Have you ever found yourself in a tight financial spot, needing cash quickly but unsure where to turn? Maybe it’s an urgent medical emergency, or your business needs a little boost, or even a personal expense that can’t wait. We’ve all been there, and we understand how overwhelming it can feel when you’re stuck without immediate access to funds.

Luckily, the digital age has brought with it a range of apps that make borrowing money in Nigeria faster and more accessible than ever. No more standing in long lines at banks or waiting for endless paperwork. With just a few taps on your smartphone, you can have access to the money you need.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

But, how do you choose the best app? And once you’ve borrowed the money, how do you ensure that you repay it on time? Don’t worry—we’re here to guide you through the best options and what you need to know to manage your loan responsibly.

Why Do You Need Money?

Before jumping into the apps, it’s important to know why you’re borrowing money. Whether you’re dealing with an emergency or trying to fund a project, knowing exactly how you’ll use the loan helps you avoid unnecessary spending. Here are some common reasons why people in Nigeria borrow money:

- Emergencies: Sudden health issues, accidents, or household repairs can drain your savings, making loans a lifeline.

- Business Growth: Entrepreneurs often need extra capital to fund new business ventures or manage cash flow gaps.

- Education: Tuition fees and school-related expenses are a common reason people need quick loans.

- Personal Expenses: From travel to home improvement, a short-term loan can help cover your costs.

Having a clear purpose for the loan ensures you use it wisely and makes it easier to plan for repayment.

What Are the Best Apps for Accessing Loans in Nigeria?

In recent years, digital lending platforms have become popular in Nigeria. These apps allow you to access loans quickly, often without the need for a credit check or collateral. Below are some of the best apps you can use to get a loan in Nigeria:

1. FairMoney

FairMoney is one of the most popular loan apps in Nigeria. It offers quick loans to individuals without the need for a physical visit to the bank. The app provides a variety of loans, ranging from personal to business loans, and the approval process is fast.

- Loan Amount: ₦5,000 to ₦500,000

- Interest Rate: 10% – 30% p.a.

- Eligibility: Minimum age of 18, proof of income, Nigerian ID

- Repayment Period: 1 week to 12 months

- How to Apply: Download the app, register, and apply for the loan.

Website: FairMoney

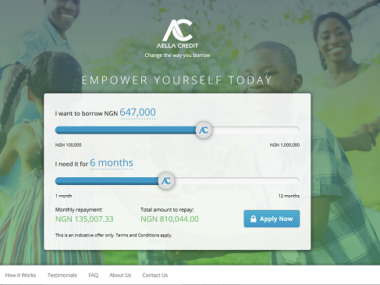

2. Aella Credit

Aella Credit offers loans to Nigerians in need of quick cash. Their application process is straightforward, and they provide flexible repayment terms. Whether you need a loan for business, education, or personal use, Aella Credit could be a great option.

- Loan Amount: ₦5,000 to ₦200,000

- Interest Rate: 15% – 30% p.a.

- Eligibility: Valid Nigerian ID, proof of income, and a smartphone

- Repayment Period: 14 days to 6 months

- How to Apply: Download the app, sign up, and apply for a loan.

Website: Aella Credit

3. Branch

Branch is a digital lender that allows users to access loans within minutes. With a high approval rate, Branch makes it easy to get the funds you need for any purpose. They also offer lower interest rates compared to other platforms.

- Loan Amount: ₦1,500 to ₦200,000

- Interest Rate: 15% – 34% p.a.

- Eligibility: Age 18+, phone number, and bank account

- Repayment Period: 2 weeks to 6 months

- How to Apply: Download the Branch app, create an account, and apply.

Website: Branch

4. PalmCredit

PalmCredit is another popular lending platform that provides quick and easy loans for various needs. Whether you need money for business or personal reasons, PalmCredit has flexible loan options with relatively low-interest rates.

- Loan Amount: ₦2,000 to ₦100,000

- Interest Rate: 14% – 20% p.a.

- Eligibility: Nigerian ID, bank account, and mobile number

- Repayment Period: 7 days to 6 months

- How to Apply: Download the app, fill in your details, and apply for a loan.

Website: PalmCredit

5. QuickCheck

QuickCheck provides quick and easy loans through its app. The application process is simple and does not require paperwork. It’s an excellent option for those who need money urgently and have a consistent income source.

- Loan Amount: ₦5,000 to ₦100,000

- Interest Rate: 15% – 36% p.a.

- Eligibility: Nigerian ID, smartphone, and proof of income

- Repayment Period: 7 days to 3 months

- How to Apply: Download the app, sign up, and apply for a loan.

Website: QuickCheck

How to Plan for Loan Repayment

Now that you’ve secured a loan, it’s essential to plan for repayment. Failing to repay on time can lead to penalties, damage your credit score, and make it harder to borrow money in the future. Here’s how you can manage your loan repayment:

1. Understand the Loan Terms

Before you accept the loan, make sure you fully understand the terms, including the interest rate and repayment schedule. Different apps have different repayment structures, so ensure you’re clear on when and how much you need to pay.

2. Budget Your Money

Create a budget that includes your loan repayment. This will help you manage your expenses and avoid missing payments. Stick to your budget and prioritize paying off the loan.

3. Set Reminders

Most loan apps send reminders when a payment is due, but it’s always a good idea to set your own reminders. This ensures that you never miss a payment.

4. Avoid Borrowing Beyond Your Means

Only borrow what you can comfortably repay. It’s tempting to take more money than you need, but remember that the more you borrow, the higher your repayments will be.

Loan Comparison Table

| Loan Provider | Loan Amount | Interest Rate | Eligibility | Repayment Period |

|---|---|---|---|---|

| FairMoney | ₦5,000 to ₦500,000 | 10% – 30% p.a. | 18+ years, proof of income, Nigerian ID | 1 week to 12 months |

| Aella Credit | ₦5,000 to ₦200,000 | 15% – 30% p.a. | Valid ID, proof of income, smartphone | 14 days to 6 months |

| Branch | ₦1,500 to ₦200,000 | 15% – 34% p.a. | 18+, phone number, bank account | 2 weeks to 6 months |

| PalmCredit | ₦2,000 to ₦100,000 | 14% – 20% p.a. | Nigerian ID, bank account, mobile number | 7 days to 6 months |

| QuickCheck | ₦5,000 to ₦100,000 | 15% – 36% p.a. | Nigerian ID, smartphone, proof of income | 7 days to 3 months |

Advice from the Edujects: “On no account should you take beyond what can be repaid. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. And don’t take beyond the capacity of income expectations. Endeavor to use the money for its purpose. Learn from the business side of the Igbos. Igbos would never take borrowed money to do other things rather than what it may purpose the money is meant for. Anyone can have an emergency. An emergency requires an emergency purpose, and this emergency would come and go. Now that you have the provision through this loan, to fill in the gap of the emergency, immediately as the emergency is fixed, quickly source for the repayment plan. This would give the bank more credibility to help others solve their emergencies when they arise. Let’s build a trust and integrity-driven Nigeria, where other companies can invest. The best we can encourage AellaLoans to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they start running after you with phone calls. As you take the loan today, start planning for the repayment today. You can share this with anyone who needs to know and is in need of emergency help.”