In today’s fast-paced world, there are times when life throws challenges your way. Whether it’s an unexpected emergency, a medical situation, or an opportunity for investment, sometimes we find ourselves needing extra financial support. You may have asked yourself, “How can I get access to a loan quickly in Nigeria?” The truth is, while loans are available, not all are easy to access, especially when you’re looking for a straightforward solution. In this article, we’ll explore the easiest types of loans you can get approved for in Nigeria, what to do to increase your chances of approval, and how to plan for repayment.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need Money?

The reasons you might need a loan vary. It could be an urgent need for medical bills, business investment, or simply a need to stabilize your personal finances. No matter the reason, it’s important to approach borrowing with a clear plan. Loans should not be seen as a way to manage ongoing debts or living expenses, but as a tool to solve an immediate problem. Borrowing wisely means taking a loan that will help you thrive and create a repayment plan that won’t derail your future.

What Types of Loans Are the Easiest to Get Approved for in Nigeria?

- Personal Loans from Banks Personal loans from commercial banks like Access Bank, GTBank, and UBA are some of the most common loans available. These loans are ideal if you need a substantial amount of money, and with the right credit score and a stable source of income, you can secure approval quickly.Requirements:

- Proof of income (bank statement, pay slip, etc.)

- A good credit history

- Government-issued ID

- Application form

Repayment: Usually, personal loans have flexible repayment plans ranging from 6 months to 3 years.

- Salary Advance Loans These are loans designed for salaried individuals, allowing you to borrow against your upcoming salary. Banks like First Bank and Zenith Bank offer this facility, and it’s easy to qualify for as long as you have a consistent income.Requirements:

- A valid salary account

- Proof of employment

- A completed loan application form

Repayment: The repayment is directly deducted from your salary over a set period (usually one to six months).

- Microfinance Loans Microfinance institutions like UMBA Nigeria and Branch offer quick, small loans with easy approval processes. These loans are ideal for individuals who don’t have access to traditional banking services.Requirements:

- Valid ID

- Proof of address

- Ability to repay (in some cases)

Repayment: Microfinance loans typically offer flexible repayment periods, which can range from a few weeks to several months.

- Online Loans (Fintech Loans) In Nigeria, technology has made borrowing faster and more convenient. Apps like Carbon, FairMoney, and Branch provide quick loans with minimal documentation. You don’t need to visit a bank or even leave your home to access funds.Requirements:

- Smartphone

- Bank verification number (BVN)

- Internet access

- Minimal paperwork

Repayment: You can repay these loans through direct debit, bank transfer, or mobile money options, usually within a few weeks to months.

What Can You Do to Get Approved for a Loan?

- Improve Your Credit Score Your credit score plays a big role in securing loans. Make sure you pay your bills on time and avoid missing loan repayments, as this will positively affect your creditworthiness.

- Maintain a Stable Income Lenders want to see that you have a consistent source of income, so it’s crucial to ensure your salary or business income is steady.

- Provide Accurate Information When applying for a loan, ensure all the information you provide is correct. Inaccuracies can delay approval and might lead to rejection.

- Have a Clear Purpose for the Loan Lenders prefer to know why you’re borrowing the money. A clear purpose and repayment plan will demonstrate your ability to manage the loan responsibly.

What to Consider When Repaying a Loan

Repaying a loan on time is essential. It not only builds your credit history but also ensures that you don’t incur unnecessary penalties. Here are a few tips for planning your loan repayment:

- Understand Your Repayment Schedule Always ask about the terms of your loan repayment before you accept any offer. This includes knowing how much you’ll pay monthly and for how long.

- Set a Budget Ensure that you set aside money specifically for repaying your loan. Treat it like an essential bill that must be paid.

- Don’t Over-borrow Borrow only what you need, as taking out more than you can afford to repay can lead to financial distress.

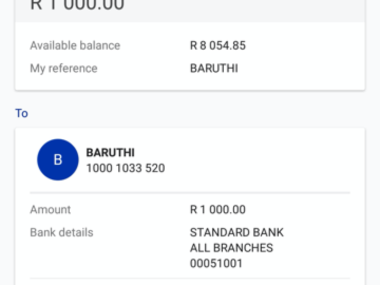

Loan Options Available Through UMBA Nigeria

| Loan Type | Interest Rate | Eligibility | Repayment |

|---|---|---|---|

| Personal Loan | 10% – 25% p.a. | Salary earners, business owners, entrepreneurs | Flexible repayment plan, up to 12 months |

| Emergency Loan | 15% – 20% p.a. | Must be a registered member of UMBA Nigeria | Repay within 30 days |

| Small Business Loan | 18% – 22% p.a. | Must have a registered business, proof of income | Repay over 6-24 months |

| Education Loan | 12% – 18% p.a. | For students or their sponsors | Repay within 12 months |

Advice from Edujects

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it just because you have access to it freely. Don’t borrow beyond your capacity. Endeavor to use the money for its intended purpose. Learn from the business side of the Igbo. Igbo people never take borrowed money for unnecessary things; the money is meant for a purpose. Everyone can have an emergency, and an emergency requires an emergency purpose. This emergency will come and go. Now that you have provision through this loan, fill the gap of the emergency. As soon as the emergency is fixed, quickly source for the repayment plan. This will build trust and integrity, driving Nigeria’s financial sector forward, where more companies can invest. The best we can encourage UMBA Nigeria to increase the number of loans given for emergencies is to pay back on time. Don’t wait until they come chasing you with phone calls. As you take the loan today, start planning for the repayment today. Share this advice with anyone who needs emergency help.”