage as they don’t fluctuate with market changes.

- Variable Interest Rate: This type of interest rate can change over time, depending on the prevailing economic conditions. While it may start lower, there’s a risk of it increasing, which can result in higher repayments later on.

- Reducing Balance: In some cases, your interest is calculated based on the outstanding principal. As you repay the loan, the interest is recalculated, which can reduce your total interest payments over time.

Why Interest Rates Matter

Interest rates are crucial because they determine the total cost of the loan. The higher the interest rate, the more you’ll have to pay back in addition to the principal amount. Therefore, it’s important to shop around and compare rates from different lenders to find the most affordable loan option.

What Should You Consider Before Taking a Loan?

While loans may seem like a quick solution to your financial problems, borrowing money comes with significant responsibilities. Here are a few essential things you should consider before applying for a loan:

1. Your Purpose for the Loan

Before taking out a loan, ask yourself why you need it. Are you borrowing money for an essential purpose like starting a business or paying for education? Or are you borrowing simply to cover non-essential expenses? It’s important to ensure that the loan is being used for something that will have long-term benefits. Avoid using borrowed funds for things like entertainment or luxury items that won’t contribute to your financial growth.

2. Repayment Plan

One of the biggest challenges many loan borrowers face is repaying the loan on time. It’s crucial to plan ahead and determine whether you can realistically afford the monthly repayments. Don’t borrow beyond your repayment capacity.

3. Interest Rates and Terms

Interest rates can significantly impact the total amount you’ll pay back over the life of the loan. While a loan may seem affordable initially, if the interest rate is high, you may end up paying more in the long run. Ensure that you understand all the terms and conditions of the loan, including the repayment schedule and any penalties for late payments.

4. Eligibility Criteria

Every loan provider has different eligibility criteria, such as a minimum income, employment status, and credit history. It’s important to check these requirements before applying for a loan to ensure you qualify.

How to Plan Your Loan Repayment

Repaying a loan can sometimes feel overwhelming, especially if it’s a large sum of money. However, with the right strategy, you can manage your loan repayment effectively and avoid falling into debt.

1. Create a Budget

Start by creating a detailed budget that accounts for all your monthly expenses, including the loan repayment. This will help you see where your money is going and where you can cut back to ensure that you can meet your repayment obligations.

2. Set Up Automatic Payments

Many banks and financial institutions offer automatic payment options, which can help ensure that you never miss a payment. Setting up auto-pay for your loan repayments will help you stay on track and avoid late fees.

3. Stick to Your Plan

Stick to your repayment schedule and avoid taking out additional loans to cover your current loan. As tempting as it may seem, borrowing more money will only make it harder to repay what you already owe.

4. Communicate with Your Lender

If you’re struggling to make repayments, reach out to your lender as soon as possible. Many lenders are willing to work with borrowers who communicate early, and they may offer an extension or a more flexible repayment plan.

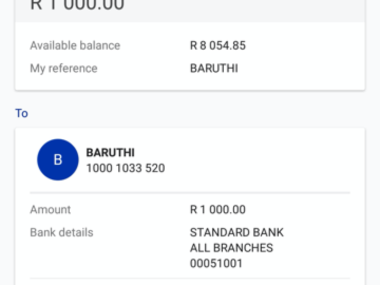

Available Loan Options in Nigeria from Umbanigeria

Here’s an example of the loan options you can get from Umbanigeria, including their interest rates, eligibility, and repayment methods:

| Loan Type | Interest Rate | Eligibility | Repayment Method |

|---|---|---|---|

| Personal Loan | 10% – 15% p.a. | Nigerian citizen, 18-60 years, proof of income | Monthly, direct debit/transfer |

| Business Loan | 8% – 12% p.a. | Business registered in Nigeria, active for 1 year | Monthly, direct debit/transfer |

| Emergency Loan | 12% p.a. | Nigerian citizen, proof of emergency | Single payment or installment |

| Education Loan | 9% p.a. | Student enrollment, Nigerian citizen | Monthly, direct debit/transfer |

You can visit Umbanigeria’s website for more details and to apply.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t borrow beyond your income capacity. Use the money for its intended purpose. Learn from the business side of the Igbo people. They would never borrow money for anything other than its intended purpose. Emergencies come and go. Once the emergency is solved, quickly plan for repayment. This builds trust and credibility with lenders. Pay back on time so that others can benefit when their emergencies arise. Repay today, plan today.”