Have you ever found yourself in a tight financial spot, needing money urgently but held back by endless bank protocols? Maybe it was an unexpected hospital bill, school fees deadline, or a sudden home repair that couldn’t wait. In these moments, every second counts, and the frustration of long bank delays can be overwhelming. The good news is that you don’t have to rely solely on traditional banks anymore. Fast, reliable, and stress-free loan options are now within your reach.

In this guide, we’ll walk you through proven strategies to access loans quickly in Nigeria without the usual stress. From online loan platforms to practical repayment tips, you’ll find everything you need to handle emergencies and meet your financial needs seamlessly. Let’s get started.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why People Need Quick Loans

Understanding the purpose of your loan can help you make smarter financial decisions. Common reasons include:

- Emergency Expenses: Medical bills, house repairs, or unexpected travel.

- Business Capital: Starting or scaling a small business.

- Education: Covering tuition or exam fees.

- Debt Consolidation: Managing existing debts by combining them into one loan.

Knowing your purpose helps you stay focused and prevents unnecessary borrowing.

Steps to Access Loans Quickly

1. Opt for Online Loan Platforms

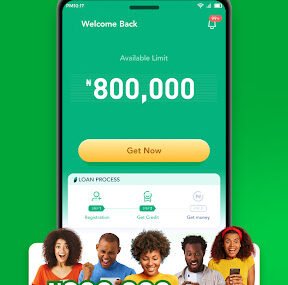

Online lenders like New Credit Loan, Carbon, and FairMoney offer quick loan approvals, often within 24 hours. Their application processes are simple, requiring minimal documentation.

2. Prepare Your Documents

Ensure you have:

- A valid government-issued ID.

- Bank Verification Number (BVN).

- Proof of income (e.g., bank statements or salary slips).

Having these ready speeds up the process.

3. Use Mobile Apps

Many lenders have user-friendly apps that allow you to apply for loans in minutes. Examples include:

- New Credit Loan App: Download Here

- Carbon App: Download Here

- FairMoney App: Download Here

4. Check Eligibility Criteria

Each lender has specific requirements. For instance:

- Minimum monthly income.

- Age restrictions (usually 18+).

- Residency in Nigeria.

5. Borrow Only What You Need

Taking more than necessary can lead to repayment struggles. Calculate how much you need and stick to it.

How to Plan Repayment

Repaying a loan on time is crucial to maintaining financial stability. Here’s how:

- Create a Budget: Factor your loan repayment into your monthly budget.

- Set Reminders: Use mobile apps or calendars to track repayment dates.

- Pay in Installments: If allowed, make partial payments to reduce the burden.

- Communicate with Your Lender: If you face challenges, discuss flexible repayment options with your lender.

Trusted Loan Providers in Nigeria

Here’s a comparison of some reliable loan providers:

| Loan Provider | Loan Amount | Interest Rate | Eligibility | Repayment | Links |

|---|---|---|---|---|---|

| New Credit Loan | ₦10,000 – ₦500,000 | 4% – 6% monthly | Valid ID, BVN, smartphone | Flexible installments | Apply Here |

| Carbon | ₦5,000 – ₦1,000,000 | 5% monthly | BVN, bank statement | Automated deductions | Apply Here |

| FairMoney | ₦1,500 – ₦1,000,000 | 4% – 30% monthly | BVN, no collateral | Flexible installments | Apply Here |

Red Flags to Avoid

Stay alert to avoid scams and fraudulent schemes:

- Upfront Fees: Legitimate lenders will not ask for payments before approving a loan.

- Unverified Platforms: Always research the lender’s credibility.

- High-Pressure Tactics: Avoid lenders who pressure you into quick decisions.

- No Physical Address: A legitimate lender will have a verifiable office address.

Edujects Advice

“On no account should you take beyond what you can repay. This is an opportunity, but don’t misuse it just because you have access to it freely. Don’t take beyond the capacity of your income expectations. Endeavor to use the money for its purpose. Learn from the business side of the Igbos. The Igbos would never borrow money to do other things other than the purpose it’s meant for.

Anyone can have an emergency. An emergency requires an emergency solution, and this emergency will pass. Now that you have access to this loan to fill the gap, immediately plan for repayment. Doing so builds trust and credibility, ensuring future access to loans. Let’s create a Nigeria where companies feel confident investing. Pay back on time, and don’t wait until you’re bombarded with phone calls. Share this knowledge with others in need, and use loans responsibly.”