There are moments in life when things don’t go according to plan. Maybe you’ve encountered an unexpected bill, your car broke down, or perhaps there’s a sudden emergency that requires immediate financial attention. It’s tough, and you’re left wondering, “Where do I turn?” The stress, the worry—it all builds up. But what if you could take control of your situation in minutes? What if you had access to funds without needing to go through long, tedious processes, without deposits or guarantees? This is where Okash steps in with a seamless solution to your financial needs.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

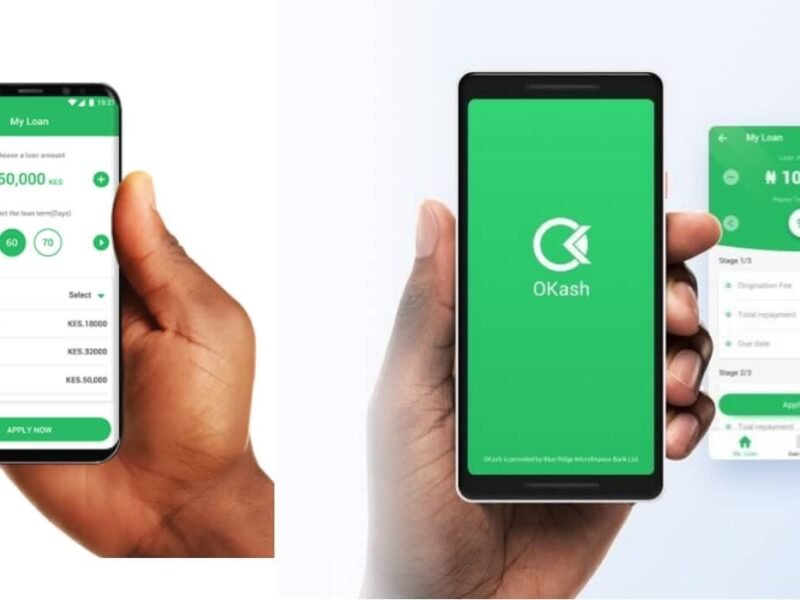

Okash offers a quick, easy, and reliable way to access loans of up to NGN1,000,000 with no deposits or guarantees required. Yes, you read that right—no deposits, no guarantees, just a simple application that takes minutes. If you’re facing an urgent financial challenge, Okash gives you the freedom to take the loan and solve your problems instantly. Let’s walk through how you can take advantage of this amazing offer, how to repay, and why it’s the perfect solution for you.

How to Get Money from Okash

The process of getting money from Okash is as easy as installing an app and checking how much you can qualify for. It’s a completely digital experience, so no need to leave the comfort of your home or wait in long lines at a bank. Here’s how it works:

- Download the Okash App: First, download the Okash app from your device’s app store.

- Create an Account: Register using your personal details—no need to submit collateral or go through complex procedures.

- Check Your Loan Eligibility: Once registered, you can easily check how much you qualify for. With no deposits or guarantees, Okash makes it incredibly easy to access loans.

- Apply for the Loan: After checking your eligibility, fill in the application form with your required details. You don’t need to worry about hidden fees—everything is straightforward.

- Get Your Money: After approval, the loan amount is transferred directly to your account in minutes. Yes, you can get the money you need in just minutes.

How to Plan for Loan Repayment

When taking a loan, it’s essential to have a repayment plan in place to avoid falling into debt. Okash offers various repayment options that can be tailored to fit your financial situation. Here are some steps to ensure smooth repayment:

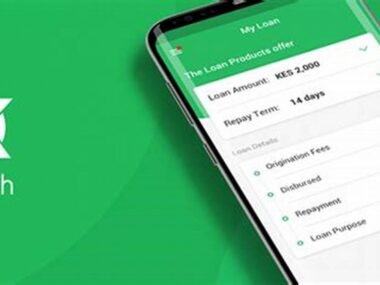

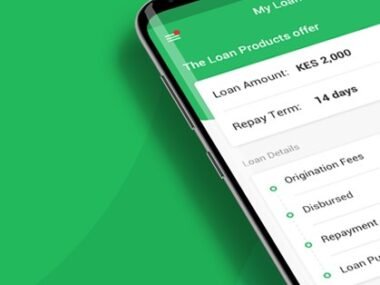

- Understand the Terms: Before accepting the loan, make sure you understand the repayment terms, including the interest rate, the repayment duration, and any applicable fees.

- Set a Budget: Carefully evaluate your income and expenses to determine how much you can comfortably repay on a weekly or monthly basis.

- Repay on Time: The key to maintaining a good relationship with Okash and avoiding late fees is making timely payments. Set reminders for repayment dates and stick to them.

- Early Repayment: If you’re able, paying off your loan early can save you on interest and help build your financial credibility.

Why Do You Need Money?

Life is full of surprises, both good and bad. Sometimes you need money for planned events, like paying for a school fee, purchasing new equipment, or investing in your business. Other times, it’s for unexpected expenses like hospital bills or repairs. Whatever the reason, Okash offers a quick, reliable solution that empowers you to handle any situation with confidence.

Loan Details from Okash

To help you understand what Okash offers, here’s a breakdown of their loan products:

| Loan Type | Interest Rate | Eligibility Criteria | Repayment Options |

|---|---|---|---|

| Short-Term Loan | 3% – 7% monthly | Must be 18+, employed or have a stable income, valid ID | Flexible repayment terms: Weekly, Bi-weekly |

| Personal Loan | 4% – 9% monthly | Age 18+, steady income, proof of identity and residence | 3 to 12 months repayment period |

| Emergency Loan | 5% monthly | Age 18+, proof of emergency need | Repay in 1 to 3 months |

Why Choose Okash?

Choosing Okash means choosing a fast, reliable, and trustworthy financial service. Here’s why Okash stands out:

- No Collateral Required: Unlike traditional loans, Okash doesn’t require any collateral or guarantees to qualify for a loan.

- Fast and Easy: Once you apply, the loan is approved and disbursed in minutes, allowing you to take care of your needs instantly.

- Flexible Repayment Options: Okash offers a range of repayment plans, so you can choose what fits best with your income.

- Transparency: Okash keeps things clear and straightforward—no hidden fees, no surprises.

Eduject’s Advice:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. Don’t borrow beyond your income expectations. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo people: they would never borrow money for anything other than its true purpose. An emergency requires an emergency purpose. Once the emergency is fixed, quickly find a repayment plan. This helps the bank maintain credibility to help others solve their emergencies. Let’s build a trustworthy, integrity-driven Nigeria where companies invest. The best way to encourage Okash to continue helping is by paying back on time. Don’t wait until they start calling you. As you take the loan, plan for repayment today. Share this information with anyone in need of emergency help.”

Conclusion

With Okash, financial freedom is within your reach. No more waiting in line, no more complicated paperwork—just quick, simple access to the money you need when you need it. Whether it’s for an emergency, a project, or any unexpected financial need, Okash makes it easy to get started. Just remember to borrow responsibly and plan for timely repayment so you can continue to access financial assistance whenever you need it. With Okash, you’ve got the support you need to navigate life’s unexpected turns.