Navigating the world of loans in Nigeria can feel overwhelming, especially if you’ve faced rejections or unclear terms. Imagine securing a loan without stress, where approval is quick, terms are simple, and repayment feels manageable. Okash loans provide a solution that’s tailored to your needs. If you’ve been searching for answers on how to make this process seamless, you’ve come to the right place.

Why Do You Need a Loan?

Unexpected emergencies or opportunities often demand financial solutions. It could be a medical bill, urgent repairs, or a once-in-a-lifetime business opportunity. Loans can bridge the gap when savings fall short. But securing one requires preparation and understanding. This guide will show you how to apply, who qualifies, and when to take the leap to avoid rejection or stress.

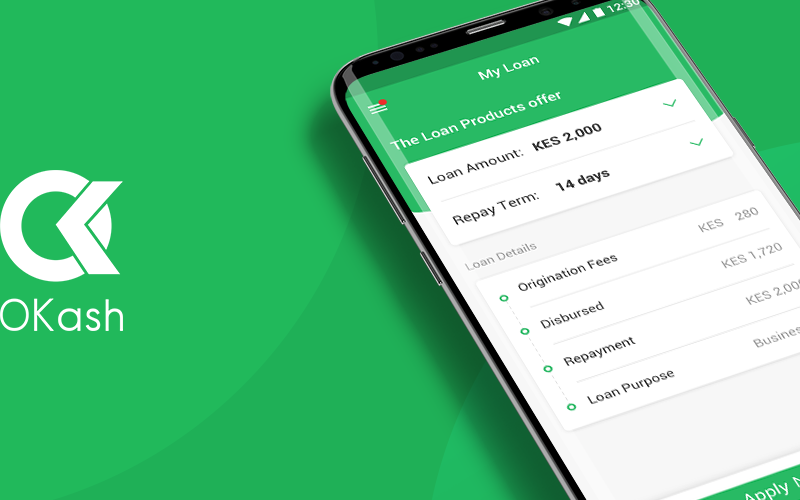

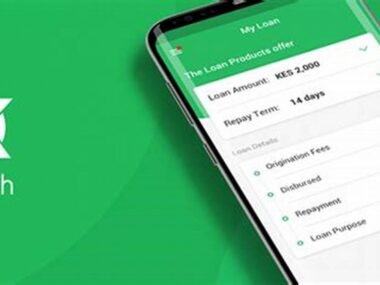

Understanding Okash Loans

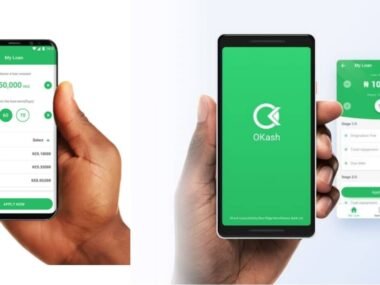

Okash is one of Nigeria’s most reliable loan providers, offering fast approvals and easy-to-navigate services. Through their mobile app, users can access loans tailored to meet various needs.

| Loan Amount | Interest Rate | Eligibility | Repayment Method |

|---|---|---|---|

| ₦3,000 – ₦500,000 | 4.5% – 36% (annually) | Must be between 20-55 years old, have a BVN, active phone number, and a stable source of income | Bank transfer, direct debit from account |

How to Apply for Okash Loan Without Rejection

To secure approval, start by downloading the Okash app from the Google Play Store. Set up your profile, ensuring that every detail, including your BVN and income information, is accurate. Trust is essential, so begin by requesting a modest loan amount. This helps establish a good repayment record with Okash. Consistency and transparency in your application go a long way in ensuring approval.

When Should You Apply for an Okash Loan?

Apply for a loan when you have a clear and justifiable need, such as emergencies or business investments. Timing is key—avoid applying immediately after a rejection. Instead, address the reasons for your previous denial, make necessary corrections, and then reapply.

Who Can Benefit from Okash Loans?

Anyone with a genuine financial need can take advantage of Okash loans. Salaried employees often use these loans for unforeseen expenses before payday. Small business owners turn to Okash to fund inventory or daily operations. Students find them helpful for paying school fees or buying study materials, while freelancers use these funds to invest in tools or resources for their projects.

How to Plan Your Repayment

Repayment should always be a top priority to avoid stress and penalties. Begin by assessing your income and borrow only what you can comfortably repay. Automating your loan repayment through direct debit ensures you don’t miss any deadlines. Allocate a fixed portion of your earnings towards repaying your loan to maintain financial stability.

Why Choose Okash?

Okash stands out for its speed and efficiency. Loans are approved and disbursed within minutes, making it an ideal choice for emergencies. The terms are flexible, allowing borrowers to select amounts and repayment periods that fit their needs. The platform is transparent, providing all the necessary details upfront. With a user-friendly app, navigating the loan process becomes seamless.

Additional Tips to Secure Approval

Ensure your BVN is linked to an active bank account that shows consistent income. Provide truthful and complete information during your application to avoid delays or rejection. Before applying, familiarize yourself with the terms and conditions, so you understand the repayment structure.

Advice from the Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t take beyond the capacity of your income expectations. Endeavor to use the money for its purpose. Learn from the business side of the Igbos—they would never borrow money for things other than its intended purpose. Anyone can have an emergency, but emergencies come and go. Use this opportunity wisely.”