Are you facing a financial crunch and wondering where to turn for help? Maybe you need money to cover an unexpected expense, pay for an emergency, or fund a project you’ve been planning for months. Whatever the reason, loans can be a helpful tool when you need money quickly. But, before you rush into borrowing, it’s essential to understand the types of loans available to you: secured and unsecured loans.

This article will break down these two types of loans, explain how they work, and give you the knowledge you need to make an informed decision. With this understanding, you’ll be better equipped to plan your repayment strategy, avoid financial pitfalls, and make the most out of any loan you decide to take.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Secured Loans vs. Unsecured Loans

Secured Loans:

Secured loans are exactly what the name suggests — loans that are “secured” by an asset. This could be your car, home, or another valuable property that the lender can claim if you fail to repay the loan. Since these loans are backed by collateral, they usually come with lower interest rates. Why? Because the lender takes on less risk when there’s an asset backing the loan. If you default on the loan, the lender can seize the collateral and sell it to recover their money.

Key Features of Secured Loans:

- Collateral is required (e.g., house, car, or other valuables).

- Lower interest rates compared to unsecured loans.

- Larger loan amounts possible, as the lender is protected by collateral.

- Risk of losing the asset if you fail to repay.

Unsecured Loans:

Unlike secured loans, unsecured loans don’t require any collateral. These loans are based purely on your creditworthiness and ability to repay. Since there’s no collateral, unsecured loans come with higher interest rates to make up for the increased risk to the lender. If you default, the lender cannot claim any property, but they can take legal action, including sending your debt to collections or impacting your credit score.

Key Features of Unsecured Loans:

- No collateral required.

- Higher interest rates due to the lack of security for the lender.

- Smaller loan amounts available in comparison to secured loans.

- Legal consequences if you default, including credit damage or court action.

How Can You Get Money with These Loans?

When you’re in need of money, both secured and unsecured loans can help — but which one you choose depends on your situation. If you have valuable assets and are looking for a larger loan with a more affordable interest rate, a secured loan might be the right choice. On the other hand, if you don’t have collateral or prefer not to risk your property, an unsecured loan might be more suitable.

To access either type of loan, you’ll need to:

- Determine your loan needs – How much do you need? How soon do you need it?

- Check your eligibility – Lenders will assess your credit score, income, and sometimes your assets (for secured loans) before approving your loan.

- Compare loan options – Look at the interest rates, repayment terms, and fees across different lenders to find the best deal.

Why Do You Need Money? There are various reasons why you might need money — from paying for medical bills, covering school fees, starting a small business, or repairing your home. A loan can provide the immediate cash flow you need, but it’s essential to be mindful of your reasons for borrowing. When applying for a loan, ask yourself:

- Is this a necessary expense?

- Will I be able to repay this loan without straining my finances?

- How will this loan affect my long-term financial goals?

Planning Your Loan Repayment

Regardless of whether you choose a secured or unsecured loan, planning for repayment is critical. Loan repayment isn’t just about making the monthly payments; it’s about ensuring you can manage your finances in a way that won’t lead to future stress.

Here are some tips for planning your loan repayment:

- Create a budget: Ensure you know how much you can afford to pay each month and don’t take on more than you can handle.

- Set up automatic payments: This ensures you never miss a payment and helps avoid late fees.

- Look for opportunities to pay extra: If you have a good month financially, try paying more toward the principal to reduce your loan balance faster.

- Track your progress: Keep track of your loan balance and your payment schedule. Seeing your debt decrease can help motivate you.

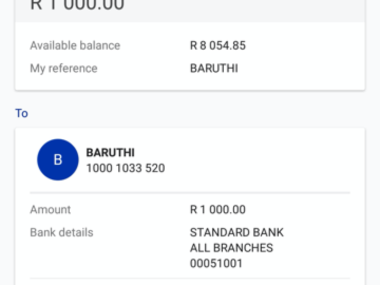

Loan Options from Umbanigeria

If you’re looking to borrow money, Umbanigeria offers both secured and unsecured loan options. Below is a table outlining their loan offerings:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan (Secured) | 8% per annum | Collateral (house, car, etc.), proof of income | Monthly payments over 12-24 months |

| Personal Loan (Unsecured) | 15% per annum | Good credit score, stable income | Monthly payments over 6-12 months |

| Emergency Loan | 10% per annum | Proof of emergency situation, steady income | Repayment within 3-6 months |

Advice from the Edujects: “On no account should you take beyond what you can repay. This is an opportunity, but don’t over-use it just because you have access to it freely. And don’t take beyond the capacity of income expectations. Endeavor to use the money for its purpose. Learn from the business side of the Igbos — they would never take borrowed money to do other things rather than what the money is meant for. Anyone can have an emergency, and an emergency requires an emergency purpose. This emergency would come and go. Now that you have provision through this loan to fill in the gap of the emergency, immediately as the emergency is fixed, quickly source for the repayment plan. This would give the bank more credibility to help others solve their emergencies when they arrive. Let’s build a trust-driven Nigeria, where other companies can invest. The best we can encourage Umbanigeria to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they are now running after you with phone calls. As you take the loan today, start planning for the repayment today. Share this advice with anyone who may need emergency help.”