In times of financial need, the thought of applying for a fund can bring both relief and anxiety. Perhaps you have a pressing emergency, need capital for a business venture, or are simply looking for funds to cover essential expenses. Whatever the reason, one thing is certain: creating a solid budget before applying for a loan is not just important—it’s essential.

Picture this: you’re overwhelmed by unexpected bills or facing an opportunity you can’t let slip away. You’re tempted to grab any loan that comes your way. But before you do, take a moment to pause and reflect. The key to a stress-free borrowing experience lies in preparation. This article will guide you through crafting a budget that not only helps you secure the loan you need but also ensures you can manage repayment without sleepless nights.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need Money?

Before diving into budgeting, identify why you need the loan. Being clear about your purpose will help you determine the exact amount you require and prevent you from borrowing more than necessary. Here are some common reasons Nigerians apply for loans:

- Emergencies: Medical bills, car repairs, or sudden travel needs.

- Business Investments: Expanding or starting a small business.

- Education: Tuition fees or professional courses.

- Debt Consolidation: Paying off high-interest debts with a lower-interest loan.

Understanding your “why” ensures that you borrow responsibly and use the funds as intended.

Steps to Create a Budget Before Applying for a Loan

1. Calculate Your Income

Start by determining your total monthly income. Include your salary, side hustles, and any other sources of revenue. This gives you a clear picture of how much money is available to cover your expenses and loan repayments.

2. Track Your Expenses

List all your monthly expenses, including:

- Rent or mortgage

- Utilities (electricity, water, internet)

- Transportation

- Food and groceries

- Entertainment

- Savings

Categorize these expenses into “needs” and “wants.” This step helps you identify areas where you can cut back if necessary.

3. Determine How Much You Can Afford to Borrow

Use this formula:

(Monthly Income – Monthly Expenses) x 30% = Maximum Loan Repayment Amount

For instance, if your monthly income is ₦300,000 and your expenses are ₦200,000, the maximum amount you should allocate to loan repayment is ₦30,000. This ensures you don’t overstretch your finances.

4. Research Loan Options

Explore different lenders to find one that suits your needs. Look for loan providers with:

- Low-interest rates

- Flexible repayment terms

- Transparent fees

5. Plan Your Repayment Strategy

Before applying, draft a repayment plan. Set aside a portion of your income each month for loan repayment. Consider automating payments to avoid late fees and penalties.

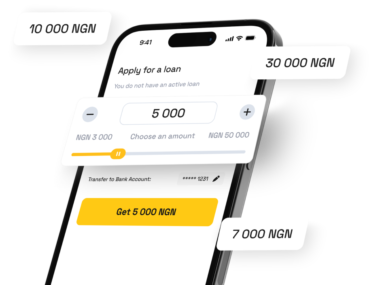

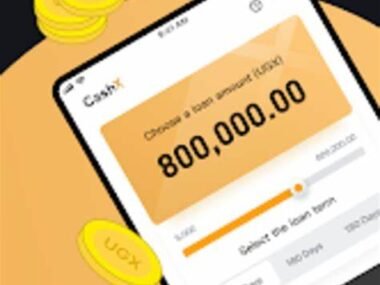

Loan Options and Details

The table below provides an example of what Cash X can offer:

| Loan Provider | Loan Amount | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|---|

| Cash X | ₦50,000 – ₦500,000 | 3% per month | Employed individuals with steady income | Monthly deductions from account |

| Cash X | ₦600,000 – ₦1,000,000 | 2.5% per month | Business owners with verifiable cash inflow | Quarterly payments |

To apply, visit Cash X.

Why Planning Repayment Matters

Borrowing money is easy; repaying it requires discipline. Failure to repay on time can lead to high penalties, stress, and a damaged credit score. To avoid this:

- Start saving immediately after receiving the loan.

- Cut back on non-essential expenses.

- Consider increasing your income through side hustles.

Edujects Advice:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to the point it affects you negatively just because you have access to it freely. Don’t take beyond your income capacity. Endeavor to use the money for its purpose. Learn from the business side of the Igbos: they would never borrow money for unrelated things—only for the purpose it is meant for.

Anyone can face emergencies. Emergencies come and go, but loans remain until repaid. Use this provision to fill the gap of your emergency. Once the emergency is resolved, quickly source for repayment. This builds credibility with lenders, ensuring they can help others in need.

Let’s build a trust- and integrity-driven Nigeria, where other companies feel safe to invest. The best way to encourage Cash X to increase loans for emergencies is to repay on time. Don’t wait until they start chasing you with phone calls. As you take the loan today, start planning for repayment today. Share this with anyone who needs emergency help.”