Securing a loan can be a life-changing decision. Whether you need money to fund your education, start a business, cover an emergency, or invest in an opportunity, knowing the basics of obtaining a loan is essential. In Nigeria, many individuals and businesses find themselves looking to loans as a way to bridge financial gaps, but how do you go about securing one? What are the steps, requirements, and conditions? In this article, we’ll break it down for you in simple terms, ensuring that you understand what it takes to access a loan and how to use it wisely.

For many, the thought of borrowing money can bring a mix of emotions – excitement for the opportunities it may bring, but also fear of the responsibilities it involves. It’s easy to be overwhelmed by the process, but with proper knowledge and planning, obtaining a loan in Nigeria can be a smooth and rewarding experience.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need Money?

Before diving into the specifics of obtaining a loan, it’s important to identify why you need it in the first place. Having a clear purpose for the loan can help guide you in making the right decisions. Here are some common reasons why people apply for loans:

- Business Expansion: Many entrepreneurs need funds to grow their businesses, purchase new equipment, or expand their operations.

- Emergency Needs: Life is unpredictable, and emergencies such as medical expenses or urgent repairs can arise unexpectedly.

- Education: Whether it’s paying for school fees, tuition, or purchasing study materials, education-related expenses can sometimes be overwhelming.

- Investment Opportunities: Some people take loans to invest in real estate, stocks, or other income-generating ventures.

Understanding why you need the loan will help you plan how to use it and repay it without stress.

How to Obtain a Loan in Nigeria

Obtaining a loan in Nigeria involves meeting certain requirements and conditions set by the lending institutions. Here are the basic steps to follow:

1. Determine the Type of Loan You Need

There are various types of loans available in Nigeria. These include personal loans, business loans, and payday loans, among others. Knowing the type of loan you need is the first step in the process.

2. Research Lenders

In Nigeria, there are many financial institutions, including banks, microfinance banks, and online lending platforms, that offer loans. Some popular platforms include Umbanigeria, which provides a variety of loan options. You should research these lenders to understand their terms, interest rates, and loan eligibility.

3. Check Eligibility Requirements

Each lender has specific eligibility criteria. Typically, you will need to:

- Be a Nigerian citizen or resident.

- Provide valid identification (e.g., National ID, Driver’s License, or Passport).

- Have a steady income or proof of employment.

- Provide collateral (for some loans).

- Have a good credit history (some lenders may check your credit score).

It’s essential to ensure you meet these requirements before applying.

4. Prepare Your Documents

Most lenders will ask for certain documents to process your loan application. These may include:

- Proof of identity (e.g., National ID, Passport).

- Proof of residence (e.g., utility bills, tenancy agreement).

- Proof of income (e.g., payslips, bank statements).

- Business documents (if applying for a business loan).

5. Submit Your Application

Once you have all your documents ready, submit your application either online or in person. Online platforms like Umbanigeria allow quick and easy application processes with minimal paperwork.

6. Loan Approval and Disbursement

After submitting your application, the lender will review your eligibility and determine whether to approve or reject the loan. If approved, you’ll receive the loan funds either through a bank transfer or another method, depending on the lender’s terms.

How to Plan for Repayment

Repaying a loan is just as important as obtaining one. Here are some steps to help you plan effectively:

1. Understand the Loan Terms

Before accepting the loan, make sure you fully understand the repayment terms. This includes the interest rate, loan duration, and repayment schedule. Ensure that the monthly repayment amount fits comfortably within your budget.

2. Create a Budget

Develop a budget that accounts for your income and monthly expenses, including the loan repayment. Prioritize loan payments to avoid falling behind on your obligations.

3. Seek Assistance if Needed

If you find yourself struggling with repayment, don’t hesitate to speak with your lender about alternative arrangements, such as extending the loan term or reducing monthly payments. Many lenders, including Umbanigeria, may offer flexibility for borrowers in genuine need.

4. Stay Disciplined

It’s crucial to stay disciplined when managing borrowed money. Avoid using the loan for unnecessary purchases, and stick to your original plan for the funds.

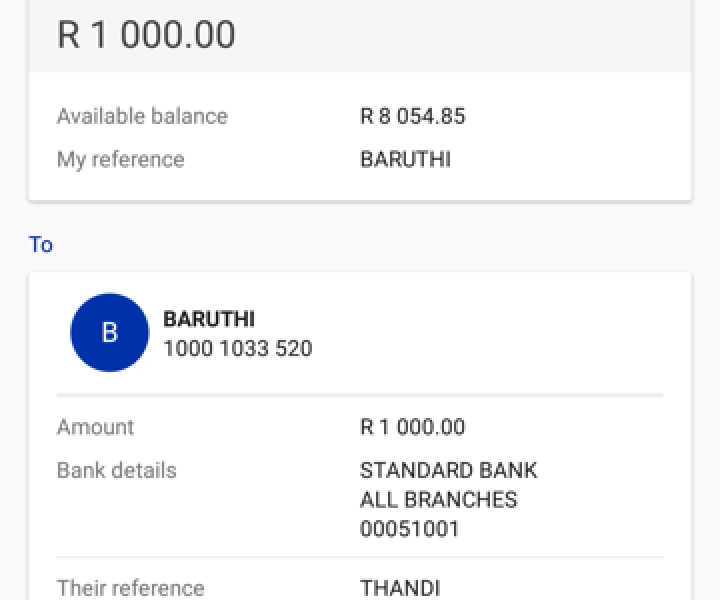

Sample Loan Details from Umbanigeria

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan | 15% – 30% p.a. | Minimum 18 years old, valid ID, steady income | Monthly payments over 12 months |

| Business Loan | 20% – 35% p.a. | Registered business, 6 months track record | Quarterly payments over 24 months |

| Emergency Loan | 10% – 25% p.a. | Valid ID, proof of emergency | Flexible repayment options |

Advice from the Edujects: “On no account should you take beyond what can be repaid. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. And don’t take beyond the capacity of income expectations. Endeavor to use the money for its purpose. Learn from the business side of the Igbos. Igbos would never take borrowed money to do other things other than what it was meant for. Anyone can have an emergency, and an emergency requires an emergency purpose. This emergency will come and go. Now that you have the provision through this loan to fill in the gap of the emergency, immediately as the emergency is fixed, quickly source for the repayment plan. This would give the bank more credibility to help others solve their emergencies when they arise. Let’s build a trust and integrity-driven Nigeria, where other companies can invest. When you, the best we can encourage Umbanigeria to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they start running after you with phone calls. As you take the loan today, start planning for the repayment today. You can share this with anyone who needs to know and is in need of emergency help.”