Money issues can come knocking unexpectedly, leaving you scrambling for solutions. Whether it’s a sudden medical expense, funding for your child’s education, or an urgent business need, loans can offer a lifeline when you need it most. But before you dive in, you might ask, “What is the minimum and maximum loan amount I can get in Nigeria?” This article breaks it down, making it easy for anyone to understand. You’ll also learn practical steps to get a loan, plan repayment, and understand why you may need it in the first place.

Understanding Loan Amounts in Nigeria

In Nigeria, the loan amount you can access depends on several factors, including the lending institution, your income, creditworthiness, and purpose of the loan. The minimum loan amount offered by most financial institutions starts at ₦10,000, while the maximum amount can go up to ₦50 million or more for corporate loans. For personal loans, the cap often ranges between ₦10,000 and ₦20 million.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Lenders such as Okash, Carbon, Branch, and FairMoney offer quick loans to individuals and businesses. The amount you qualify for will depend on:

- Your credit score and history.

- Your monthly income or business turnover.

- The nature of the loan—whether it’s personal, business, or emergency.

- Collateral or guarantor requirements.

Steps to Access Loans in Nigeria

1. Research and Choose the Right Lender

Not all lenders offer the same terms. Compare interest rates, loan tenures, and repayment plans. For instance, fintech platforms like Okash are ideal for quick, short-term loans, while banks may offer larger loans with longer repayment periods.

2. Meet the Eligibility Requirements

Typical requirements include:

- A valid means of identification (National ID, driver’s license, etc.).

- Proof of income or bank statement.

- A functional BVN (Bank Verification Number).

- Good credit history.

3. Submit an Application

Most loan providers now operate digitally. Fill out the online application forms accurately and submit the required documents. Some fintech companies disburse loans within minutes after approval.

4. Plan Your Repayment

Loans are not free money. Before applying, create a repayment strategy to avoid defaulting. Late repayment can lead to penalties and a poor credit rating.

Why Do You Need Money?

Before taking out a loan, ask yourself why you need the money. Some common reasons include:

- Business Expansion: Loans can help grow your business by funding inventory, equipment, or new ventures.

- Education: Covering tuition fees or school expenses.

- Medical Emergencies: Immediate access to funds can save lives.

- Debt Consolidation: Paying off high-interest debts to consolidate into a single manageable repayment.

- Housing Needs: Financing rent, home repairs, or purchase.

Understanding the purpose ensures that you don’t misuse the loan and can plan its effective utilization.

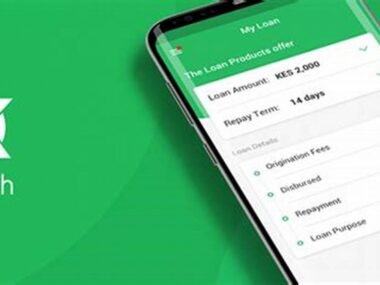

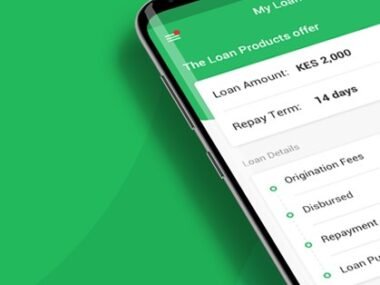

Loan Details: Okash

| Provider | Loan Amount | Interest Rate | Eligibility | Repayment Options |

|---|---|---|---|---|

| Okash | ₦10,000 – ₥50,000 | 4% – 24% monthly | BVN, proof of income, valid ID | Bank transfer, app payments |

| Carbon | ₦5,000 – ₥1,000,000 | 5% – 15% monthly | BVN, credit history, smartphone access | Automated debit, online banking |

| FairMoney | ₦1,500 – ₥1,000,000 | 10% – 30% monthly | BVN, valid ID, proof of residence | Bank transfer, app payments |

Note: These terms can vary. Always confirm with the lender before applying.