Have you ever been in a financial crunch and needed a quick solution, like an urgent loan? You’re not alone. Many people in Nigeria face similar situations, whether it’s to cover a medical bill, pay school fees, or even fund a small business venture. With the rising number of digital lending platforms in Nigeria, securing a loan has become relatively easy. However, it’s crucial to understand your rights as a borrower to avoid falling into unforeseen traps or facing unfair practices. Let’s dive into what rights you have as a borrower and how you can manage loans responsibly.

You can also read:

- How to Get Fast Funds with Instant Approval and Easy Terms!

- Are There Agricultural Loans for Farmers in Nigeria?

- How Can Rural Farmers Access Loans Without Bank Accounts?

- What Types of Loans Are Available to Nigerians, and Which One Suits My Needs Best?

- How Can I Manage My Loan Repayment If I Have a Fluctuating Income?

- How to Get Quick Loan Approval Without Stress in Nigeria

- How to Apply for Loans Without Being Rejected in Nigeria

- Proven Steps to Secure a Loan Without Collateral in Nigeria

- The Secrets to Getting Your Loan Approved on the First Attempt

- How to Borrow Money Safely Without Falling for Scams

- How to Access Loans Fast Without Long Bank Delays

- How to Apply for a Loan Without a Guarantor or BVN

- The Easiest Way to Get a Loan Without Collateral in Nigeria

- Best Loan Options in Nigeria for People with No Steady Income

- Smart Strategies to Get Your Loan Approved Faster

- How to Access Loans for Your Business Without High Interest Rates

- Top Mistakes to Avoid When Applying for a Loan in Nigeria

- How to Borrow Money Without Ruining Your Reputation

Understanding Your Rights as a Borrower in Nigeria

In Nigeria, as a borrower, you have certain rights and responsibilities that protect you from unethical practices. These rights are enshrined in the Consumer Protection Law, the Central Bank of Nigeria’s (CBN) regulatory guidelines, and the Nigerian Financial Literacy Framework. By understanding your rights, you are better equipped to avoid predatory lending and ensure a smooth borrowing experience.

1. Right to Transparent Loan Terms

When applying for a loan, you have the right to know the complete terms and conditions of the loan. This includes the interest rate, repayment schedule, penalties for late payments, and any other applicable fees. No lender can hide any charges or surprise you with additional costs. Transparency ensures you make an informed decision and avoids unpleasant surprises later.

2. Right to Fair and Equal Treatment

You are entitled to equal treatment regardless of your background, gender, or financial status. Discriminatory practices are illegal, and you should report any discriminatory behavior by a lender. The lender must treat you respectfully throughout the loan process, from application to repayment.

3. Right to Privacy

Lenders must keep your personal information secure. Any data you share, such as bank details or employment information, must only be used for the purpose of processing your loan application. It’s essential to understand that no lender has the right to share or misuse your data for any unauthorized reasons.

4. Right to Information on Loan Repayment

As a borrower, you must be provided with clear and accessible information regarding your loan repayment plan. This includes the payment schedule, due dates, and total amount to be repaid. Your lender should offer flexible repayment terms, where applicable, to accommodate your financial situation.

5. Right to Legal Recourse

If a lender violates any of your rights or engages in fraudulent behavior, you have the right to seek legal recourse. This could include filing complaints with regulatory bodies such as the Consumer Protection Council (CPC) or the CBN. You may also take legal action against the lender if necessary.

How to Get Money Through Loans in Nigeria

If you find yourself in need of funds, getting a loan is a viable option. Here’s a step-by-step guide on how you can access a loan:

- Research and Choose a Lender Start by researching different lending platforms that best suit your financial needs. Platforms like Swiffund offer loans for various purposes such as personal expenses, business, or emergencies.

- Loan Application Once you’ve chosen a lender, proceed to apply for the loan. This typically requires filling out an online form and providing personal details like your name, address, and employment status. Be sure to read the terms before submitting.

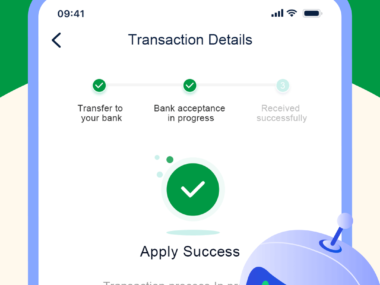

- Loan Approval After your application is submitted, the lender will evaluate your eligibility. If approved, the funds will be disbursed to your bank account or mobile wallet.

- Repayment Plan Discuss and agree on a repayment plan with your lender. Most lenders will provide a flexible schedule based on your loan amount and financial capacity.

How to Plan Loan Repayment

Successfully repaying a loan requires careful planning. Here are some practical steps to help you manage your loan repayment:

- Create a Budget: Set aside a portion of your monthly income specifically for loan repayment. This ensures you are financially prepared to meet your obligations.

- Pay Early or On Time: Avoid late payment fees by ensuring timely repayment. Early repayment may even help reduce your interest charges in some cases.

- Communicate with Your Lender: If you’re facing difficulties, always communicate with your lender. Some platforms offer extensions or changes to the repayment schedule if necessary.

Why You Might Need a Loan

Loans serve a variety of purposes, but here are some of the common reasons people in Nigeria borrow money:

- Emergency Expenses: Loans are often used to cover urgent, unplanned expenses like medical bills or car repairs.

- Business Funding: Entrepreneurs borrow to expand or start their businesses, especially in the absence of adequate capital.

- Education: Loans are often used to pay for tuition or other educational expenses.

- Home or Property Acquisition: Some borrowers take loans to purchase property or make improvements to their homes.

Loan Options from Swifund

Swifund is one of Nigeria’s top lending platforms that provides a variety of loans to meet different needs. Here’s a summary of the loans they offer:

| Loan Type | Interest Rate | Eligibility | Repayment Plan |

|---|---|---|---|

| Personal Loan | 10-15% | Nigerian citizens, 18 years and above, verified bank details | Monthly installments, 3-12 months |

| Business Loan | 8-12% | Business owners with proof of business activities | Monthly installments, up to 24 months |

| Emergency Loan | 5-10% | Anyone with urgent needs, verified personal details | Quick repayment, within 30 days |

| Educational Loan | 12-18% | Students or parents with proof of school enrollment | Flexible, monthly installments |

For more information or to apply for a loan, visit Swifund.

Advice from the Edujects:

“On no account should you take beyond what you can repay. This is an opportunity, but don’t over-use it to affect you just because you have access to it freely. And don’t take beyond the capacity of income expectations. Endeavor to use the money for its purpose. Learn from the business side of the Igbos: They would never take borrowed money to do other things. Rather, they use it for its intended purpose. An emergency requires an emergency purpose, and this emergency will come and go. Now that you have provision through this loan, to fill in the gap of the emergency, immediately as the emergency is fixed, quickly source for the repayment plan. This would give the bank more credibility to help others solve their emergencies when they arrive. Let’s build a trust-driven Nigeria, where other companies can invest. The best we can encourage Swiffund to increase the number of loans given to emergencies is to pay back on time. Don’t wait until they are running after you with phone calls. As you take the loan today, start planning for the repayment today. You can share this to anyone who needs help with an emergency.”