Imagine this: you’re in need of financial help to push your business forward, solve a personal emergency, or cover that urgent bill. You feel the pressure building up, and time is not on your side. The thought of securing a loan quickly seems like a lifesaver, but there’s one big concern—how to get it without facing disgrace. In Nigeria, where the financial system can be tricky to navigate, securing a loan without the right knowledge and approach can often lead to embarrassment or worse, a financial downfall.

Don’t worry. In this article, we’ll walk you through everything you need to know about how to secure a loan fast in Nigeria, how to ensure you pay it back without stress, and who the reliable loan providers are in Nigeria. By the end of this guide, you’ll be able to take control of your financial situation confidently, avoiding the common pitfalls that cause embarrassment.

Why Do You Need Money Right Now?

Whether you’re a small business owner needing urgent capital for your operations, a student trying to pay school fees, or a family facing unexpected medical bills, we all face situations where cash flow is tight. And let’s face it—when there’s no emergency fund to fall back on, loans become the next best option. But the key question here is: How can you secure a loan quickly without putting yourself in a difficult situation?

How to Secure a Loan Fast in Nigeria

- Understand the Type of Loan You Need Before you start applying for loans, it’s crucial to understand what kind of loan you need. Are you looking for a personal loan, a business loan, or maybe an emergency loan for a specific purpose? Knowing this helps you apply for the right product from the right lender.

- Research Trusted Financial Institutions There are many loan providers in Nigeria—banks, microfinance institutions, and digital lenders. Some companies offer loans with minimal paperwork and quick disbursement, while others may require you to submit collateral or meet other requirements. Make sure you choose a lender with a solid reputation for delivering loans efficiently and transparently.

Some trusted names in the industry include:

- Access Bank: Known for providing quick loans to both individuals and businesses.

- Branch: A mobile-based loan service that gives quick personal loans with flexible terms.

- Carbon: Formerly known as Paylater, it offers fast loans via an app, with no paperwork required.

- Umba: Known for providing personal loans quickly with minimal documentation.

- Prepare the Necessary Documentation To avoid delays, ensure you have all the necessary documents ready. This could include your ID, bank statements, proof of income, and any other supporting documents required by the loan provider. Many digital lenders now offer loans without requiring physical documents, but be prepared to submit digital copies when asked.

- Check Your Credit Score Your credit score plays a significant role in determining whether you’re eligible for a loan and how much interest you’ll pay. Ensure your credit history is in good standing. If you have a poor credit score, it might be harder to get a loan, or you may face higher interest rates.

- Choose the Right Loan Amount It’s tempting to borrow a large sum of money, especially when the process is quick and easy. However, it’s essential to borrow only the amount you can repay comfortably. Don’t forget—loans come with interest, and failing to repay can lead to huge financial strain.

- Set Up a Repayment Plan It’s easy to get carried away by the idea of having money in your pocket today, but how will you repay it tomorrow? Be honest with yourself about your income and expenses before taking the loan. Understand your monthly budget and ensure that the loan repayment fits comfortably within it.

Make sure to:

- Read the terms and conditions carefully.

- Set reminders for repayment dates to avoid late fees and penalties.

- Consider setting up automatic payments to avoid missing payments.

When Can You Expect the Loan to Be Approved?

Loan approval times vary depending on the lender. Some digital lenders approve loans within minutes, while traditional banks may take longer. Here’s a breakdown of when you can expect a response from different lenders:

- Access Bank: Instant loan approval if you meet the requirements.

- Branch: Loan approval within a few minutes to an hour.

- Carbon: Immediate approval for most loans.

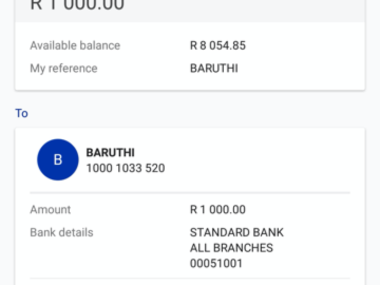

- Umba: Loan approval typically happens within 24 hours if all conditions are met.

Who Are the Best Loan Providers in Nigeria?

Here are some of the best and most reliable companies offering loans in Nigeria, based on fast approval times and transparent loan terms:

| Lender | Loan Type | Interest Rate | Eligibility | Repayment Terms |

|---|---|---|---|---|

| Umba | Personal loans | Varies (low rates) | Nigerian adults, working class | Flexible, 30 days to 6 months |

| Carbon | Personal loans | 15-30% (annual rate) | Nigerian adults, with a bank account | 2 weeks to 12 months |

| Branch | Personal loans | Varies (competitive rates) | Nigerian adults, working class | Flexible terms (short-term) |

| Access Bank | Personal & Business loans | Varies based on credit score | Nigerian adults, with good credit history | Flexible, based on loan agreement |

How Can You Pay Back the Loan?

Repayment terms vary from one lender to another. Most lenders offer flexible repayment plans based on the loan amount and your income. Here are some common repayment options:

- Installment Plans: Monthly repayments over several months.

- Lump Sum: Full repayment at the end of the loan term.

- Salary Deduction: Some employers partner with lenders to deduct repayments directly from your salary.

Advice from the FINANCE.Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t over-use it just because you have access to it freely. And don’t take beyond the capacity of your income expectations. Always endeavor to use the money for its intended purpose. Learn from the business side of the Igbos. The Igbos would never borrow money to do other things rather than invest in a business or for a purpose that brings returns.”

By following this advice, you can avoid falling into the trap of borrowing beyond your means and ensure that your financial future remains secure.

Securing a loan fast in Nigeria doesn’t have to be complicated or come with the fear of disgrace. By understanding your loan options, preparing the necessary documentation, borrowing responsibly, and setting up a clear repayment plan, you can access the funds you need without stress. Always ensure you work with trusted and reliable lenders to avoid any potential financial pitfalls.