When financial emergencies arise, the stress of finding quick funds can be overwhelming. For Nigerians urgently needing money, understanding your loan eligibility can save time, reduce frustration, and increase your chances of approval. Whether you need funds to cover medical bills, education, or unforeseen expenses, taking a systematic approach to checking your loan eligibility is critical. This comprehensive guide walks you through the steps to ensure you’re well-prepared before applying for a loan.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why You May Need a Loan

Life’s uncertainties often push us into situations where we need financial assistance. Here are some common reasons Nigerians may need a loan:

- Unexpected Expenses: Medical emergencies, home repairs, or urgent travel.

- Education: Covering tuition fees or related costs for yourself or a loved one.

- Business Growth: Funding new ventures or expanding existing businesses to achieve greater profitability.

- Debt Consolidation: Paying off high-interest debts with a lower-interest loan to manage finances better.

Before you apply for a loan, take a moment to reflect on your reasons for borrowing. This will help you stay focused, disciplined, and intentional about how you use and repay the funds.

Steps to Check Your Loan Eligibility

1. Understand the Loan Requirements

Each lender has specific criteria that you must meet to qualify for a loan. Familiarizing yourself with these requirements saves time and prevents unnecessary rejections. Common requirements include:

- A valid ID: Examples include NIN, voter’s card, or driver’s license.

- Proof of income: Most lenders require recent pay slips or 3-6 months of bank statements.

- Guarantor: Some lenders may ask for someone to guarantee the loan.

- Employment or business records: Evidence that you have a stable source of income or a thriving business.

Visit the lender’s website or contact their customer support to review these conditions carefully.

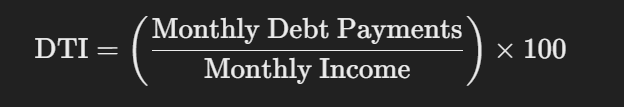

2. Calculate Your Debt-to-Income Ratio (DTI)

Your debt-to-income (DTI) ratio shows how much of your income goes toward repaying debt. It is one of the most critical metrics lenders use to assess your ability to repay a loan.

Formula:

Most lenders prefer a DTI below 40%. Lower ratios increase your chances of approval.

3. Review Your Credit Score and Financial History

Although credit scoring systems are still developing in Nigeria, many lenders assess your financial behavior, including your history of repaying loans, any pending debts, and your bank’s transaction records. Ensure you clear any outstanding obligations before applying.

4. Use Loan Eligibility Calculators

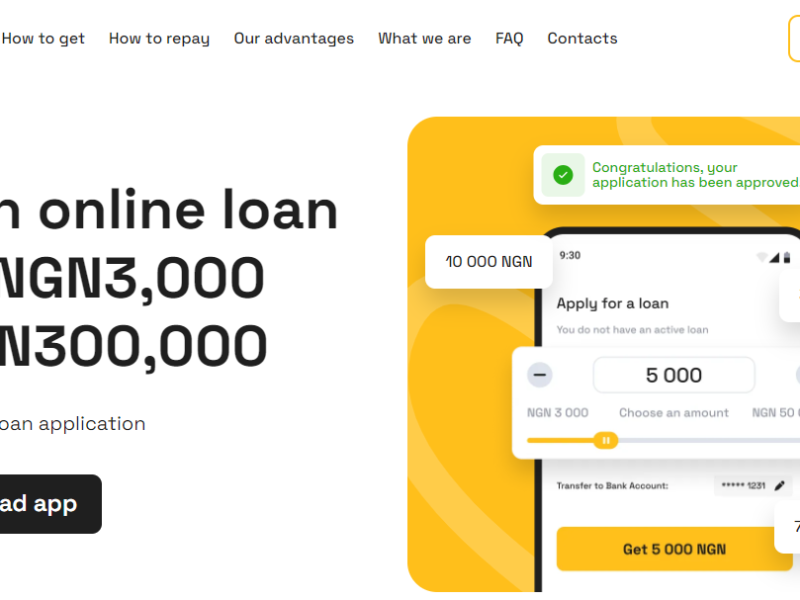

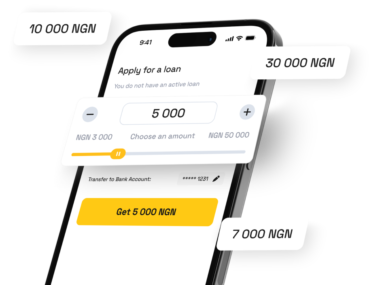

Several online tools allow you to simulate loan scenarios and determine your eligibility. Input your income, expenses, and desired loan amount to see if you qualify. For example, lenders like Cash X offer such calculators on their websites to help you make informed decisions.

5. Gather Necessary Documents

Avoid delays in processing your loan by preparing all required documents in advance. These typically include:

- Proof of identity (NIN, voter’s card, driver’s license, etc.).

- Recent bank statements (covering at least 3 months).

- Employment letters or business registration certificates.

- Proof of address (utility bills or tenancy agreements).

6. Confirm the Lender’s Terms and Conditions

Read the fine print to understand the interest rate, loan tenure, fees, and penalties. Ensure you’re comfortable with the terms before proceeding.

Planning Your Loan Repayment

Taking a loan without a repayment strategy can lead to financial stress. Here’s how you can plan for repayment:

- Analyze Your Cash Flow: Dedicate a fixed percentage of your income to loan repayment.

- Create a Budget: Identify and cut unnecessary expenses to free up funds for repayments.

- Set Reminders: Use digital tools or manual reminders to avoid missing repayment deadlines.

- Opt for Flexible Repayment Plans: Many lenders offer adjustable repayment options. Choose a plan that aligns with your financial capabilities.

Available Loan Options

| Lender | Loan Amount (₦) | Interest Rate (%) | Eligibility Criteria | Repayment Options |

|---|---|---|---|---|

| Cash X | Up to 5,000,000 | 2.5 per month | Valid ID, income proof, good credit history | Flexible installments, up to 12 months |

| QuickFunds | Up to 1,000,000 | 3.0 per month | Employment details, bank statements | Weekly or monthly payments |

| NaijaCredit | Up to 500,000 | 2.8 per month | Guarantor required, no past loan defaults | Bi-weekly payments |

Why Knowing Your Eligibility Matters

Understanding your loan eligibility is vital for several reasons:

- Prevents Rejections: Save time by applying only to lenders where you meet the criteria.

- Reduces Stress: Knowing what to expect minimizes surprises during the application process.

- Helps You Compare Options: By understanding various lenders’ terms, you can choose the most favorable loan.

Edujects Advice

On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it and create financial stress just because you have access to it freely. Always ensure the money is used for its intended purpose. Learn from the Igbo business culture: they borrow only for ventures that promise returns. Emergencies happen and will pass, so plan for repayment the moment you take the loan. Build credibility with the bank to encourage more investments in Nigeria. As soon as you take the loan, start planning for repayment. Paying back on time improves trust and ensures others benefit from these opportunities.

Let’s build a trust-driven Nigeria, where companies like Cash X can confidently increase emergency loans, knowing borrowers will repay.