In today’s fast-paced world, starting or growing a business can feel like a daunting task—especially when the roadblock is access to funding. Whether you are a small business owner in Nigeria looking to expand or someone trying to start their entrepreneurial journey, obtaining a loan can provide the financial boost you need. But the burning question on your mind is, What are the key factors that lenders consider when approving business loans?

Imagine this: You’ve put in months or even years building your business, and now you need extra capital to take it to the next level. You’ve heard about business loans, but securing one seems like an uphill battle. What do lenders really look for? The process can feel like a mystery, but don’t worry. In this article, we will demystify the loan approval process and outline the critical factors that determine whether your business loan application gets approved or denied. Let’s dive in.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Why Do You Need a Business Loan?

Before we break down what lenders consider, let’s take a moment to understand why you might need a loan for your business.

- Expansion: You need capital to grow—whether it’s expanding your product line, opening new locations, or hiring more employees.

- Cash Flow Issues: Your business may have irregular cash flow, and a loan can provide the liquidity you need to cover operating expenses during lean periods.

- Equipment Purchase: If your business requires new machinery, technology, or vehicles, you might need a loan to make these purchases.

- Emergency Expenses: Sometimes unexpected costs arise, and a loan can help cover the gap until you are back on your feet.

Whatever the reason, securing the right loan can enable your business to overcome financial challenges and push forward toward success. But before lenders hand you that much-needed cash, they need to feel confident in your ability to repay the loan. So, let’s explore the key factors that will determine your loan approval.

Key Factors Lenders Consider When Approving Business Loans

- Credit History Your credit score is one of the first things lenders check. It’s essentially a snapshot of your financial reliability. If you’ve managed your personal or business credit well, paying off debts on time, lenders will see you as a less risky borrower. If you have poor credit, you may still qualify for a loan, but it might come with higher interest rates or stricter terms.

- Business Plan and Purpose Lenders want to understand how you plan to use the loan and how it will help grow your business. A well-structured business plan with clear goals and objectives demonstrates that you know where you’re headed. Whether it’s for expansion, equipment, or covering cash flow gaps, having a solid plan shows lenders that the money will be used wisely and that you have a strategy for generating revenue to repay the loan.

- Revenue and Profitability Lenders typically look at your business’s financial health to determine whether you can handle loan repayment. If your business generates steady revenue and has a proven track record of profitability, it will increase your chances of approval. Be prepared to provide financial statements, tax returns, and bank statements as proof of your business’s income.

- Collateral Collateral is an asset (such as property, equipment, or inventory) that can be used to secure the loan. If you default on the loan, the lender can seize the collateral to recover their money. Offering collateral can improve your chances of approval, especially for larger loan amounts or if your business doesn’t have a long credit history.

- Debt-to-Income Ratio Lenders will assess your debt-to-income (DTI) ratio to evaluate your ability to repay a new loan. This ratio compares your business’s debt obligations to its income. A high DTI ratio indicates that your business might be over-leveraged and could struggle to handle additional debt, which can be a red flag for lenders.

- Time in Business The longer your business has been operational, the more stable it is considered to be. Lenders may favor businesses that have been around for at least 1-2 years, as this indicates that your business has weathered challenges and is likely to have a solid foundation. Startups with little to no track record may find it more difficult to secure a loan.

- Industry Type Certain industries are considered riskier than others. If your business operates in a volatile or high-risk sector, lenders may be more hesitant to approve a loan. On the other hand, businesses in stable and profitable industries may have an easier time getting approved.

- Personal Investment Lenders want to know that you are personally invested in your business. This could mean showing that you’ve contributed your own capital, or that you’re taking steps to ensure the business’s success. Personal investment signals to the lender that you’re serious about the business and will take responsibility for its success.

How to Plan for Loan Repayment

Once you’ve secured a business loan, it’s time to focus on repayment. Here are key strategies to ensure that you can repay the loan without straining your business:

- Create a Realistic Repayment Schedule: Work with the lender to set up a repayment schedule that aligns with your business cash flow. Be sure to factor in your monthly expenses and revenue projections.

- Use Loan Funds Wisely: Only use the loan for its intended purpose. Avoid spending borrowed funds on non-essential items. This will help your business grow and generate the income needed to repay the loan.

- Track Cash Flow: Regularly monitor your business’s income and expenses to ensure you can cover the loan repayments. If you foresee any cash flow issues, consider adjusting your repayment schedule or seeking alternative funding.

- Plan for Contingencies: Unexpected expenses can arise, so have a contingency plan in place to ensure you can make your loan repayments even during tough times.

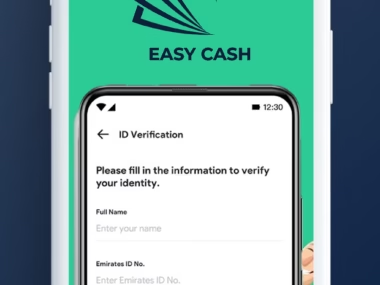

Easy Cash Loan Options for Your Business

If you’re looking to secure a loan, Easy Cash offers a range of flexible loan options that can help meet your business needs. Here’s a breakdown of the loan options they provide:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Quick Business Loan | 15% per month | Must be a Nigerian citizen with a registered business | Weekly, bi-weekly, or monthly |

| Emergency Business Loan | 18% per month | Must have a verifiable emergency and stable income | Flexible repayment options |

| Equipment Loan | 20% per month | Business must be operational for at least 6 months | Flexible, with a maximum of 12 months |

Easy Cash provides easy-to-access loans with flexible repayment plans, making it a reliable option for businesses in need of fast funds.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t overuse it to affect you just because you have access to it freely. Don’t take more than what your income can comfortably cover. Endeavor to use the money for its intended purpose. Learn from the business mindset of the Igbo people—they never borrow money for purposes other than the one it was meant for. Anyone can have an emergency, but an emergency needs a defined purpose. Once the emergency is resolved, plan immediately for repayment. This builds trust and credibility. By repaying your loan on time, you ensure that more people can get help when they need it. Don’t wait until the lender starts calling you—start planning for repayment as soon as you take the loan. Share this information with anyone who needs help and is in an emergency.”

Conclusion

Securing a business loan in Nigeria can be a game-changer for your business, but it requires careful planning and an understanding of the factors that lenders consider. Whether you’re seeking funds for expansion, equipment, or managing cash flow, being prepared and following the right steps can significantly increase your chances of approval. Make sure your business is in good financial standing, have a solid repayment plan, and use the loan responsibly to grow your business.