Living on a small salary can feel overwhelming, especially when unexpected expenses arise or when you’re striving to achieve your financial goals. If you’re in Nigeria and struggling to make ends meet, you’re not alone. Many people face the challenge of stretching limited resources while also trying to save money. But here’s the good news: with the right strategies and mindset, it’s possible to save, no matter how small your income is. This guide is here to help you take control of your finances and pave the way for a more secure future.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why You Need to Save Money on a Small Salary

Saving money, even in small amounts, can make a big difference over time. Here’s why it’s essential:

- Emergency Preparedness: Life is unpredictable, and having savings ensures you’re ready for unexpected events.

- Financial Independence: Savings reduce your reliance on loans or financial help from others.

- Future Goals: Whether it’s starting a business, purchasing a home, or pursuing further education, savings act as a foundation.

- Peace of Mind: Knowing you have a financial buffer reduces stress and improves your overall well-being.

Practical Steps to Save Money on a Small Salary

1. Track Your Expenses

Start by understanding where your money goes. Use a notebook or budgeting app to record your daily expenses. Categorize them into essentials (rent, food, transport) and non-essentials (entertainment, luxury items). This helps identify areas where you can cut back.

2. Create a Budget

Allocate your income to essential expenses, savings, and discretionary spending. The 50/30/20 rule can guide you:

- 50% for Needs: Rent, utilities, food.

- 30% for Wants: Entertainment, leisure activities.

- 20% for Savings/Debt Repayment: Start with small amounts and gradually increase as your income grows.

3. Prioritize Saving

Treat saving as a non-negotiable expense. Automate a portion of your salary to go directly into a savings account. Even saving as little as ₦100 daily can accumulate to ₦3,000 monthly and ₧36,000 yearly.

4. Cut Unnecessary Expenses

Look for areas where you can save:

- Cook meals at home instead of eating out.

- Use public transport or carpool to reduce transport costs.

- Buy in bulk to save on groceries.

5. Earn Extra Income

Consider side hustles or freelancing to supplement your income. Platforms like Fiverr, Upwork, and local opportunities such as tutoring or small-scale trading can help.

6. Avoid Impulse Purchases

Before buying anything non-essential, ask yourself, “Do I really need this?” Delaying purchases can help you avoid wasteful spending.

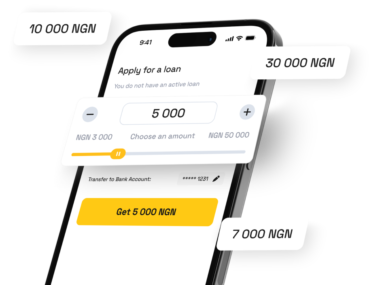

7. Leverage Loan Opportunities Wisely

If you need additional funds for emergencies or investments, consider borrowing from reputable lenders. Below is a comparison of available options:

| Lender | Loan Amount (₦) | Interest Rate (%) | Eligibility Criteria | Repayment Options |

|---|---|---|---|---|

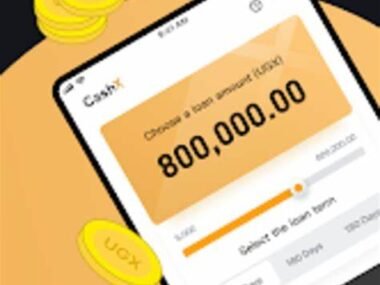

| Cash X | Up to 5,000,000 | 2.5 per month | Valid ID, proof of income | Flexible installments, up to 12 months |

| QuickFunds | Up to 1,000,000 | 3.0 per month | Employment details, bank statements | Weekly or monthly payments |

| NaijaCredit | Up to 500,000 | 2.8 per month | Guarantor required, no past defaults | Bi-weekly payments |

| FastTrack Loans | Up to 2,000,000 | 2.9 per month | Valid ID, business registration | Monthly installments, up to 6 months |

| SME Booster | Up to 10,000,000 | 2.0 per month | Strong credit history, business plan | Quarterly payments |

Planning for Loan Repayment

Borrowing money can be a helpful financial tool, but repayment planning is crucial to avoid falling into debt traps. Here are some tips:

- Create a Repayment Plan: Dedicate a specific portion of your income to loan repayments.

- Stick to Deadlines: Avoid penalties by paying on time.

- Communicate with Lenders: If you anticipate delays, inform your lender and discuss options.

- Use Extra Income: Direct any windfalls (e.g., bonuses, tax refunds) toward repayment.

Edujects Advice

On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it and create financial stress just because you have access to it freely. Always ensure the money is used for its intended purpose. Learn from the Igbo business culture: they borrow only for ventures that promise returns. Emergencies happen and will pass, so plan for repayment the moment you take the loan. Build credibility with the bank to encourage more investments in Nigeria. As soon as you take the loan, start planning for repayment. Paying back on time improves trust and ensures others benefit from these opportunities.