In today’s fast-paced world, financial emergencies can strike without warning. Whether it’s a medical bill, an urgent home repair, or an unexpected expense, these situations can leave you feeling overwhelmed and uncertain. You might find yourself asking, “Where can I turn for quick financial relief?” The answer might be found in low-risk loan services such as Okash loan. If you’re looking for guidance on how to apply for a loan and secure approval with ease, you’re in the right place. This article will walk you through everything you need to know to navigate the application process smoothly and ensure your financial needs are met.

How to Secure Low-Risk Loan Approval in Okash

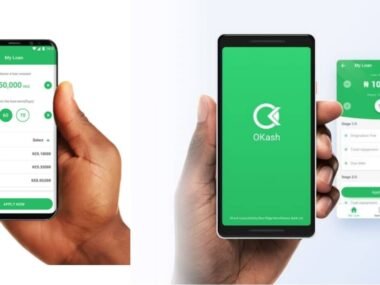

The idea of applying for a loan may feel intimidating, but securing approval with Okash can be much simpler when you’re well-prepared. Start by understanding the eligibility requirements. Okash typically offers short-term loans, ideal for emergencies or urgent financial needs. By familiarizing yourself with these prerequisites, you can avoid unnecessary delays and increase your chances of success.

Your creditworthiness plays a significant role in loan approval. Okash will assess your credit history, so it’s essential to have a good standing. If you’re unsure about your score, consider checking it in advance to understand your position. This way, you can address any issues that might affect your approval.

Having all the required documentation on hand will also make the application process smoother. Okash typically asks for proof of identity, income, and residence. Ensure these documents are accurate and up-to-date to avoid any setbacks. When you have everything ready, you demonstrate your commitment to the process.

Selecting the right loan amount is another critical factor. It’s tempting to borrow more than necessary, but doing so could cause financial strain later. Okash offers various loan amounts, so it’s important to choose one that fits your immediate needs. Remember, borrowing only what you need will make repayment easier and keep you on track.

Repayment is an essential part of the loan process, and having a clear plan in place can significantly impact your ability to repay on time. Okash provides flexible repayment options, but it’s up to you to ensure you can meet your commitments without putting undue stress on your finances. A well-thought-out repayment plan is a sign of financial responsibility and can help you build a positive relationship with Okash, ensuring easier access to loans in the future.

When to Apply for an Okash Loan

Timing plays a crucial role when applying for a loan. You want to apply for a loan when it’s absolutely necessary, avoiding unnecessary financial pressure. Okash loans are ideal for situations where you need quick access to funds, and they work best for urgent expenses like medical bills or emergency repairs.

If you’re dealing with unexpected medical costs, Okash could provide the financial relief you need. Whether it’s a routine check-up or an emergency procedure, having the funds available quickly can make all the difference. Similarly, repairs for your home or vehicle often cannot wait, and Okash loans offer a solution when these unforeseen expenses arise. Sometimes life throws challenges your way, and Okash loans are designed to provide a temporary solution to those financial gaps.

Who Can Apply for Okash Loans?

Anyone who meets the eligibility criteria can apply for an Okash loan. Applicants must be between the ages of 20 and 55 and should have a steady income. This can come from employment, business, or freelance work. Additionally, an active bank account is required for loan disbursement and repayment. Okash loans are also available only to residents of Nigeria who can provide valid proof of address.

Loan Details from Okash

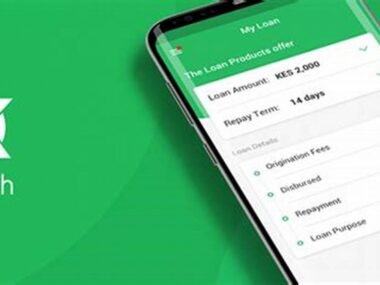

Okash offers a variety of loan options tailored to meet different financial needs. Below is a table summarizing the key loan types, their interest rates, eligibility, and repayment periods:

| Loan Type | Interest Rate | Loan Amount | Eligibility Criteria | Repayment Period |

|---|---|---|---|---|

| Personal Loan | 15% – 30% | ₦5,000 – ₦100,000 | Proof of Income, Age | 7 – 30 Days |

| Emergency Loan | 10% – 20% | ₦3,000 – ₦50,000 | Active Bank Account | 7 – 14 Days |

| Medical Loan | 12% – 25% | ₦5,000 – ₦75,000 | Proof of Medical Emergency | 7 – 21 Days |

The repayment process is simple and can be done through various channels like bank transfers, direct debit, or mobile payment options, offering you flexibility and convenience in managing your finances.

Why Do You Need a Loan?

When unexpected financial needs arise, a loan can offer the quick access to funds that you need. Okash loans provide a fast and flexible solution, making them an ideal choice for emergencies. The ability to borrow funds quickly means you don’t have to endure financial strain while waiting to save for those urgent expenses.

Another reason to consider an Okash loan is the flexibility they offer. With different loan types and repayment schedules, Okash can cater to a variety of financial situations. You can borrow what you need and repay it in a way that fits your budget, making it a manageable option for many people in Nigeria.

Finally, having the ability to borrow in times of need can give you peace of mind. Knowing that you have a safety net for financial emergencies means you don’t have to stress about how to handle unexpected costs. Okash loans offer a way to get through difficult moments without sacrificing your financial well-being.

Expert Advice for Borrowers

It’s crucial to approach borrowing with care. As you take the loan today, start planning for the repayment today. Don’t wait for the due date to approach before thinking about how you’ll pay it back. Timely repayment not only helps you maintain a healthy financial status, but it also ensures you build trust with Okash, which could lead to more favorable loan options in the future.

Advice from the Finance.Edujects

On no account should you take beyond what can repay. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. Don’t take more than your capacity of income expectations. Endeavor to use the money for its intended purpose.

Learn from the business side of the Igbo people. The Igbo will never borrow money to do anything other than what the loan was meant for. Emergencies require an emergency purpose, and once the emergency is solved, quickly source a repayment plan. This will build credibility with Okash and help more people in the future.

Let’s build trust and integrity-driven Nigeria, where other companies can invest. To increase the number of loans provided for emergencies, repay on time. Don’t wait until the company starts chasing you with phone calls. As soon as you receive your loan, start planning for its repayment.