Taking a loan can feel like a lifeline, a chance to break free from financial constraints and build a better future. Yet, the process of securing a loan, especially in a country like Nigeria, can feel daunting. You may have found yourself wondering how to get a loan that’s not only approved but also tailored to your needs. You may have questions about how to plan repayment, or why you even need the money in the first place. If you’re thinking about getting a loan, it’s crucial to understand the steps, the why, and the how. This article will guide you through how to get a loan in Nigeria with high approval chances, providing the knowledge you need to take this step with confidence.

Who Can Get a Loan in Nigeria?

In Nigeria, loan eligibility typically depends on a few key factors, such as your income, your credit score, your purpose for the loan, and your ability to repay. Banks and lending institutions assess these elements to determine if you’re eligible for a loan and whether it’s a safe financial investment for them.

The types of individuals or entities that can apply for loans include:

- Salaried individuals: If you’re employed, you may be eligible for personal loans. Regular income and employment verification play a huge role in approval.

- Small business owners: Many lenders offer loans specifically designed to help entrepreneurs expand their businesses. This could be anything from working capital to purchasing new equipment or even paying salaries.

- Students: Some lenders provide educational loans to help cover school fees or educational expenses.

- Self-employed individuals: Loans can also be granted to freelancers or those running their businesses.

- Government employees: Being employed by the government often increases your chances of loan approval, as lenders view these jobs as more stable.

How to Increase Your Chances of Getting a Loan Approved

To improve your chances of getting your loan application approved, follow these steps:

1. Know Your Creditworthiness

Before applying for a loan, check your credit report to understand your financial health. Your credit score is an important factor for banks when approving loans. If your score is low, it could be a good idea to clear existing debts before applying. If you don’t have a credit history, consider using a secured loan option where you offer collateral. A good credit history will increase your chances of approval.

2. Choose the Right Loan Type

There are various loan options available in Nigeria, such as personal loans, business loans, car loans, and payday loans. Choose the loan type that aligns with your financial needs. Each loan type has different requirements and terms, so make sure you understand which one is most suited to you.

3. Ensure You Meet Eligibility Criteria

Most loan institutions have specific eligibility requirements that must be met to qualify. Common requirements include:

- Minimum age (18 years and above)

- Proof of steady income or employment

- Collateral (for secured loans)

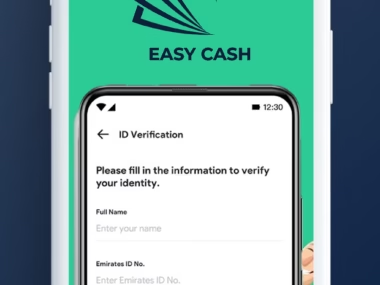

- A valid ID and proof of residence

- Bank statement for at least 3 months Ensure you gather all necessary documents before applying to avoid delays.

4. Prepare a Solid Repayment Plan

Lenders want assurance that you can repay the loan. To increase your chances of approval, create a clear repayment plan. If you’re borrowing for a business, be ready to show how the loan will generate returns that will enable you to repay. If it’s a personal loan, ensure you can meet the monthly repayments without straining your finances. Transparency about your financial situation will make lenders more comfortable approving your loan.

5. Apply to the Right Lender

There are a variety of banks, microfinance institutions, and online lenders in Nigeria. Some may offer loans with flexible terms, while others may have higher interest rates or stricter requirements. Research different lenders before applying. Online platforms like Paylater, Carbon, and FairMoney offer quick loans with high approval chances if you meet their criteria.

Why You Need Money and How You Can Plan for Repayment

Why You Need the Loan

It’s important to be clear about why you need the money. Is it to fund your business idea? Is it for personal expenses like paying for education, medical bills, or home renovation? Knowing the purpose of your loan will help you manage it better. Avoid using borrowed funds for non-essential spending like luxury items or short-term gratification.

How to Plan for Repayment

Proper planning for repayment is key to maintaining a healthy financial future. Here’s how you can plan:

- Set a budget: List your monthly expenses and include the loan repayment as part of your regular budget.

- Prioritize debt: If you have other existing debts, focus on settling high-interest debts first.

- Regular payments: Pay your loan in installments as agreed with the lender. Missing payments can hurt your credit score.

- Avoid over-borrowing: Only borrow what you can repay comfortably, based on your income.

Loan Providers in Nigeria

Below is a simple table showing some easy cash loan providers in Nigeria, their interest rates, eligibility requirements, and how repayment works.

| Loan Provider | Interest Rate | Eligibility | Repayment Terms |

|---|---|---|---|

| Paylater | 15%-30% p.a. | Must be 18+, Have steady income, Valid ID | Weekly/Monthly repayments via bank transfer, Mobile app |

| Carbon | 12%-25% p.a. | 18+, Good credit history, Bank account | Flexible payment terms, Auto-debit for repayment |

| FairMoney | 10%-35% p.a. | 18+, Proof of income, Bank account | Weekly/Monthly, Mobile app for payments |

| Branch | 12%-35% p.a. | 18+, Steady income, Bank statement | Repay via direct bank transfer or app |

| QuickCheck | 10%-35% p.a. | 18+, Mobile number, Bank account | Weekly payments via app |

Advice from the FINANCE.Edujects

On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. Don’t take beyond your income expectations. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbos. The Igbos would never borrow money to do other things than invest in their business. Keep your focus on the bigger picture, and always ensure that borrowing is a step towards growth.