Life is unpredictable – emergencies happen, bills pile up, and sometimes, it feels like everything is happening at once. But if you’ve borrowed money to cover an emergency or to invest in your future, failing to repay that loan on time can have severe consequences that will affect your financial health for years to come. Imagine the stress and worry when you realize your loan repayment date is approaching, but you’re just not ready to pay. Missing a loan repayment is not something anyone wants to experience, but it’s essential to understand the consequences that could follow.

In this article, we will dive deep into the repercussions of missing a loan repayment, explore what you can do to avoid it, and offer practical advice on how to handle such situations. We will also share tips on how to get the money you need, plan for repayment, and keep your financial future intact.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

The Impact of Missing a Loan Repayment

Missing a loan repayment may seem like a small issue at first, but it can spiral into serious problems if not addressed promptly. Here are some of the consequences you could face:

1. Damage to Your Credit Score

One of the most immediate consequences of missing a repayment is the negative impact on your credit score. A poor credit score can affect your ability to get loans, credit cards, and even affect your job prospects, especially in sectors that require a credit check. A low credit score makes it harder for you to access future credit and can make borrowing more expensive due to higher interest rates.

2. Late Payment Fees and Penalties

When you miss a repayment, the lender will usually charge a late fee or penalty. These fees can increase the total amount you owe and make it harder to catch up on payments. The longer you wait to make the repayment, the more interest and penalties will accumulate, resulting in a much higher amount than initially borrowed.

3. Legal Action and Debt Collection

If you continue to ignore your loan repayments, the lender might take legal action against you. This could involve sending your debt to a collection agency, which will then contact you persistently to recover the money. Debt collectors can be relentless, and their actions can cause significant stress. In extreme cases, your lender may even take you to court, which could lead to a judgment against you and further harm your credit.

4. Seizure of Collateral

In the case of secured loans, where you put up an asset (like your car or property) as collateral, missing a repayment can lead to the lender seizing the asset. Losing a valuable possession like a car or property could cause long-term financial setbacks and stress.

5. Increased Debt Burden

The longer you delay repayment, the larger your debt becomes. Interest keeps accruing, and additional fees pile up. This means that what was once a manageable loan can quickly turn into an unmanageable burden, affecting your overall financial health and stability. In many cases, you may find yourself trapped in a cycle of debt that’s hard to break.

What Can You Do to Get Money?

While missing a repayment is a stressful situation, it’s essential to focus on solutions. If you need money to cover your repayment or avoid further debt, consider these options:

- Personal Savings: If you have savings, using them to cover your loan repayment can help you avoid penalties and interest. If not, it’s time to reconsider your financial habits and start saving for emergencies.

- Side Jobs or Freelance Work: Take on extra work, such as freelancing, tutoring, or part-time jobs, to generate quick cash to pay off your debt.

- Borrow from Family or Friends: If possible, ask family or friends to lend you money to cover your repayment. Be sure to discuss a repayment plan to avoid putting them in an uncomfortable situation.

- Sell Unused Items: Look around your home for items you no longer need. Selling them can provide the funds to pay off your loan and avoid the consequences of missing repayments.

How to Plan for Loan Repayment

The best way to avoid missing a repayment is to plan ahead. Here’s how you can set up a repayment strategy:

1. Create a Budget

A budget is your best tool for managing your finances. Start by listing all your monthly expenses and allocating funds for loan repayments. Prioritize paying off high-interest loans first, and set aside a specific amount for your monthly repayments.

2. Set Up Automatic Payments

If possible, set up automatic payments with your lender. This ensures that your payments are made on time, even if you forget or are too busy. Many lenders offer this feature through online banking, and it’s a great way to avoid late fees.

3. Adjust Your Spending Habits

Review your spending habits and eliminate any non-essential expenses. Use the extra money to build an emergency fund or cover loan repayments. Reducing your spending will also help you avoid needing a loan in the future.

4. Talk to Your Lender

If you’re struggling to repay your loan, don’t wait until it’s too late. Reach out to your lender to explain your situation. Many lenders will work with you to extend the repayment period or adjust your repayment terms.

Why You Need the Money

Loans are often necessary to cover unexpected expenses or to invest in your future. Here are some common reasons why people take loans:

- Emergency Situations: Medical bills, home repairs, or urgent travel plans.

- Business Ventures: Starting or expanding a business to improve your financial situation.

- Educational Costs: Paying for school fees or educational expenses.

- Household Needs: Renovating your home, buying household appliances, etc.

Understanding why you need the money is important because it helps you prioritize the loan’s purpose and plan your repayment effectively.

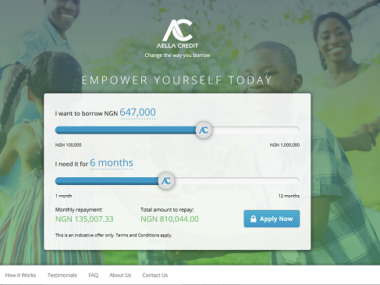

Available Loan Options from Aella Loans

If you’re looking for a loan in Nigeria, Aella Loans is a popular choice. Below is a breakdown of the loan types, interest rates, eligibility, and repayment methods:

| Loan Type | Interest Rate | Eligibility | Repayment Method |

|---|---|---|---|

| Personal Loan | 5% – 20% p.a. | Nigerian citizen, 18-60 years, steady income | Weekly, monthly |

| Business Loan | 10% – 25% p.a. | Registered business, active for at least 6 months | Monthly, direct debit/transfer |

| Emergency Loan | 8% p.a. | Nigerian citizen, proof of emergency | Single payment or installment |

| Education Loan | 7% p.a. | Nigerian student, enrollment verification | Monthly, direct debit/transfer |

Visit Aella Loans to apply for a loan or get more details.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t borrow beyond your income expectations. Use the money for its intended purpose. Learn from the business side of the Igbo people. They would never borrow money for anything other than its intended purpose. Emergencies come and go. Once the emergency is solved, quickly source for the repayment plan. This builds trust and credibility with lenders. Pay back on time so that others can benefit when their emergencies arise. Repay today, plan today.”