We’ve all been there—faced with a pressing financial need that requires immediate attention. It’s stressful, isn’t it? Whether it’s paying for school fees, handling an unexpected medical emergency, or taking care of urgent family obligations, the need for quick access to funds can feel overwhelming. But don’t worry—you’re not alone, and there are solutions tailored to your needs.

Imagine having access to a loan service that doesn’t just give you the funds you need but also helps you plan for repayment without adding stress to your life. This guide will walk you through everything you need to know about accessing a loan quickly, how to make repayment stress-free, and the key considerations you need to make before applying.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

What Can You Do to Get Money Fast?

- Research Loan Providers

Look for trustworthy financial institutions offering quick loans, such as Aella Loans, that prioritize transparency, ease of application, and fast disbursement. Check their interest rates, eligibility requirements, and repayment terms. - Leverage Online Loan Platforms

Platforms like Aella Loans allow you to apply for loans online with minimal paperwork. You can complete the process within minutes from the comfort of your home. - Explore Alternatives

If you’re not ready to take out a loan, consider other sources such as borrowing from friends or family, selling unused items, or taking on freelance work for quick cash. - Utilize Salary Advance Services

Some employers offer salary advance programs to help employees access a portion of their earnings before payday. - Crowdfunding Platforms

If your financial need is tied to an emergency or project, you might consider crowdfunding platforms where others can contribute to your cause.

Why Do You Need Money?

Understanding why you need the loan is crucial. Here are some common reasons:

- Emergency Medical Bills: Health emergencies don’t wait, and having immediate access to funds can save lives.

- School Fees: Investing in your child’s education is a top priority for many families.

- Business Expansion or Startup Costs: Entrepreneurs often need financial support to scale their operations or kickstart new ventures.

- Household Repairs: Unexpected repairs, such as fixing a leaking roof or a broken appliance, can disrupt daily life.

Clearly defining the purpose of the loan ensures that you remain focused and disciplined in its use.

Planning for Repayment

- Assess Your Income

Before borrowing, evaluate your income streams. Ensure you have a clear plan to repay the loan without jeopardizing your financial stability. - Create a Budget

Allocate a portion of your monthly income toward repayment. Prioritize this over non-essential expenses to avoid falling into debt. - Automate Payments

Many lenders, including Aella Loans, offer automatic deductions, which can help you stay consistent and avoid late fees. - Consider Additional Income Sources

Taking on a part-time job or freelance work can help supplement your income and make repayment easier. - Communicate with Your Lender

If you foresee challenges in repaying on time, communicate with your lender early. They might offer extensions or alternative plans.

Aella Loans: A Solution You Can Trust

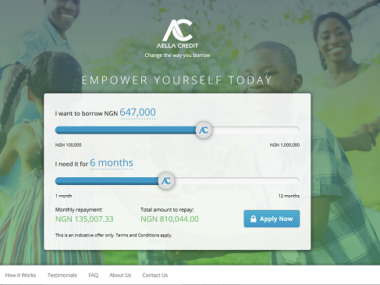

Aella Loans is a trusted platform designed to make borrowing simple and accessible. Below is an overview of what they offer:

| Loan Type | Maximum Loan Amount | Interest Rate | Eligibility Criteria | Repayment Options |

|---|---|---|---|---|

| Personal Loans | Up to ₦5,000,000 | 4-30% | Must be employed or own a business | Flexible repayment in installments |

| Emergency Loans | Up to ₦2,000,000 | 2-20% | Valid ID and proof of income | Automatic deductions available |

| Educational Loans | Up to ₦5,000,000 | 3-25% | Evidence of school fees | Monthly payment plans |

Visit Aella Loans to start your application today!

What Makes Aella Loans Different?

- Fast Approval: Receive funds within 24 hours of application.

- No Hidden Charges: Enjoy transparent loan terms with no surprises.

- Flexible Terms: Choose repayment options that suit your income.

- Dedicated Support: Aella Loans provides excellent customer service to guide you through the process.

Advice from Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to your detriment just because you have access to it freely. Don’t take beyond the capacity of your income expectations. Ensure you use the money for its intended purpose. Learn from the business acumen of the Igbos—they never borrow money for unrelated purposes. Emergencies will come and go. Once you resolve your emergency, quickly source for the repayment plan. Doing this builds credibility, allowing banks to assist others in their time of need. Let’s build trust and integrity to encourage more companies to invest in Nigeria. Start planning your repayment as soon as you take the loan. Avoid late payments or dodging calls from lenders. Share this information with anyone in need of emergency help.”

Take the stress out of paying school fees with Aella Prestige Loans! Get up to ₦5,000,000 to secure your child’s education today. No worries, just progress. Apply now and give your kids the future they deserve!