Securing low-interest funds in 2025 can feel like a lifeline for many people—whether you’re an individual navigating a financial emergency or a business owner looking for expansion capital. However, with this opportunity comes the challenge of choosing the right path and avoiding financial pitfalls that could create even bigger problems down the line. You might be asking yourself: How do I secure low-interest funds? When should I seek a loan to avoid getting trapped by high-interest rates? And who should I turn to for the best financial options in 2025?

These are the exact questions millions of people are asking in today’s economic climate. With inflation and economic uncertainty in many regions, financial pressure is mounting, making it even more essential to make sound financial decisions. Securing low-interest loans in 2025 is more than just an opportunity—it’s about having access to crucial resources that could help you overcome hurdles, grow your business, or address unforeseen personal challenges. But how do you navigate this maze of options and make the best decisions for your future?

In this comprehensive guide, we’ll answer your burning questions and provide expert insights into how you can secure low-interest funds, plan for repayment, and avoid common financial pitfalls. By the end, you’ll be equipped with the tools and knowledge to make smart borrowing decisions and set yourself up for financial success.

How to Secure Low-Interest Funds in 2025

Securing low-interest funds in 2025 requires a blend of preparation, understanding of available options, and timing. The first step to obtaining a low-interest loan is understanding your financial situation and how much debt you can responsibly take on. Here’s how you can ensure that you are making informed and strategic decisions when seeking loans:

1. Understand Your Creditworthiness

Your credit score plays a crucial role in determining the interest rates you’ll be offered. Lenders use credit scores to assess your risk level—if your score is high, you’re seen as a lower-risk borrower, which means you’ll likely secure a loan with a lower interest rate. Before seeking any loan, take the time to check your credit score and address any negative marks on your credit report. If your credit score isn’t ideal, focus on improving it before applying for loans, as this will improve your chances of securing low-interest funds.

2. Explore Various Loan Providers

While traditional banks are a go-to for many borrowers, don’t overlook other potential lenders such as credit unions, peer-to-peer lending platforms, or online lending options. In 2025, there are more alternatives than ever, with many online lenders offering competitive rates that could be lower than traditional banks.

When searching for low-interest funds, always compare different lenders and their offerings. Interest rates, repayment terms, and loan processing fees can vary significantly between institutions. By comparing your options, you ensure you’re getting the best deal possible for your needs.

3. Consider Secured Loans

Secured loans—those that require collateral, such as a home or car—often come with lower interest rates because they present less risk to lenders. If you have valuable assets, consider using them as collateral to secure a loan with favorable terms. However, ensure you’re prepared to repay the loan promptly, as failure to do so could put your property at risk.

4. Negotiate Loan Terms

Never hesitate to negotiate the loan terms. While it’s not always possible, some lenders are willing to offer lower interest rates or more favorable repayment terms if you present a solid case. It’s essential to show that you have a plan for repaying the loan and that you’ve done your research on available loan products.

5. Look for Government Assistance Programs

In some regions, governments provide low-interest loans to help businesses and individuals during times of economic distress. These programs may be offered for specific purposes, such as business expansion, homeownership, or educational funding. Government-backed loans often come with lower interest rates and longer repayment periods, making them a great option for securing low-cost funds.

When Should You Seek a Loan to Avoid Financial Pitfalls?

Timing is critical when it comes to securing a low-interest loan and avoiding financial pitfalls. Borrowing at the wrong time or for the wrong reasons can lead to a cycle of debt that’s difficult to escape from. So, when should you seek funds in 2025?

1. When You Have a Clear Purpose

Loans should never be taken for impulse purchases or to cover non-essential expenses. Only borrow funds when you have a clear, well-thought-out purpose. This could be for business expansion, paying for an emergency, or investing in an opportunity that will provide a return on investment. Lenders will often want to see that the money is being borrowed for a specific, justified purpose.

2. During Low-Interest Periods

Interest rates fluctuate based on economic conditions, and 2025 will likely present both high and low-interest periods. Timing your loan application during a time when interest rates are low can help you secure more favorable terms. Keep an eye on economic reports and forecasts, and try to plan your borrowing around times when rates are low. If interest rates are expected to rise, it may be wise to borrow sooner rather than later.

3. When You Have a Solid Repayment Plan

Before applying for any loan, ensure you have a clear and realistic repayment plan in place. Taking on a loan without knowing how you’ll pay it back could lead to debt accumulation and high-interest charges. By assessing your income and expenses, and setting aside funds for loan repayment, you ensure you’re not caught off guard.

4. During Financial Emergencies

If you encounter an unforeseen emergency, such as medical bills or urgent home repairs, seeking a low-interest loan can help cover costs without putting your financial future at risk. However, only take out a loan if absolutely necessary, and make sure you’re able to repay it as soon as possible. Avoid using loan funds for non-emergency expenses that could lead to financial strain.

Who Should You Turn to for the Best Financial Options in 2025?

In 2025, there are several options available for securing low-interest funds. But who should you turn to for the best financial solutions?

1. Traditional Banks

While banks often have stricter lending requirements, they are still a reliable option for securing loans, especially for individuals or businesses with strong credit histories. Banks offer both secured and unsecured loans, and many have competitive interest rates for qualified borrowers. Ensure you shop around and compare different banks to find the best rates.

2. Credit Unions

Credit unions are often able to offer lower interest rates and more favorable loan terms compared to traditional banks. If you’re a member of a credit union, check their offerings first. They typically provide both personal and business loans at competitive rates, with a focus on supporting their members’ financial wellbeing.

3. Online Lenders and Fintech Platforms

Online lenders and fintech platforms have become major players in the lending industry, offering fast, convenient loans with relatively low interest rates. Many of these lenders use advanced algorithms and data analytics to assess loan eligibility, making them an appealing option for borrowers who may not meet traditional bank criteria.

4. Peer-to-Peer Lenders

Peer-to-peer (P2P) lending platforms connect borrowers with individual lenders. These platforms can offer competitive interest rates and flexible loan terms. If you’re looking for a loan for a specific project or business, P2P lenders can be a great option for securing funds.

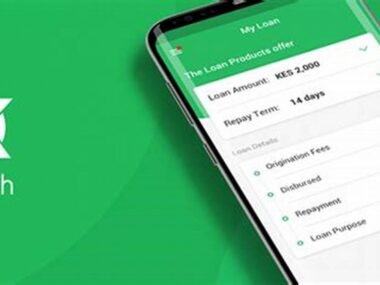

Okash Loan Details

To give you an example of what to expect in 2025, let’s look at Okash, a popular lending platform in the financial industry:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan | 12% – 20% annually | Must be at least 18 years old, with a stable income | Flexible repayment in 30 days to 12 months |

| Business Loan | 10% – 15% annually | Registered business, proof of income | Repayment plan based on business cash flow, up to 12 months |

| Emergency Loan | 8% – 15% annually | Minimum income of ₦50,000 per month | Repayment in full within 30 days or installments |

Advice from Finance.Edujects:

“On no account should you take beyond what can be repaid. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t borrow beyond your capacity for repayment. Always use the money for its intended purpose. Learn from the business side of the Igbo culture. They would never borrow money for something other than its intended use. Any emergency requires an emergency purpose, and this emergency will come and go. Now that you have provision through this loan, to fill in the gap, immediately source for a repayment plan. This gives the bank more credibility and helps others when they face emergencies. Let’s build trust and integrity in Nigeria, where companies can invest. The best way to encourage lenders like Okash to provide more loans for emergencies is to pay back on time. Start planning for repayment the moment you take the loan.”